It seems reasonable to think that this is the worst market crash in history. Stock markets are a relatively well-documented phenomenon since their invention only a couple of dozen generations ago, and the data seem clear.

And I was there.

I’ve been actively following this crash every day the markets traded. And I’ve been trading too. Ouch. This post is deliberately something of an ermine-esque ‘reflections from the front’, recording some of my thinking/recollections, as they occur to me and while they are fresh.

Wasn’t January a long time ago?

I remember reading about the Coronavirus in January. I was travelling through Hong Kong myself that month. The virus hadn’t reached HK; it was a story in the business pages about China.

I also had my first cold/flu for 2+ years in December/January. A nastier one than normal, which has left me with a persistent slight ‘non-medical’ cough. Grumble.

The first material impacts on my portfolios were at the end of February, after Italy moved into crisis mode. I had just finished a £1m+ topup of my equity portfolio, using proceeds from my former Home.

Almost to the day, after my £1m had slid (over 2 weeks) into my investment portfolio, the markets began their steep decline. That left me down, in February, [9%], with about £250k of cash left as dry powder. FTSE fell below 7000. That is one of only benchmarks that I immediately remember, 3 weeks later. The other one is the share price of a company I used to work for, and which will be very resilient in crises.

My immediate reaction was to buy, slightly, as I was underweight equities. In particular, I bought my former company shares, at a 30% discount to their peak.

I bought Hargreaves Lansdown – which was 25-30% down on peak, courtesy I think of its founder offloading a few £00m – but which I see as a strong market leader with network effects. I bought AdiDaS, a global brand “on sale”. I bought MicroSoFT – which is a company I love but have missed out on owning. I bought DISney – owner of some of the most valuable IP in the world.

Lovely weather for an oil shock

A week or so later, and the markets have taken a savage further tumble. Triggered by the Saudis/Russians launching an oil price war.

FTSE was at 5500. I am being rung by anxious friends, or asked at work about what to do. I am clear: hold / buy. This time isn’t different. All will be a lot higher than 5500 by 2030. Carry on doing what you are doing.

My house, sold at the start of February, is gone. In financial terms. I’ve lost (in paper terms) more money than I got from the house. And, no, I haven’t ringfenced the capital gains I owe from that sale yet.

Beware the bargains

In the meantime, early in the month, I am buying. My former company share price has fallen a further 25%, to about half of its peak. I buy again.

At this point I’m struggling with what to buy. Definitely no travel businesses, exhibition businesses (I realised, only after trying to catch the INForma falling knife), or restaurant/leisure businesses (e.g. The Restaurant Group, 80% down from peak). I am also very nervous about banks, which sound OK at the moment but if businesses are collapsing then they will be next in the line of fire, and they are devilishly hard to apply the normal investment approaches to anyway.

But what to buy? I have been leaning towards blue chip businesses that have a strong dividend track record, like JPM, and the quasi FTSE tracker – CTY of London Investment Trust. I have bought RightMoVe – an impregnable business in the short term (but one which has just announced a 75% temporary price cut for all its customers!). But mostly I have been leaning towards digital, repeatable/subscription-orientated businesses. I’ve bought GOOGle, ADoBE, EXPeriaN, XeRO. And I’ve bought a few AMaZoN.

Looking back even just a few days, I was very much in ‘buy’ mode. I sold a couple of bond positions to rebalance, but my other trades were all Buys. I have barely touched my ‘dry powder’ – the buys I’ve been placing have been small, and funded out of margin loans / redemptions.

Monevator publishes @TA’s excellent “Do. Not. Sell” blogpost. A piece I am intellectually completely aligned with. So when I am being asked “but markets feel like they are still going down – why buy now when you can wait” I have no trouble answering “you can’t time the bottom; it makes no difference buying on the way down than on the way up, if you are in for the long term – don’t miss the bargains”.

Now for the main course

A week later, FTSE is dipping below 5000. It is clear now that the UK is heading for extreme measures. The US hasn’t woken up to this yet; people I’m dealing with across the pond still think this disruption is going to be weeks long, not months or even years.

Nonetheless, at this point in the journey I find myself changing posture. I know in theory I should hold, or ignore the markets, or even buy if I can. However, two factors are making me wobble.

- My margin loan. It is concentrated in my Interactive Brokers account. So my wobbling has centred on this account. My IB account in fact has some sub-accounts – with different levels of leverage. The smallest sub-account is a High Yield Portfolio, and has the least margin cushion. This sub-account is closest to running a margin call; something I am in fact quite curious to see.

- The other factor on my mind is the remaining vicious uncertainty. The UK media has discussed only one person leaving home at at a time, and all business premises being shut. It seems to me the USA hasn’t properly ‘got with the program’ yet. So there could be much more S&P pain to come. And it feels like there is a very real chance of wholesale business failures/closures – e.g. most UK retail businesses, all airlines, not to mention countless supply chain knock on effects. Perhaps, just perhaps, this time really is different.

I find myself with an allocation which is Long on Fixed Income, Short on Cash, and varying almost daily on Equities (sometimes Long US, sometimes Short UK). The pound has crashed at this point which has pulled my UK position down, but also left me shorter on Cash overseas than normal – because my margin loan in USD/EUR/etc is now bigger than it was. I still have my £200k+ dry powder.

So the w/c 16 March I was quite busy:

- Concentrating my margin loans into GBP. GBP loans are cheap, and the currency volatility is one risk too many.

- Exiting some positions. TGT, a great US retailer that has an awesome dividend paying approach, just feels too risky for me. So does SKT, an opportunistic outlet mall real estate play. Retail is Risk, right now. Cisco has been on my ‘exit list’ for a while, but as most of its revenues are Capex spending, and Capex spending i think will get clobbered in a dash for cash, I’m out.

- Reducing my US equities exposure back to target. This has left me selling (small portions of) some amazing businesses, including Verizon, Blackrock, JP Morgan and Amazon. I like all these businesses, am very happy owning them, and believe they will be even more strongly positioned in 10 years time than they are now. So I am only selling to manage my risk exposure; there is a limit to how much I can do via ETFs alone. This is fairly new behaviour for me.

- Buying Australia Equity ETFs. Australia has kept dropping; it has been my perennial underweight holding all month. I keep topping up.

Perfect posture?

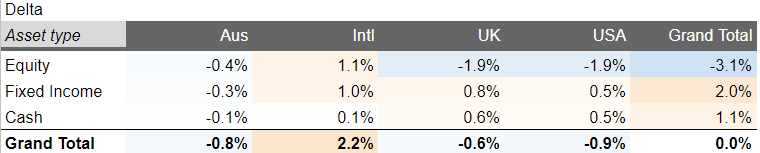

With one full week of March still to go, I’m very happy with my allocation, which is shown below. I still have my dry powder (not shown in the table below – as it sits in a savings account, not in the portfolio). I’m underweight Equities (quite materially), overweight Fixed Income, and overweight Cash. I am very slightly overweight International (Eurozone and Asia), and slightly underweight UK/USA.

You could call these unders/overs a tactical (temporary) adjustment to my target allocation. If this weekend is the bottom, I will miss a bit of upside, but my underweight equities position will soon return to normal. If the knife has further to fall, I’m a little bit protected.

I believe we have quite a bit more pain to endure, but I do not believe in timing markets. And I am pretty clear why I own every holding in my portfolio. So I’m strapped in for the ride.

Other reflections

A few other points strike me. I’d be interested in other readers’ comments/reflections, too.

- Bonds are, in the main, doing exactly what we want them for. Behaving completely differently from equities (unlike in 2008, when correlations all converged on 1 i.e. everything tanked together). In fact they (well, government ones at any rate) have generally gone up, versus two months ago, for which we are grateful. However there are exceptions; I very nearly sold my Premier Oil 5.5% bonds last month, at 105p; now they are in distress territory at around 50p each. At individual company level, bonds carry binary risk.

- I’m down around 25% from peak. I haven’t measured exactly – the inflows of February disguise the numbers. This is not great, but it is not a wipe-out.

- For all the mayhem, a whole bunch of my equity holdings are still above my purchase price. My US index holdings, and US blue chips like Pfizer, JP Morgan, as well as the tech giants Google, Amazon are all way ahead of when I invested. Consumer staples like Diageo, Nestle, Unilever are also still up considerably on prices not that long ago.

- There is, as yet, no suggestion that the banks are exposed. If that rumour mill starts, the mayhem will get considerably worse.

- My approach to leverage is making me sell. Is this the right approach? Should I just let my leverage take up the slack? I have plenty of headroom – even in the IB account that has almost all my leverage. Somehow I have decided to trim the risk here – even though this means selling stocks like Amazon – am I actually timing the markets / selling at a low?

- For all the talk about how, as journo MSW puts it, “the entire global economy has now come to a hard stop pretty much instantaneously”, that is just not true. Plenty of people’s jobs are continuing; delivery drivers and NHS staff, obvs. Grocers. Civil servants, local councils. Journos, stockbrokers. Pensions are still being paid. And even more peoples’ salaries/income is continuing. Consumer spending will be down, and the leisure/travel sectors will be carnage, but savings will be up.

- Dividends are drying up, I fear. This will make me disproportionately sad/nervous. In ‘normal’ recessions, and stock market crashes, dividends fall much less far than stock prices. My gut says that this time, in dividend terms, is different – as companies faced with enormous sudden uncertainty will hoard cash.

21-Mar-20: UPDATED to say that on the day of writing – 21 March 2020 – I don’t directly know anybody who has had the virus. Family OK, colleagues OK, friends OK. Several people I know directly have had scares/similar symptoms. And two friends-of-friends have got it.

22-Mar-20: UPDATED to say that I have just heard that a friend of mine – younger/fitter/healthier than me and most of my mates – has had it, and given it to his immediate family. He thinks his symptoms were “upper moderate”, but now feels some relief to have had it. Thank God he and his family have recovered OK.

Are bonds really doing exactly what we want them to do in a crisis, particularly long bonds. This must surely be one of the most wild weeks for gilts in history. And global fixed income was at by far its richest level at the start of the month, the most recent leg lower in stocks has also been reflected in bonds as fund managers sell everything to raise cash due to the financing squeeze.

Do not sell, even though you have leverage, I am not a fan of the tech sector as I think the long term valuations are ludicrous but it seems difficult to think this whole crisis won’t lead a firm such as Amazon to outperform on a relative basis. Sadly you missed the warning signs, I was fortune enough to sell most of my holdings in mid Feb as I thought it made no sense for markets to be at very stretched new highs given the possibility of a global pandemic, however I’m totally back in now, and I intend to keep adding as we go lower.

Banking stocks are absurdly cheap now, this is probably the time to buy domestic bank stocks although I agree it is a difficult thing to do, but the level of cash they are pumping out vs valuations compared to almost any other sector is absurd. Boris and Rishi will not let major British companies suffer as a result of this crisis, it will not be like RBS in 2008.

Be at peak panic when other people are calm, and be calm when others are at peak panic, we will reach peak panic at some point in the next month, by the end of April I intend to be maximally deployed in equities. You need to own something because global governments will keep printing money.

LikeLiked by 1 person

Good comment – thank you.

When you say ‘do not sell’ – how far or for how long should I let me allocation stretch outside the target?

Bonds – they have felt uncorrelated to equities (which does not mean they go up when equities go down). At least the government ones (Gilts/Treasuries) have. Corporate bonds feel alarming like equities at the moment, and not very good ones!

I was aware of pandemic but have broadly ignored SARS/MERS/H1S1/AIDS/etc without regret . More fool me, perhaps. And my overriding aim is not to try to time the market.

Banking stocks are tempting. JPM has always been my ‘exception’ to the ‘don’t touch’ rule. I have also held some HSBC, for no particular reason. HSBC was a relative decliner in Jan/Feb (I had a Limit Sell on at £6.00!) but now actually looks almost like a safe haven. I have also in fact been nibbling at WFC – which is very badly bombed out but feels like a stalwart business if it can just get out from under the politicians. Lloyds/Barclays/etc are just too unpredictable for me.

I have been wondering about inflation too and suspect you are right. INXG is my ‘go to’ inflation play and I suspect I will be topping back up, but not while I am overweight on bonds.

LikeLike

In the last 3 years I am sure there have been times you have thought about what your strategy would be if there was a stock market crash, my overarching view is not to detract from that plan now, just because the world appears to be breaking down. If you are strongly of the view that the situation gets worse in the US (which I think is possible) and you have a strategy to buy back again at a certain level then I think that makes sense, though it flies in the face of not trying to time the market.

I should rephrase ‘do not sell’ to ‘do not reduce exposure to risk assets’. So a recycling of risk from US to other countries makes sense, particularly given the weakness in non US stocks and the strength of the dollar, but increasing exposure to fixed income and reducing margin loan size does not.

Corporate bonds I know very little about, but in general I am not a fan of anything between equities and top rated gov bonds, I prefer either 100% risk or 100% safety. Lloyds and Barclays are for the brave, I am buying (very small!) of both.

Personally I much prefer TIPS to UKTIs, US inflation forecast to be much lower, and they have higher real yields, though then of course you only protected from world inflation as opposed to UK specific inflation.

LikeLiked by 1 person

Bonds have done their job during this crash but with rates now effectively zero the concern is where they go from here. Yields can’t really drop any further so there seems to be imho minimal upside now and a lot of potential downside.

I notice you don’t seem to have any direct exposure to PM although I guess you may have indirect exposure via some of your Aussie holdings. Is that deliberate? With all of the money being pumped into the system, both fiscal and monetary, inflation could be a real issue down the track if the stimulus isn’t turned off in time. I’m not sure INXG is a great hedge given the tinkering that can be done to the basket, the sceptical me can see a low headline figure while everything around us inflates. But that might be a concern for another day, first we need to avoid Japan style deflation

LikeLike

PM? Premier Oil? If so, no I don’t.

LikeLike

(PM=Precious Metals) No, definitely not. I invest in things that produce an intrinsic return – see https://firevlondon.com/2017/05/29/why-investing-beginners-should-consider-stock-markets/ for more colour.

LikeLike

It is absolutely not true that bond yields can not fall further (and so prices higher) Look at the longest bond of each of US, UK and Germany. The lowest price of each, just this month, is 20-30% below the highs seen at the start of the month. Every time we think yields have found a floor, they seem to find a way to break through to the downside.

LikeLiked by 1 person

I don’t know about this being the ‘worst market crash in history’

So far I think the US market is just back to the level of three years ago; in the 2008-2009 it went back the level of ten years prior at its worst point dropping by about half from its peak

The crash looks rapid, down 15% in a week; but on Black Monday 1987 the S&P went down 23% in one day.

LikeLike

Fastest ever.

LikeLike

I remember the ’87 crash. I had only recently begun investing and so I read up on what had happened. The whole thing clearly made no sense at all so I decided to view it as a mirage and just carried on investing as money became available. You could say I was buying the dip but that’s not how I looked at it. It was more a case of “Oh do stop messing about!”

Such insouciance is possible when your total investment is low, you still have decades of future salary to look forward to, and events in your family life dominate your attention. But what if you have a pile of irreplaceable capital, are about to retire, and are prone to obsess over your investments?

An everything bubble, accompanied by governments panicking over a pandemic, and the whole thing flavoured by an oil price war: that is no mirage.

LikeLiked by 1 person

Compelling post, FIRE v London. Fascinating to listen to you think. Good luck out there!

LikeLiked by 1 person

Maybe the fastest crash, but at about 40% down it is not as bad as 2001-2002 or 2008 in the UK, so far.

LikeLike

Not yet, no….

LikeLike

You shouldn’t be FIRE if you can’t handle 50% down.

LikeLiked by 1 person

You are buying cloud businesses (Microsoft and Amazon) but selling how businesses connect to them. (Cisco). On an aside, the Microsoft Azure outages have been a pain this week (Spark clusters)

LikeLiked by 1 person

[…] I posted this last week, but FirevLondon’s play by play really is an eye opener (33) […]

LikeLike

[…] V London, having just sold his house, had £1m of cash to put to work. And off he went, a spectacular example of holding one’s nerve while there was more than a trickle of blood spilling onto the […]

LikeLike