Well, May 2020 was the month that highlighted, as the Economist put it, Boris’ short-Cummings. Remember much else happening that month?

In May the UK started unlocking, slowly. The government(s) has(ve) been slowly releasing the strait jacket to fit what people (in London at least) have been doing anyway for a week or two. I’ve stayed healthy, and my boundaries have enlarged slightly – by which I mean I had my first Zoom party, and there are slightly more restaurants available on Deliveroo.

London has been looking beautiful. Full marks to the first person to name correctly the parks shown below – just some of the ones I’ve visited this month.

Markets up over 5%

Meanwhile, the market’s mad bounce back in April has continued. Quite calmly.

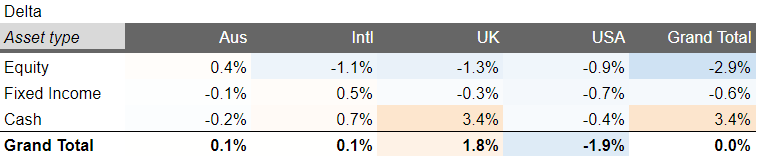

Equities are up more than 5%. Ah no, sorry, not in the UK they aren’t. And in fact the GBP fell against major currencies, which would normally push FTSE up relatively, but not this month. FTSE lagged by gaining ‘only’ 3.3%. Yet another good month to be globally diversified.

Australia had the stand out month, though I haven’t been following closely enough to know why. I do remember buying a lot of Australian equities in the last two months as my rebalancing system signalled they had fallen underweight, and their rebound has left me feeling almost overweight Oz.

Rebalancing the portfolio to a fixed allocation is about buying low and selling high and Australia over the last few weeks is a textbook example of how it can work well.

Bonds continued to climb but they looked positively pedestrian compared to equities.

I have been deliberately staying slightly aloof from the markets.

My portfolio is now only down about 5% from peak. Income levels look like have dropped more than share prices – very unusually – but time will tell. I’ve been letting my equity exposure remain underweight (except Australia!), but keep my bond exposure on target. I’m also materially less leveraged than normal, with my margin loan over £100k smaller than it might be.

What market slump?

I understand three clear arguments for why equity markets have recovered.

The first reason is that interest rates have cratered. To the extent that share prices reflect the net present value of future cashflows, having a lower time value of money increases the value of the future, and thus increases share prices.

The second reason is the notion that the lockdown disruption is only temporary. In the scheme of big global brands like Walmart, MMM, Disney and Amazon, 2020 is just a blip. I am more sceptical of this argument, especially for the travel / leisure sectors.

And then there is the third reason which is the wall of money from central banks. This is used to buy bonds. Not only brand new ones issued by governments, but also second hand ones sold by somebody else. So the sellers have to put their money somewhere. And they refer to arguments 1 and 2 above.

Reasons to be fearful

From where I sit though there are still very much reasons to be fearful.

In the US, where as I write this many cities are under curfew. I think Donald Trump is worried if he loses the election he may end up in prison. He will fight this election not to boost his ego and satisfy his competitive spirit. He will fight this election like a frightened dangerous animal.

In the UK, the Brexit monster is re-awakening. And Her Majesty’s Government has been shown to be wearing some very translucent clothes. I am reminded of my mindset a few weeks before the referendum in 2016; I can see how things can get worse much more easily than I can see how they get better.

And as to the FTSE, it really isn’t selling itself to me at the moment. No tech businesses, plenty of banks, a bunch of mining/resource companies.

My gut has been asking whether I really want 23% of my invested portfolio in UK equities, and concluding I don’t. My head has been pushing back – saying altering my target allocation is the refuge of the market timing scoundrel.

I’m reducing my target UK exposure

I want to trim my UK exposure, at least until the Brexit question has more clarity. I don’t mind holding UK government bonds – they can’t afford to let rates rise / prices fall. But UK equities feel like tarnished goods. I’m reducing my target allocation from 23% to 20% – by about 10%.

Do I just trim UK equities, in favour of bonds? Or do I allocate UK equities to other geographies? I think the latter makes more sense – UK equities are only 5% of world equities so I’m just converging slightly closer to the world benchmark, while retaining a significant degree of home bias.

I’ve decided to shift my UK exposure into various places. I’m increasing my ‘International’ exposure from 20% to 22%, half in equities and half in bonds. And I’m upping my US equity exposure from 45% to 46%, despite worrying that the US markets have a nasty awakening in store for them. This all leaves me 91%/21% Equity/Fixed Income, instead of 92/20. A very slow shift towards fixed income, but a shift nonetheless.

I’ll record this update on my Investment Philosophy log. And try to resist the temptation to drop the UK weight in half again!

> I think Donald Trump is worried if he loses the election he may end up in prison.

I love that insight!

FWIW I don’t see any park pictures at all. But I do see your other images. Is there an authorisation problem?

LikeLike

Thanks Ermine! Especially for the tip re park pictures; I was pasting in from Google Photos and that didn’t work! Now fixed.

LikeLike

Yup, looks good to me now. I’m going to pitch for the Albert Hall, the bit north of the Serpentine as you head up to Lancaster Gate ISTR. Stumped on the others, I’d hazard a guess one is Richmond Park, but I’ve only ever crossed it on a bike at nights after work because I knew a lady in Wimbledon, sarf from my bedsit in Ealing. But it’s been many decades…

LikeLike

No points (‘cos Albert Hall is not a park), bad luck!

LikeLike

November is a long way away here in the states. I just hope that it doesn’t get too ugly. On a positive note, that you for your wonderful update and sharing your pictures. The parks look beautiful and being outside has been a wonderful benefit of the weather starting to get better.

Bert

LikeLike

[…] sink at the markets, because if he doesn’t get his base onside he’s looking at a risk of doing time. So the cash and the gold I bought anew (as opposed to the gold I bought before the brexit vote) is […]

LikeLiked by 1 person

[…] As does Firevlondon (35) […]

LikeLike

I saw a 7.9% increase for May across the whole (leveraged) Rhino portfolio, I’m pretty sure thats an all time record (as was the -9.4% in March). Tumultuous times indeed. Currently glad I got a lump in at start of April.

LikeLike

you were relatively unscathed in March, compared to me! Nice work.

The last four months have all seen bigger % changes than any of the months since I started tracking rigorously in Jan 2013. Hang in there…..

LikeLike

Great pictures, completely agree this past week has been excellent weather (and market) wise! Just hope the summer hasn’t peaked too soon. Only been to London a handful of times, mainly for work so won’t have a hope in guessing locations ha!

Impressive work rebalancing Australia, although why do you isolate that country as a defined market in your tracking?

USA makes sense due to its size, then the UK due to having a home bias, although intrigued to know why you place a lot of importance on that market! Cheers!

LikeLike

Thanks John! I have family in Australia, spend some weeks every year there, and consider it a possibility for spending more time in. Hence I special case it in my asset allocation.

LikeLike

First one is Regents Park near the mosque and canal, the last one is Wormwood Scrubs. Not sure about the others – Battersea Park with the trees?

LikeLike

When I say first, I mean second picture obviously, as the very first is Kensington Gardens in front of the Albert Hall.

LikeLike

Or is asking for “the exact location” a clue – 0 degrees at the prime meridian in Greenwich Park?

LikeLike

[…] overweight), and short equities (by almost 3%). My UK exposure is slightly long, reflecting the drop in my target last month rather than any gains/investment in UK equities. I’m waiting for it to drift lower, rather […]

LikeLike

you never gave us the answers to the parks quiz!

LikeLike

Indeed! Regents Park, Gladstone Park, Mt Walk in Kensington Gardens, Wormwood Scrubs, Kensington Gardens again

LikeLike

Aha. Oh well, 3/5 not too bad. Never heard of Gladstone Park either.

LikeLike