The title of this blog is that fundamental question: how much is enough? Much of the thinking around FIRE boils down to answering this question.

And as with so many good questions, the answer depends on perspective. And perspective itself depends, among other things, on height. And I think height is a useful metaphor for explaining how much is enough for me.

Ceilings vs floors

I remember my scorn about twenty years ago for my friend W, who was my most earnings-focused mate, when he told me that “I couldn’t live on a salary less than £100k”. At that point I earnt less than half that and very much saw £100k as a ceiling, not a floor.

In any case, these days I’m afraid I would now regard £100k p.a. as definitely a floor. And I mean £100k post tax, of actual money that I could spend. It would fund my ‘needs’: groceries, utilities, transport, medical bills, household cleaning and maintenance, and such like. It would also pay for my investment expenses, though obviously there is a ‘circular reference’ here (as the more that is ‘enough’, the higher the expenses that ‘enough’ needs to fund!).

My ‘needs’ are based on relatively low housing costs. I don’t have a mortgage on my home. I am also ignoring my house as an asset – so it is not part of the ‘enough’ calculation either.

Based on a 4% Safe Withdrawal Rate (a.k.a. the 25x rule), £100k p.a. needs a pot of £2.5m. Tax would complicate that somewhat, but assuming I remain married, and that the current allowances remain in place, I am prepared to ignore tax, for the moment. Certainly I know people earning almost £90k who have <10% tax, and I think as a couple we could make the tax at £100k p.a. relatively minimal.

Or perhaps one should think of the tax liability as roughly equivalent to the state pension/benefits which, in other respects, I am ignoring for the purposes of ‘enough’ calculations.

In actual fact, whether £2.5m turns out to be enough depends on two key questions:

- What return does the portfolio deliver in the long term, and

- In what order (or sequence) – i.e. if it alternates 15% and -5% every year, you do much better if you begin with a +15 and not a -5.

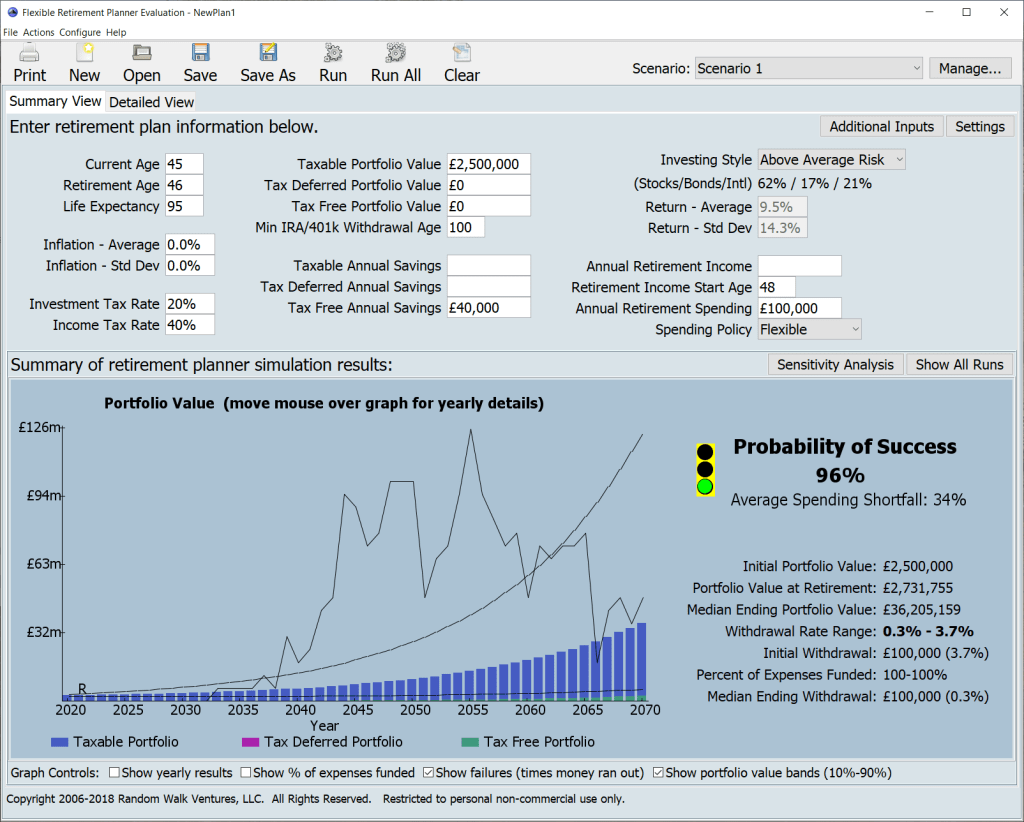

I’m using the Flexible Retirement Planner to see how confident I can be that £2.5m is ‘enough’. I am assuming £100k of spending, starting ‘from now, with a £2.5m windfall’. This assumes the £2.5m windfall is fully unsheltered. I also assume that henceforth we will plough £40k per year into tax sheltered savings (i.e. maxxing the UK’s ISA allowance as a married couple), which will slowly improve the after-tax returns and income. We are investing with ‘above average risk’ (roughly 65% equities).

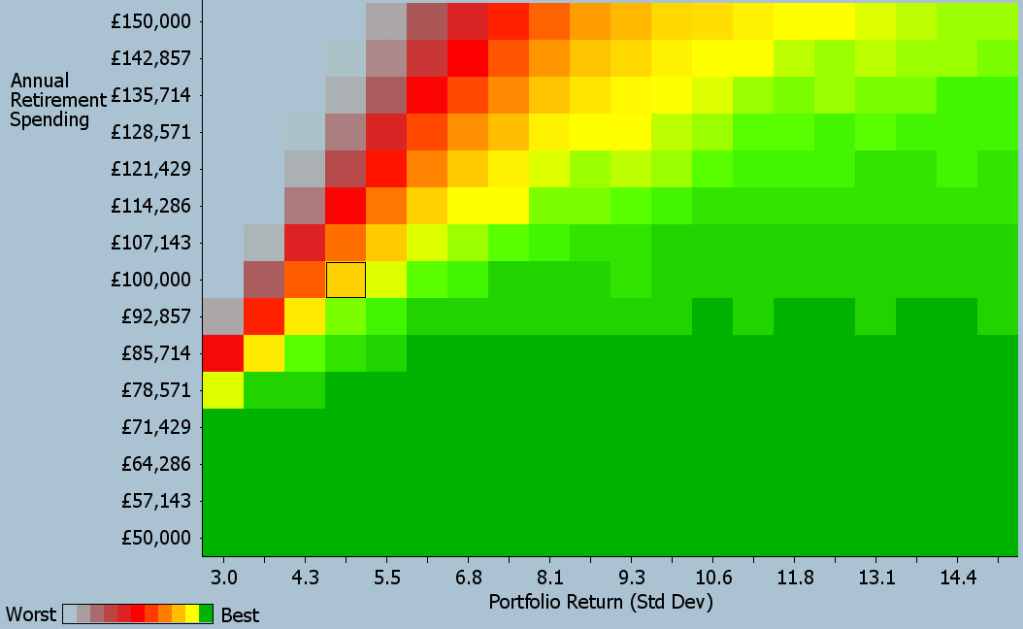

My annualised returns have been 11% per year over 7 years. Let’s call that about 8% per year above inflation. The Planner’s stats tell me that there is a 98.9% probability of having ‘enough’ – this box is a bright green. On the heatmap, green signifies over 90% probability that there is ‘enough’. Red signifies only a 50% probability.

But my 11% figure is only 7 years’ track record, and it doesn’t include a market bust; over the last 20 years my returns are, I think, closer to around 7%, or only 4-5% above inflation. The highlighted amber box shows the scenario where returns average 4.9% (above inflation, say), and my income remains (inflation adjusted) at £100k for 50 years. In that case I have only a 87% probability of having enough – or a one in seven chance of running out of money. The ‘Safe’ Withdrawal Rate is, rightly, not called the ‘Bulletproof’ Withdrawal Rate.

Climbing off the floor

While £100k would more than cover my ‘needs‘, but it would not cover very many of my ‘wants’. I’d have to eat out less, travel less, and be less charitable.

In point of fact the majority of my spending is on ‘wants’, not ‘needs’. I want to eat out, regularly, and check out some of London’s better restaurants. I want to travel, carbon taxes permitting, using London’s excellent airport/rail links. And I want to ‘pay it forward and back’, and continue to support philanthrophic causes. And of course with a bigger pot I will have bigger investment expenses; at least £10k if I spent only 40bps, in total, on a £2.5m pot.

I haven’t mentioned medical / care expenses but I want to be able to handle those too – though I suspect that the moment I have hefty health-related costs my eating out / travel / etc costs would drop in mitigation.

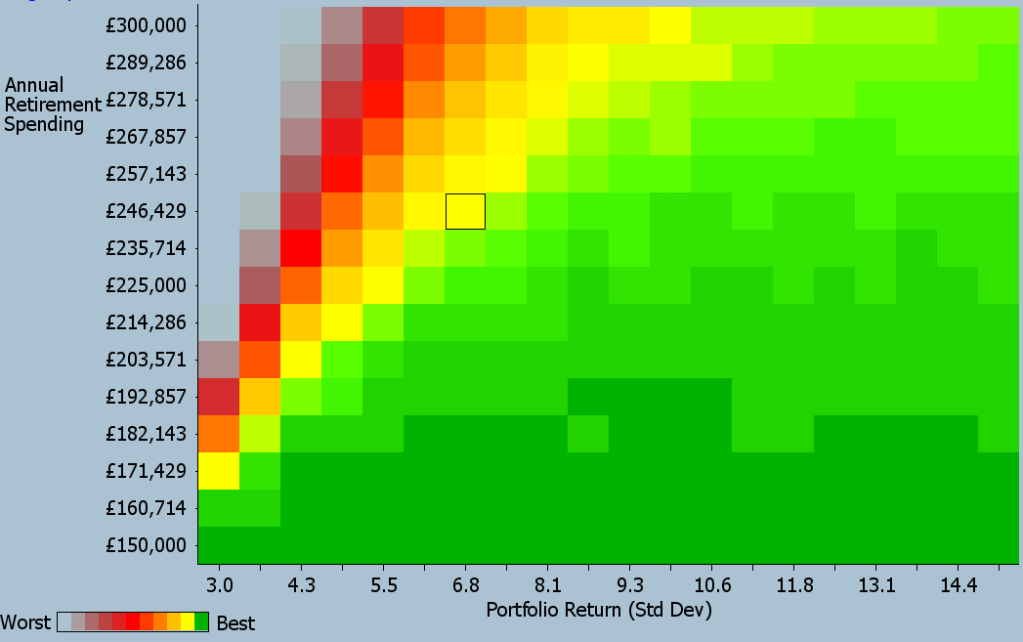

I think my annual income, that would leave me comfortably able to afford more than enough ‘wants’, would need to be around £200k p.a. This is twice the height of the ‘floor’. This sounds like a vast amount relative to the UK national average of around £30k per household. On the other hand I have written before about gilded Londoners who believe £500k of (gross) income a year is the minimum required to live properly.

And at £200k of annual income, the question of tax is unavoidable. Assuming I (Buffett style!) sold assets and paid Capital Gains Tax (at 20%), instead of taking dividends and paying Income Tax (at almost 40%), this suggests I’d need £250k of pre-tax income, and the pot is actually just over £6m.

Don’t touch the capital!

My bar is however higher still. I want to be funding spending (and taxes) from investment income, without any need to sell ‘capital’. And my income yield is somewhat lower than the 4% SWR I’d used above; it’s closer in fact to 3.5%. This also pushes my tax rates up, to about 30%. So now my £200k spending money needs almost £300k of gross income, which requires a pot of £8.5m (at 3.5% yield) to deliver.

Two more storeys to climb

Psychologically I have two more storeys to climb.

First of all, I want my lifestyle to be relatively unaffected even by a severe market drop. How severely can the market drop? I reckon on a blended fall of about 25% – taking into account my diversified asset allocation. In effect, therefore, my pot of £8.5m needs to be ‘post crash’ – suggesting I only really have ‘enough’ once the pot reaches £11m. At that point I can cope with a market crash, and still have enough to live a very ‘wanty’ life, and pay my taxes, without touching my nest egg, and on an indefinite basis.

I’m close to the top of my ‘enough’ definition at this point. But in fact I aim for one layer higher still. Arguably the most toppy layer of all – perhaps the penthouse floor? And this layer exists because I want to maximise my ISA/SIPP tax incentives.

The ISA maxing double whammy

To maximise my ISA/SIPP tax incentives, I need to ‘max out’ my contributions. My SIPP is already on track to hit the Lifetime Allowance, so this doesn’t really alter my calculations so far. But ISAs have a £20k annual contribution allowance, on a ‘use it or lose it’ basis. So for me and Mrs FvL to maximise this, I need to move £40k a year from unsheltered funds into an ISA.

But aiming to maximise my ISA benefits also has a further implication. To maximise the benefits, no money must be withdrawn. Any withdrawal represents opportunity lost; £1000 withdrawn in 2020, could have been left in to compound up tax-free for, touch wood, 50 years. If I sustain 7% returns in the ISA, in 50 years that £1000 would miss five ‘doubles’. In 50 years time the ISA would be £64k smaller.

Aiming to maximise my ISAs means effectively ignoring the ISA pots from all these calculations. I’m really redefining the question as ‘how much is enough, ignoring (but contributing to) a fully-maxed out ISA’?

If I/Mrs FvL worked to earn that £40k ISA allowance, we’d need to earn over £70k per tax to fund it. In practice I don’t think of these funds coming from income, but rather being unwrapped assets that I sell to fund the ISA topup. Conceptually, I need to ‘ringfence’ a pot of unwrapped assets, just to fund the annual ISA allowance. How much ‘ringfence’ is required? At a 4% yield, I’d have to ringfence £1m. At my 7 year annualised return of 11%, and assuming 20% capital gains tax, I’d only need to ringfence just over £400k. Let’s take the mid point – about £750k of assets are required to fund the ISA topup without disrupting the ‘nest egg’ or my spending profile.

So, that leaves my ideal ‘enough’ figure as over £12m, excluding the ISA and excluding my home. That includes a £750k ‘funding the ISA’ pot, a cushion to allow for a nasty (but not the worst possible) market drop, enough to allow me to take dividends, and pay my taxes.

Surely I can’t be serious?

£12m certainly seems like a lot of money. I do not have an absurdly opulent lifestyle; I only have one home, I don’t have to pay for school fees / nannies, nor do I have armies of staff or very expensive hobbies. How can I possibly need so much money to have enough to calmly embrace financial independence at my current spending level?

Of course a pot of £5m, less than half my ideal figure, would certainly be a fine thing to have – particularly if it is in addition to my home. I could live a decent life, in London. I could probably do so indefinitely. I’d be able to build my ISA for some time yet. But there is a >5% chance I’d have to cut back; allowing for inflation, there could be as much as a 30% chance of running out of money. I’m young enough not to like those ‘in extremis’ scenarios much.

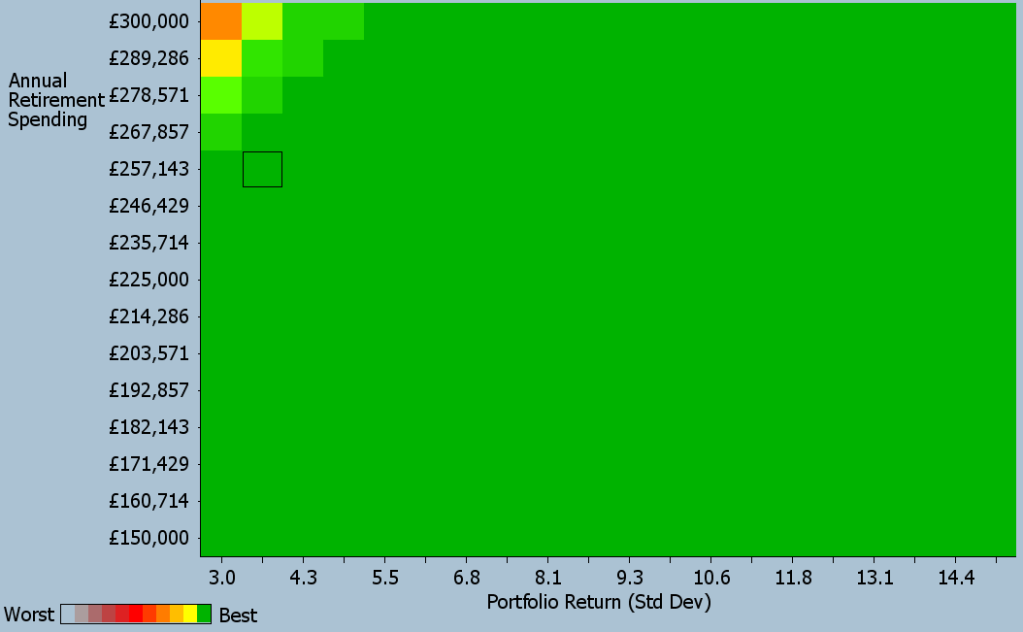

And it is those ‘extremis’ scenarios that are bumping my pot up so much. Let’s just doublecheck how my Flexible Retirement Planner models my penthouse-floor pot of £12m. I’m going to come down a storey, because my approach has built in a buffer to allow for a 25% market fall – something which, in effect, the statistical modelling of the Flexible Retirement Planner does for me. So if my £12m took a 25% bath right at the outset, leaving me with £9.0m, here’s the heatmap:

I’m not quite 100% guaranteed that £12m is enough. The key risk is, effectively, taxes going up – which would make me seek higher gross income to maintain my lifestyle. The equivalent risk is my spending levels increasing, something that is certainly possible. But these risks only prove serious if portfolio returns are below 4% on average. Assuming my analysis is all after inflation, that is a real possibility (apologies for obscure economist pun!). But the chances of low returns, just after the 25% bath, as well as taxes going up, is a chance I will take. For me, a pot of £12m (excluding housing and ISAs) would definitely be enough.

This is a great article. I admire your forthright writing. I have a soft target of $15m which is pretty much exactly the same. I do think you can’t use anything like 4% though. I know you’re kind of not. But you kind of are.

Have you seen my post about the SWR and annuity rates? You should probably be using something closer to 2%

https://www.finumus.com/blog/low-interest-rates-and-the-safe-withdrawal-rate-swr

LikeLiked by 1 person

Thanks to you too! I love your blog too, as it happens, but no I hadn’t caught your article.

As you say, I am kind of using 4% (well, 3.5%), and kind of not.

I have a lot of layers of safety built into my approach – not least the flexibility to dial down my ‘wanty’ spending – so in effect maybe that covers some of the gap between 1.6% and 3.5%?!

LikeLike

Yeab. I think the dynamic spending with a low SWR covering essentials and any excess returns covering nice-to-haves is actually the way forward.

My other mental trick, cheating? Is to just categorise some things that might be considered expenses to some, as debt. School fees is the text book case. They are a one-off, I don’t need to pay them forever so my natural yield doesn’t need to cover them. I just subtract the total remaining outlay from capital.

LikeLiked by 1 person

I agree re ‘projects of finite life’ – better to ringfence a pot and ignore it in the calcs, than stress about the outgoings.

LikeLike

I’d be curious to know more about your £100k minimum expenses. What do your expenses look like? How has life changed as you’ve gone from £50k pa to £100k?

As you can imagine, those on lower earnings might be curious what your life looks like, and how it’s substantially better, than theirs. What can you do that others can’t?

LikeLike

Well, I am budgeting on £30k+ on household (cleaning, gardening, repairs, capital projects – a roof job beckons); this is £2.5m pot, £10k of investment expenses are easy too – even if they are ‘hidden’. That makes £40k. I am ignoring tax, but you could well include it.

Groceries (Ocado, not aldi; fancy pet food), Utilities (fast broadband, naturally), medical (>£10k last year) and public transport are over £25k p.a.

That’s £65k p.a. This doesn’t include any clothing, Amazon/etc shopping, ATM cash, at all.

Now add any dining out, booze, foreign travel, car, taxis, clothing, shopping, ATM cash, and I quickly approach £100k.

I bet most readers of this blog spend more than me on at least one of the above categories, even if their total spending is lower.

On top of this, I eat out and travel a lot. I fly business class, out of my own pocket, at least once a year. I donate to charity. These latter points are all new since my spending has gone from £50k to >£100k p.a. I could live happily without much this, but my objective is to be financially independent without spending ‘constraints’, if I can. If I have to be constrained, I will be cope, and won’t expect much sympathy.

LikeLike

£25k on public transport costs?

That either is a type or a complete rip-off!!! Maybe that’s for everyone but it’s mightily expensive.

I have looked at getting a season ticket for my commute which is about 1h20m by train and it would be about £4,797 a year. That’s a lot in my eyes – and I know that commuting in London is bad but £25k!!!

LikeLike

No. Groceries, medical, utilities, transport all together.

LikeLike

ah – I misread.

LikeLike

Hey bud,

Any advice on increasing my income?

I’m 31 and currently earn circa £47k, however I recently started dating a girl a couple of years younger who is on circa £80k likely to rise north of £100k next year.

We don’t live in London but do live in a HOCL area (starter home circa £325k in ok part of town).

Since we’ve been together I’ve noticed my spending has edged up, higher than ever before with monthly trips and expensive hobbies we both share.

I intend to purchase a house in the next year and whilst I could cut right down (as I have in the past), I’ve discovered it’s a lot more enjoyable to increase my income.

I have circa £100k in assets so am ready to go now but girlfriend doesn’t have any savings and wants to contribute (used to be bad with money, unsure on her actual spending one bank account, no budget).

Any advice?

Anon

P.S. I’m a marketer, partner is a headhunter.

LikeLike

Interesting scenario; you have savings, but ‘low’ income; she has ‘high’ income but no savings. Not sure how to handle that, in the context of a house purchase. Ideally you can teach her the savings habit….

No particular advice on increasing your income. You are in a more stable line of work than her, so on a ten year view you may earn more. In the meantime, build skills, look for more responsibility, etc. And keep saving!

LikeLike

Two immediate thoughts. Both of your occupations are in industries likely to face major disruption from cognitive technology and intelligent automation. There is a risk that both could go the way of the high street travel agent, and become a historical legacy. To make big bucks, you both need to retrain into something involved in cognitive technologies.

Some short term “hits” to raise income:

https://www.moneysavingexpert.com/make-money/

LikeLike

My feeling is the numbers that constitute enough will vary massively across people with an interest in figuring out those numbers, probably by at least an order of magnitude.

As an aside, could I ask what an average working week constitutes, in terms of hours (including any commuting)?

LikeLike

@Rhino – right now my working week is long – 45-50 hours or so – but this is by my own choice and probably won’t last too long. I think my comfortable steady state would be 30-40 hours a week.

LikeLike

My hours are also currently about 50 (inc. commute time) and at that level it starts to get increasingly tricky to fit everything else in around the edges of work. Something I need to rectify going forward. Looks like my annual expenses this (tax) year will be just under 40k or thereabouts for a family of four, but it does jump around a lot year on year.

LikeLiked by 1 person

I have always loved your blog but given that the UK average family spending is around £29k – what are you spending the other £71k on?

Sure, London is expensive but an £8,000 spend a month must include a large number of highly discretionary items like monthly holidays, new cars every year, a drug habit or even maybe could stretch to private nursery fees for two kids.

A side question could be what are you missing out on by not having £200k a year to live off?

If the question is “how much is enough?” maybe you could start with what you need first and what you’d like next before fixating on £XX.Xm to fund that lifestyle.

I am not sure after a certain point all that money spending is worth it especially since it must be earned in the first place. But I’m happy to have you think otherwise. 🙂

(https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/expenditure/bulletins/familyspendingintheuk/financialyearending2018)

LikeLike

Just like to jump to FvL’s defense here – I don’t even live in London and our family (of 4) expenditure is about £80k p.a. and that’s not including mortgage interest, which is ~0 or school fees (which we don’t count as an income expense). This is easily covered by investment income, but I’m considered quite frugal by my friends, most of whom certainly look like they spend a lot more than we do.

LikeLiked by 2 people

I suppose that we’re heading the same way. We have swung from around £2k a month when the kids were born (and not travel for us) up to £6k+ now including nursery fees) – that’ll come down I’m sure (for example we are looking at £10k on one-off (I hope) house repairs/improvements this year)

But £80k a year is a lot of discretionary spend – which is fine if you are earning £120k after tax but it’s not in keeping with the idea of reducing and controlling spending to make you more financially stable.

LikeLike

I’d also like to see an expense break-down from both of you – not because you NEED to reduce it – as is the FIRE mantra – but mainly due to curiosity. As I’ve never spent much more than £10k per year, it’s just alien to me.

I mean, surely the extra must be going on things like expensive hotel holidays (instead of Airbnb) and £100 bottles of champagne (instead of £5 Aldi Prosecco)? Or maybe Range Rovers? Those things are ridiculously expensive 🙂

I can’t fathom anything else that would eat that much spending when you’re NOT including housing costs!

Here’s my 10k breakdown from a few years ago (from an old Reddit post) before I moved to London – https://thesavingninja.com/how-to-live-off-10k-per-year/

LikeLiked by 2 people

We are a family in the north of England and spend between £65k and £80k per year. There are four adult size members of the family. Big discretionary costs are holidays and house improvements. We have no mortgage, no school fees and one seven year old car. However we spend freely on things we want to do.

I anticipate that when our kids are off our hands our expenses will probably halve. £50-60k will be enough to live in clover.

But I do think £200k is kind of hard to achieve. I’d have to really work at my spending to get anywhere close. Maybe I could buy a Tesla. (Every year?)

LikeLike

We are a family of 4, and we are averaging £80k pa. However, about £24k is on rent (we choose to rent) and £18k on nursery fees. Curious to see your expense breakdown

LikeLike

Spending £100k a year on day to day living can be easily done – I do that but I would be the first to admit that if I was not time poor I could do it on far less and be far more efficient in that expenditure and probably appreciate more modest things more

I spend £1k recently on a meal for 4 in a Michelin 2 star restaurant and week later spent £75 for 2 on a middday meal in a restaurant hoping they would soon be awarded a Michelin star – I thought the later meal was marginally better and was far far more of an efficient purchase

LikeLiked by 1 person

I think your approach is too optimistic. The SWR you are using is too high.

I probably sound like a broken record, but your assumption is what for the deflator? It seems that you are just assuming CPI. The issue is that that only adjusts for average cost of living and not for standards of living. A £100k+ lifestyle puts you in the top few percent (or possibly 1%) in terms of standards of living. You cannot simply assume that the deflator for the top few percent = average deflator. It simply isn’t the case. In fact inflation levels for the top few percent are running at least 1-2% above average levels. That will turn an SWR of 3.5% into 2% instantly.

I don’t think SWRs scale well for those looking at “fatFIRE”. Those looking at “leanFIRE” can use 3-4% and then, if the actual SWR turns out to be 2% or less, fall back on things like the state pension or a job stacking shelves to make up the necessary £5-10k/annum. We can’t. It doesn’t turn the dial. The fact is that long-dated real yields are negative: that’s a bad signal. Your returns were given a huge tailwind in recent years from those long-dated real yields going negative. It may not repeat.

I notice you are using the Flexible Retirement Planner but you are putting in 0% for inflation and 0% for inflation volatility. Surely you need to use something like 2-3% for both? You earn returns nominal and pay tax on those. Not on the real return. When I stick in 3% for both the success rate drops to 81%.

LikeLiked by 1 person

@Zx48k very good points, as usual.

I am using rpi/cpi assumptions on inflation/deflator, ie about 2-3pc pa.

You are doubtless right that at my level of spending inflation is probably higher than average. Though I don’t have school fees to pay, which are (I perceive) a big contributor to that inflation.

As far as modelling is concerned I leave the inflation setting at 0, but treat my numbers as ‘before adjusting for inflation’. Ie treating 10pc return as actually 7pc after inflation. Is that not about right? It obviously implies that isa allowances up rate with inflation, which they probably won’t, but as I’m ignoring isas anyway I don’t think that matters.

LikeLike

In FRP you want to put in an explicit level for inflation and inflation volatility. Zero for both will underestimate your SoR risk plus it messes up the tax calculation. So use 10% with 3% inflation, rather than 7% with 0% inflation. It won’t change the numbers radically but it could move them by 5% or so.

I think your return assumptions are punchy. If your portfolio has sources of return (your angel investing say) that can justify this then fine. But to assume these asset returns whilst also assuming that the cost of living for the top 1% (who will be benefitting from those great asset returns), will just rise at CPI flat, well I think the joint probability of that scenario is low.

LikeLiked by 1 person

Gentlemen, I offer you my father’s Advice to a Young Man.

“However much you love your daughter never buy her a horse.” I took it as both a literal and metaphorical instruction.

LikeLiked by 1 person

Multiplying the needs by 25 or whatever I do not feel is accurate in that ones needs in later years are more likely to be healthcare which of course could be very substantial indeed.

Mitigating that time some extent is that in ones older years foreign travel designer clothes etc will have lost their appeal and I would suggest aside from health care needs ones needs will tend to be less

My model is £100k per annum plus a home outright and a rainy day fund of £1m assuming a home of say £1.5m this would mean self sufficiency at circa £5m – assuming the home is in good order at the date of retirement

LikeLiked by 1 person

one problem with accumulating £5m’s worth of assets is that there are not many people who can do it and if you are on the way to £5m you need to pass £1m, £2m, £3m and £4m to get there.

It’s more of a get rich plan than the old early retirement idea but maybe you are ok with that.

LikeLike

RIT thought £1m was enough, but had one more year and surged past it, retired, hated it and went back to work. No amount was enough for him.

I ran my models at £45k expenditure, but still can’t imagine how I’ll ever spend that much, more than £100 a day. I certainly couldn’t imagine spending £700 a day. Most days I spend nothing as I read books and do conservation work. But then I’ve been retired for 3 years, and you are still working. I was contacted about lucrative contract work last week, but rejected it immediately, I truly have enough.

LikeLiked by 2 people

My household is pretty frugal and we are both decent earners and savers but we do have a 5 year old child to plan for. School fees probably won’t be an issue as we bought a house in the catchment of one very good and one outstanding school. I’m pretty certain we’d have a decent very early retirement with a household net worth of £3 million which we should hit by the end of the year. We are both mid 40’s so we have the scope to keep working but I’d prefer to go sooner or later. However, I have known several people who left the workforce early and then returned again soon after. However, having a decent net worth at least will make that choice optional. If the £3 million gave us a drawdown of 80k to 100k then I think I’d also struggle to spend to that level.

LikeLiked by 1 person

Finumus, I loved your SWR=annuity rate article but as FvL says, safe doesn’t mean bulletproof. He’s modelled 65% equities so presumably expects a risk premium over the annuity rates. Plus annuity fees are 1-2% per year, so a low cost portfolio should outperform by say 1%.

LikeLike

You should read the ERN ultimate guide to SWR. It’s a beast – about 30 dense posts from memory, but well worth a read. There are so many variables with all of this, and it’s ultimately a VERY personal thing – e.g. you have your red lines about not reducing expenses during a bear market (that might never happen :)), whereas someone else might prefer to take that risk on their books and cut expenditure or increase income at that point if the dreaded 50% bear emerges from hibernation. Working all those extra years to fill a pot to insure against a very low probability scenario is in and of itself a risk – what if you drop dead just as you fill the pot? Not taking a step back now is a risk as far as I’m concerned too. It doesn’t need to be a binary thing.

I try not to stress about all this stuff too much these days… after a few years of kicking about doing nothing I actually got bored and now just work remotely, but on my terms, and from Bali where I pay 0.5% tax with a cost of living that is ridiculously low for a very high quality of life. I have so many job offers it’s astonishing – I thought it would be hard to find remote work, but apparently it’s not the case.

My strategy has been to cover a baseline living allowance with relatively “stable” income streams (rental properties in London and Australia), bond-like instruments, etc. Then the volatility in my equity portfolio is less of a concern to me. If I’m having a few good years I can scrape some cream off the top, if not, I just leave it alone.

For a while I tore myself apart thinking about all these edge cases with SWRs, but at some point I think you just have to go with the flow and adapt to the circumstances as things evolve. I don’t think spending inordinate amounts of time thinking about (and working to insure against) cases in the 99th percentile is a great use of time. I look at the 95th percentile to be aware of it, but generally, I just focus on the 80th percentile and the other side, in the knowledge that if it all hits the fan, I’ll either need to pull my belt in a bit, or get out and do some work. But hey, it might never happen, or I might already be dead, so I’ll worry about it if and when it happens.

LikeLiked by 1 person

Nice post. There aren’t many certainties in life and trying to forecast / model every potential outcome can be exhausting. My household has a couple of rental properties so we have additional income streams that can support our basic lifestyles if we choose to take very early retirement. Other investments ISA’s / pension funds can remain untouched fro at least the next 15 years. Hopefully we’ll be earning pretty much the same in retirement as we did in our working lives – without the related commuting and child care costs.

LikeLiked by 1 person

So you need 12 million to generate 200k, a “personal SWR” of 200/1200=1.67%. That’s very close to the 1.7% that Finumus reasons is the value of the “market SWR” based on current annuity rates. Or have I got it wrong?

LikeLike

Ridiculous waste of an article. £12m would allow you to put your money in an account making 2% (inflation) and take inflation adjusted £200k out for 60 years before your funds were depleted. Fancy modelling and over conservative assumptions have led to a nonsense outcome that tells you very little.

LikeLike

actually 12,000,000 / 200,000 = 60 years So no need to even risk being in anything but cash.

LikeLike

You state… at £200k spending the question of tax is unavoidable.

I would disagree with this – I am a PAYE worker making just over that level and have not paid a single penny’s tax in the last five years (other than NI)

Easy to achieve through the use of VCTs and EISs… and the beauty of my VCTs, in particular, is they also yield a semi-decent 4% tax free annual income

LikeLiked by 1 person

Ok fair enough. Though you are still cash flow down, I presume, from the new vct/eis investments?

LikeLiked by 1 person

Yes fair enough. Tho making enough VCT/EIS investments to eliminate income tax / cgt, you will still be cashflow negative – so the net result is still that £200k gross is not £200k of spendable cash.

LikeLike

How does that work? I thought VCT investments are made from net income so aren’t you still hitting the higher and additional rate tax bands? VCTs only recoup 30% tax, not the full 40 and 45% that a portion of your income falls under.

Very interested in understanding your approach.

LikeLike

Late back to this conversation. But all you’re really doing here is paying VCT fund managers and the management of dodgy start-ups your money instead of the tax man. I don’t really see how it helps?

And that VCT dividend income, for the most part, is not really income. It’s mostly return of capital dressed up as income.

LikeLiked by 1 person

First post was slightly corrupted….

Here goes….

Firstly great post. Anything, which gets those amount of comments has the interest of the reader. Probably because how much is enough is the great imponderable.

FWIW – I am comfortably in top 1% of earners in the UK but our annual expenditure (ex. School fees) for a family of four is in line with national average. Accordingly we are saving / investing a high portion of net income because who knows what the future holds. Again the less spoken truth of FIRE is a high income or a low expense is necessary.

I only say that because I feel that you could substantially cut your annual expenditure and overall levels of happiness would not adjust. Hedonic adaptation and all that. So I struggle to understand a £200k year expenditure beyond the overall understanding that spending any amount of money is clearly possible (e.g. Johnny Depp has spent apparently $650m and he doesn’t appear very happy). We have a happy and imo high quality standard of living on the national average. Hey we’re not by any means always happy but that’s not to do with money.

If you are shooting for £200k a year then I don’t think a £12m pot is enough assuming you want (a) a 50 year timeframe (b) to see through any prolonged market drawdown – 50% seems quite possible over a ten year period (c) want your capital to be untouched in real terms over the long term (d) want your spending power to be in line with your peers (e.g. earnings growth) not inflation growth. I honestly think somewhere nearer £20m (unscientific guess) is probably needed, which sounds heretical.

I feel that’s also because of two additional factors (a) political risk and (b) the unknown unknown.

With respect to (a) the govt is coming for your money and indeed anyone who is above average wealth. That’s because the population is ageing and people haven’t saved enough as we know. Witness budget rumours on pension and FIC’s – and that’s a conservative govt. How long before there’s a wealth tax, removal of CGT allowances, tax on ISA’s, annual charge on any balances in banks accounts, wealth tax, 25% tax free sum is removed, removal of state pension or any combination of the above. As we become cashless this will become easier and easier to implement. If the answer is they’d never do it, people won’t save well the government doesn’t really want people to save beyond being off the state and I feel confident these policies will be super popular if the monies go towards paying state pensions and if you are moderately wealthy where are you going to go? If we start seeing some productive deflationary growth (free energy, greater use of robotics) then I agree this may not happen.

I must admit if you have say £12m you’ve probably got enough to pull the plug and move to a tax free location and largely solve that problem. £1 – roughly £5m you are firmly in the cross hairs. 50 years of compounding….if you get my point? Fair play if so. If I model my future options one scenario is to keep working fairly hard in my job (circa 60 hours a week) to 60, invest as I continue to do and with some decent growth rate I could theoretically get to that figure. Not entirely sure of the point though given the melting of the ice block i.e. your days left alive. It is my great imponderable. Happy to take advice.

So to sum it up, I’m shooting for a position somewhere between zero and your figure due to lower expenses but the unknown unknowns is a major question if your time span is 50+ years at which point SWR rates seem a bit meaningless. I would probably shoot for a lower figure, spend a little below the natural yield so build in a buffer, accept the market volatility in the portfolio and the unknown unknowns. And have a bug out plan if the political environment became unacceptable.

LikeLike

Using the available natural yield of about 5% from equity income investment trusts, as of this morning, would suggest only £4 million is needed to produce £200,000 per year. Some studies on happiness suggest that about £50,000 is an optimum amount, with more money beyond that not leading to much more happiness. That, would suggest only £1 million is needed.

I think that would cover most people, or most FIRE seekers, but I think you are not most people!

LikeLike

I love that the natural yield on equities has gone up by more than 10% literally while we’ve been having this conversation!

LikeLiked by 1 person

haha – its been a rough old week!

LikeLike

[…] Firevlondon provokes a lot of discussion when he shares his financial goals (51) […]

LikeLike

I am (i) either misunderstanding or; (ii) there are some fundamentals missing; or (iii) I am not grasping this. This is what I understand / am yet to understand from your post…

1. You are 45 now with a pot of £2.5m and plan to retire with £12m and start drawing income from your assets at 46 at a rate of £200k/annum for 50 years…?

2. How do you get from your actual to wanted position investing with only £40K / annum ISA investment and returns from existing portfolio and how long does this take?

3. If £12m is your wanted position why such emphasis on SWR? You could comfortably take £200k capital from your portfolio each year and still have assets have left over when you expire. Surely the alternative to not running down your portfolio is a very large inheritance tax burden although it is not clear to who this will fall as you do not mention dependants. Also, if SWR is just a modelling exercise, once you are doing it in real life and your assumed % SWR starts encroaching on your capital, surely you simply adjust it…?

4. This is anecdotal but without exception, those who aspire or already have the lifestyle and spending that you seek are not retired and see no end in sight to using their human capital rather than financial assets to secure an income – perhaps I’m mixing in the wrong circles.

5. You do not elucidate the maintenance requirements on your home, detailed travel requirements, etc. but experience suggests your estimates are very high.

6. You are prepared to work 45-50 hours per week to hit your target. Have you considered the opportunity cost of what you will not have the resources in terms of time or energy to do in order to meet this financial goal and associated lifestyle?

In short, this article whilst interesting seems to be paying a lot of attention to the cobweb in the corner of the room rather than the room itself…the fundamentals do not quite add up. I see the next post is fighting complexity which I would definitely recommend!

LikeLike

Great article.

Lots of discussion above about how people spend their money, my own personal spending (early 30s married couple no kids) is (no mortgage) is around £120k pa, I track most expenditure and it’s split like this. This gives us a highly excessive lifestyle of regular meals out, designer clothes, regular weekends away and 1-2 business class long haul holidays, though I don’t own a car.

Bills £7k

Supermarket £5k

Domestic Help £3k

Transport (mainly taxis) £5k

Dinners/Drinks £20k

Clothes £5k

Holidays £35k

Big ticket items (wedding, engagement ring, kitchen refurb, new roof, something always comes up) £40k

LikeLiked by 1 person

I started my FI journey thinking that a paid off 4 bed house in nice area and 4% SWR £48k a year for family of 4 would be good enough. I’ve arrived. I feel much more secure in that e.g losing my job does not worry me especially.

However, although I don’t love my job, I do love the income! I took the family + mother in law on a luxury (to us) 1.5 week winter sun holiday. I hardly noticed the £5-6k cost other than the reduced savings for 2 months. I think that’s the difference of a higher retirement income. You can have the occasional discretionary splurge, and not have to worry!

I’m currently debating with myself the merits of sticking with my low 6 figure job in legal and getting to £60k on 4%SWR, vs throwing myself into the random world of work. In other words networking to find people I want to work with who have a problem I can help solve. And then trying to make it pay a little. Probably an ownership stake. I live in Cambridge, so I am hopeful such opportunities exist. But I’ve been too busy in the office to really look.

Personally, I think £5k a month for a family of 4 is comfortable. But who knows how I will feel when I reach that. Maybe I’ll be here in 6 years writing that £100k is the minimum.

LikeLiked by 1 person

£100k annual, that is.

LikeLike

[…] Is £12 million enough to retire on? – Fire Vs London […]

LikeLike

Wonderful post FvL! I am a fellow Londoner (South London) and have just come out in the FatFIRE community.

I think I agree with you. I’m trying to hit a £100k SWR 4% with £2.5M (but might reduce that with Property to around £1.5M).

The thing that has bugged/intrigued me up until now with the FIRE community is that it has missed out expense inflation from the equation. I may be missing the point but, if your current expenses cannot be a the same in 10-20 years time because inflation is a real problem.

When I raised this in MMM and Reddit they gave me the narrative of:

– Its factored into the SWR (only on the withdrawal rate post FIRE not the pre-FIRE expense target)

– You will pay less tax when you are FIRE (No I won’t, I will still be higher rate CGT and Income)

– You will get more and more frugal as years go by. When the price of eggs go up you will turn vegan (And its healthier so win-win)!

I may be missing something but would love an opinion on that.

I started on FIRE long before I knew that such a movement existed. I had a FatFIRE flavour already modelled out in Excel. And the key thing I did was calculate my expenses and adjust them for inflation. This made the calculation harder as it was a moving target. SO I engineered my spreadsheet to work out the linear equation to work out how much I would be saving + the time taken + the SWR.

So although my expenses are £84k now, they are predicted to grow to £112k in 10 years time. I have therefore decided to stick to £100k because I know we are not going the full FatFIRE route but a softer FatFIOR route as we will have side hustles and I will likely do the odd IT Contract (I’m a Technologist working in Big Banking).

LikeLike

Great article Mr FvL,

I’ve been a long time reader of MMM, however, being an SW London resident with two children in private school not all of his views work for my life style. I’ve been grappling with this question for a while, I think I ‘need’ £3 to £4M overall including property equity (though love the margin finance on your property, MMM looks to have embraced this too) to feel financially ‘secure’ though I am fortunate that I run my own company and can dip in and out of employment if required. I’m about a third of the way to this goal though I am able to save £200k a year going forward enabling me to reach this target by late forties If I stay the course! So not that early but a good deal earlier than most.

LikeLiked by 1 person

[…] each of us has a different ‘number’ to hit, and mine is almost certainly higher than most, my invested portfolio has been larger than I might reasonably need for some time now. It would […]

LikeLike

New here! I say go for it. 12 million pounds should feel pretty good, especially if you have a family to take care of in London.

I live in San Francisco and $5 million is barely enough. Need $10+ million here and our cities are similarly expensive.

The crazy thing is, once you hit $10 million, getting to $15-$20 million comes quick!

Sam

LikeLike

I think the answer is:-

1) You own the home you like live in and is adequate for your needs now and in the future outright and is in good order

2) 25 X your annual expenditure ( less if over 57 – I would suggest )

3) £0.5m rainy day fund

PROVIDED you have learnt and can control that driver which draws us towards consumerism and being competitive

LikeLiked by 1 person

a very late response to this having just found this page, and then visiting the calculator. Many thanks for providing this, and to Finimus also for the updates. I fully agree the % success decreases quite significantly when running 3% inflation with 5% vol against 6% equities and 15% vol (my cases) vs 3% equities alone.. Secondly – for you FirevL -> I think you need to click the ‘stable’ drop down tab not ‘flexible’ which will reduce it further (and I think gets to around a 1.5% SWR needed for it to properly work (95% success with above numbers)

LikeLike

Thanks Andy. Yes I think the point about inflation is a good one – inflation vol (std dev) at least risks higher tax bills, as made by ZX48k. Thanks also for the tip re Spending Policy being Stable. Noted!

LikeLike