The Black Live Matter protests are shining a light on racism, and police brutality. Which both feel quite a long way from the topic of this blog. But as I reflect on them I realise that I have never really discussed any ‘purpose/values’ driven investing. So here goes.

I notice my age increasingly frequently these days, especially at work – where I am almost the oldest person in a young, dynamic, London workforce.

Where I am aligned with my workforce is that we are all, by the main, modern, liberal, decent Londoners. I don’t believe anybody I work with is a racist, or a sexist, or somebody who would wilfully harm the environment.

Nonetheless, my younger colleagues definitely differ from me in how they put values front and centre; they crave a ‘purpose’, and they embrace their purpose/values in much more of what they do. So, for instance, to the extent they manage their investments they would be much more likely, I think, than my peers to look for ‘socially responsible’ investing – or Environmental/Social/Governance (ESG) investing.

Why ‘socially responsible investing’ never appealed to me

When I started my investment journey, over twenty years ago, any ‘environmental’/similar investing was, to put it charitably, a niche sport. The range of investments was very limited, and it was assumed that the returns would be mediocre. Fees were high. I was not attracted to it.

A second factor was some learned cynicism. I have worked, in some form or other, in a range of industries in my career. One or two of them are seen as ‘bad’ industries – one company would definitely be screened out of an ESG filter. Defence, gambling, alcohol, tobacco – these sectors usually just get a blanket Black Mark in ESG screening.

But my opinion is that you see moral challenges / dubious activities in almost all industries – many of which are seen as ‘good’. For instance:

- Insurance. This large industry has a fundamental conflict of interests at its heart. Are insurers bad people? What about claimants who overinflate claims? Or the vets/mechanics who increase prices for insured animals/cars?

- Finance. Obviously bankers got properly spanked in 2008 for some very bad behaviour. But overdraft’s rip off prices, 50% APR pay day/guarantor loans, credit card’s 20%+ APRs still exist – and indeed are as successful as ever. And what about fund managers – how many of them are really making an honest living? With Adair Turner (then head of the FSA) can ask “aside from the ATM, what useful piece of financial innovation has there been for 20 years”, where does that leave the hundreds of thousands of people employed in this industry, on a ‘good vs bad’ spectrum?

- Resources. Again, a clear candidate for exclusion from ESG portfolios. But some of the leaders here, like BP and Shell, are amongst the biggest investors in renewable energy, carbon reduction technologies, safe extraction techniques, etc in the world. Is it fair to treat firms like Shell as pariahs, but firms like Asos and Fever Tree selling disposable fashion / sugared packaged water as stockmarket darlings?

- Media/comms. The American reality TV show The Bachelor had never picked a non-white Bachelor in 25 years. The Oscars has become a byword for entitled privilege. MTV barely featured black artists. American mobile / broadband coverage is a stitched up monopoly, charging prices that are double their European equivalents. These industries are ‘respectable’?

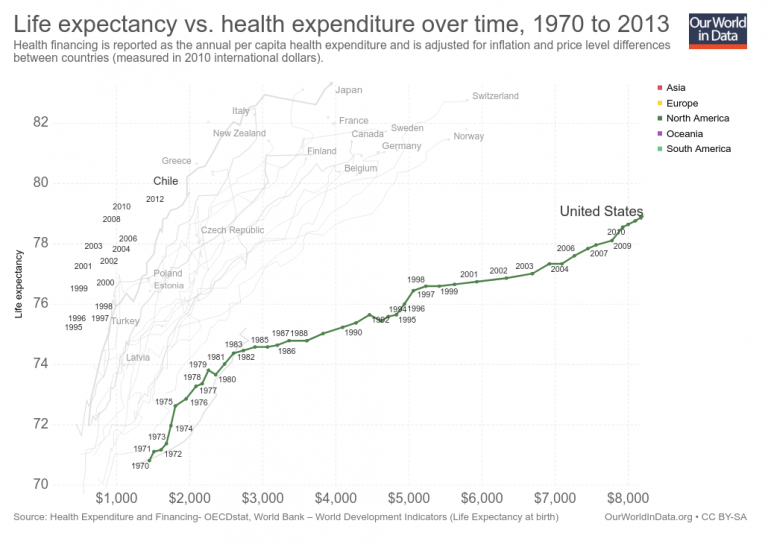

- Healthcare. Obviously fixing people is good, right? But if you don’t think that vested interests and ‘bad’ behaviour aren’t partly to explain for why the US spends double the proportion of GDP on healthcare as other OECD countries, and gets worse outcomes, then you haven’t been paying attention.

- Cars. Dieselgate, anybody? OK, there’s always Tesla. But Elon Musk’s treatment of investors, his marketing of enhanced cruise control as ‘auto pilot’ resulting in several deaths, his defamatory behaviour – is he really one of the good guys?

I could go on. My point is not to reveal some great expose about how, say, Aviva or GSK or Disney are bad companies. My point is that there are relative angels and relative devils in every industry – alchohol, media and mining included. The idea that we should ‘blacklist’ some firms and ‘whitelist’ (what awful choices of words!) others doesn’t sit naturally with me.

How ESG is making the world better

What’s inescapable in modern business is how the wider pressure for ‘E S G’ is being felt everywhere.

Climate change, with an E, is the most visible bit of ESG. Especially since Greta. At the business level, the Paris accords are becoming de facto standards for all UK listed business, not to mention the (rest of the) EU and beyond. Much as the economist in me would prefer more carbon tax (aviation fuel tax? zero!) and less moralising, even I can see that the push for more disclosure, the pressure this forces down the supply chain, the improvements in consumer awareness, are all making things happen. And in the last few months, spurred by the pandemic, it feels like we have reached an inflection point.

James Anderson of Scottish Mortgage Investment Trust put it well:

The End of Carbon

One such miracle may already have occurred. It may eventually

be seen as equally historic and as beneficial as the pandemic has

been malign. The age of carbon may have ended before the virus

spread. For all the drama of the Saudi-Russian clash or of

negative oil prices this was a transformation long foretold but

finally turning unstoppable in the first quarter of 2020. The

remorseless fall in the prices of renewable energy has at last

translated into savage competition against traditional fuels.In the first three months of 2020, 52% of German electricity came

James Anderson, Scottish Mortgage Investment Trust 2019 Annual Report

from renewables. In the UK that figure was 45%. No wonder the

share prices of Exxon, BP and Schlumberger were already falling

sharply in January and February. Sad though it is to say

pandemics are far more common than energy transitions in the

history of the world. The rise of renewables and the electrification

of transportation will be central to the investing world of the next

twenty years at least. It matters.

As to the social side of things, diversity is a broad church. I have seen a Board of Directors of a self-proclaimed diversity leader, that comprised 18 men and no women, and only one non-white face. I know of (women) HR leaders who measure diversity gaps entirely by gender. I know of a diversity-as-a-service business that wouldn’t employ an (ethnic minority) former government minister (with excellent qualifications) because he was a Tory. But there is no question that the spotlight and the mirror are turning on all of us, in all these areas.

The laggard on the ESG front right now looks like Governance. Germany’s corporate governance sins are well publicised, but for me the US deserves its place on the naughty step – allowing supervoting controls, combined CEO/Chair positions, and other things that feel like egotistical anathama to this London resident. But even this area feels like just one or two more mega scandals away from progress. Facebook’s employee mutiny against Zuck recently; Buffett’s awaiting legacy; Amazon, post Bezos; Musk’s next brush with the SEC. At some point shareholder rights are going to get their place in the sun.

And meanwhile, meanwhile, the drum beat grows louder. For me the latest crescendo was seeing Blackrock’s new feature on their iShares ETF website pages.

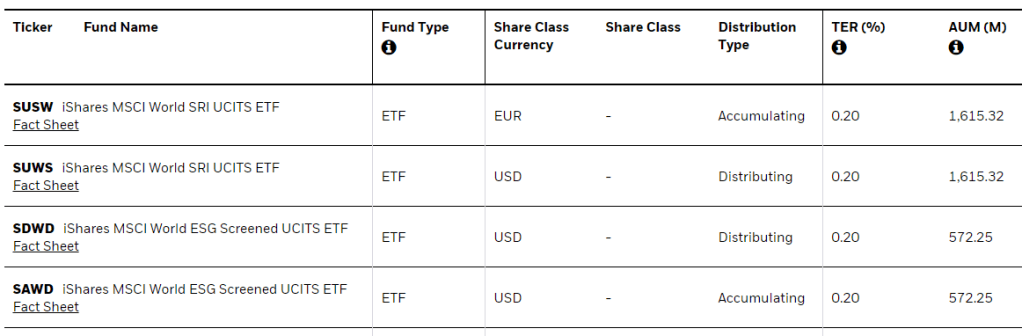

Blackrock now helps you pick a Sustainable version of any of its ETFs. Ha! you scoff – that’s because they cost more, earning Blackrock higher fees. But that ETF IWRD, their MSCI World tracker, costs 50bps. The Sustainable alternatives they list cost only 20bps – that’s less than Vanguard’s ‘unsustainable’ VWRL.

I doff my cap to Blackrock here. It has written to every publicly listed company’s CEO telling them to get with the ESG program. They have pushed an ESG productset. They are, with that green banner, actively encouraging investors to choose ESG, and offering very price-competitive choices.

If the next generation all heads ESG, and as a result most of Blackrock’s funds become ESG, and thus most of their trillions of $AUM can’t or won’t invest in, for instance, Apple, because of Apple’s cadmium mining – how long will Apple keep mining cadmium? For probably quite a long while yet, but you get the picture – it is pushing cadmium water uphill while it does so.

The investment governance police, an ecosystem that us FIRE types don’t think about much, is proselytising the ESG religion effectively. The (former) Governor of the Bank of England, Larry Fink (CEO of BlackRock) and other big beasts are in the pulpit, preaching climate change and sustainable practices. The big investors (Vanguard, Blackrock, L&G, JPM, etc) all play the role of the church elders, monitoring the congregation discretely but effectively; they all have ESG people with teeth. And the proxy agencies are effectively the choirmaster – they set the lead for the smaller funds, such that the biggest agency apparently can single-handedly drive enough votes of a typical FTSE-350 business to automatically land them on the ‘naughty step’ (that the authorities put you on if you fail to get enough shareholder support for a resolution) if they recommend against a motion.

So increasingly, supply and demand are all driving in the same way. Investors, especially the ‘woke’ amongst them, are demanding ESG. And the supply is creating ESG product – by a mixture of measurement, screening, exhortation and regulation.

ESG is no longer a limited, inferior choice

So, in the space a barely a few months, we now have credible-looking ESG alternatives to the key ETFS that form the building block of a well-designed portfolio. For UK Equities, rather than VUKE (0.07%), you can pay a bit more and have UKSR (0.28%). For US Equities, rather than VUSA/IUSA (about 0.07%), you can have SUUS (0.2%). For US corporate bonds, rather than VUCP (0.09%) you can have BSUS (0.25%).

Yes, those Sustainable ETFs cost over 20bps, compared to the 7/9bps you can pay for popular large ‘unsustainable’ (?) ETFs. But in fact there are pockets of value. Vanguard’s world equity tracker, VWRL, costs 22bps; iShares’ ESG SUWS, with similar geographic coverage (albeit against a large cap index, not all cap), costs only 20bps. You can have a global equities tracker, ESG, for 20bps. Would you really prefer an ‘unsustainable’ index tracker of FTSE-100, for 9bps?

These fee differences are at least in part a function of scale. But iShares’ SUWS has $1.7bn of assets; this is half as big already as Vanguard’s flagship FTSE-100 tracker VUKE. Given the growth of ESG it won’t be too long before that scale advantage tips the other way.

In any case, even if you have to pay 20bps more, many people would regard that fee load as an acceptable price to pay. You can make that difference up by not using your uncle’s favourite broker, Hargreaves Lansdown, but shopping around a bit instead.

Of course your uncle would be shaking his head at your ESG ways. Push him, and he’d probably mention performance. Because historically the socially responsible movement has paid a performance penalty compared to the full market. Does that still hold?

There are signs that the performance discount may be fading. A recent study by Morningstar suggested that in Europe, the 10 year track record is moving in ESG funds’ favour.

And, I am starting to think, with enough pressure from the corporate governance police, the policy makers, the millennials, it stands to reason that market forces will deliver higher performance for ESG-friendly companies than their unfriendly rivals.

Will you join the movement? If not now, when?

Another excellent article from FvL. One comment. HL is actually very cheap, if you hold shares and/or ETFs and not funds, and if your portfolio is big enough. For example, if your HL stocks and shares ISA is composed of shares and ETFs only, your annual fee is capped at £45 per year. If there’s a better deal for non-fund portfolios, please do post and let us all know.

LikeLike

iWeb has no platform or annual fees. Only a £25 account opening fee. Dealing fees are also only £5

LikeLike

Thank you. Good information. I would still prefer to pay a little more for HL customer service, website, and app, but you are right.

LikeLike

From HL’s website – it’s SIPP charges are as follows:

“Including UK and overseas shares, investment trusts, exchange-traded funds, VCTs, gilts and bonds.

0.45%

capped at £200 per year”

I think SIPP charges are the starting point for most people. ISA charges are the same but capped at £45 per year. I agree that for ISAs in particular those fees are not unreasonable. My point tho is that if you are fussing about 20bps then you can do better by moving off HL, as Master Distiller illustrates below.

LikeLike

Bloomberg’s Matt Levine wrote an interesting piece on this topic. The TLDR quote being;

“No one invests in all the companies and then tries to make “the economy,” in the abstract, better. But it is, increasingly, a business model. The big diversified institutional asset managers, investing giants like BlackRock Inc., do more or less buy big stakes in all the companies, and they don’t generally have the tools or desire to monitor all those companies closely and try to improve their performance. But their big stakes in every company give them a lot of influence; it is just that they can’t efficiently use that influence to push specific corporate actions that would idiosyncratically improve individual companies. Instead they use it to push very broad ideas that they think will improve long-term results for companies generally.

So BlackRock’s big pre-coronavirus push was for companies to have better environmental policies, on the (ostensible) theory that this would improve long-run results for everyone. If the oceans rise and the cities flood, that will be bad for the economy and all the stocks. No one company can prevent that, but maybe all the companies working together can, and BlackRock’s perspective is that of all the companies. “

As the only shareholders company management are actually mindful of, I’m all for BlackRock et al pushing the ESG agenda

For the full article

https://www.bloomberg.com/opinion/articles/2020-05-27/all-the-stocks-are-the-same-now

LikeLiked by 1 person

I tend to think this is mostly marketing from BlackRock – but its a good message and I will probably jump on board a bit too. Adding a bit of diversity to how my portfolio is weighted isn’t a bad idea.

If you look to the underlying holdings they don’t scream good corporate citizens to me, but the direction of travel is positive and I am sure ESG ratings will improve as investors value it.

LikeLiked by 1 person

Great post and i was going to write something very similar but it wouldn’t have been half as good.

Yiu raise up a lot of great points like why is oil companies bad and consumer companies good?

My experience of the oil business is that they try 100 times harder than people might imagine to be clean, safe and environmentally friendly.

Ok – the product is bad but they know better than most.

LikeLiked by 1 person

I agree… I dealt with Shell a bit many years ago and concluded, as you say, that they put the environment way ahead of practically everybody.

LikeLiked by 1 person

[…] Firevlondon has a great post on ESG investing (35) […]

LikeLike

[…] sort of controversy, you’d be left with a shamefully small pool of choices! As fellow blogger FIREvLondon highlights, there are “dubious activities” in all spheres of industry – companies […]

LikeLike

The Bachelor has been running for 25 years?!

LikeLike