The UK election already seems some time ago. Really, it was just last month, and mid month too. And it provided welcome clarity – I will say that for it – after several years of frustration. For all the hyperventilating Brexit nonsense, citing ‘enemies of the people’, ‘a treasonous Speaker’, parliament undermining democracy etc, the root cause of much of the last few years’ nonsense was the lack of a majority in Parliament. Parliamentary sovereignty is supreme, and is delegated to the government/executive by a clear majority. All else is noise.

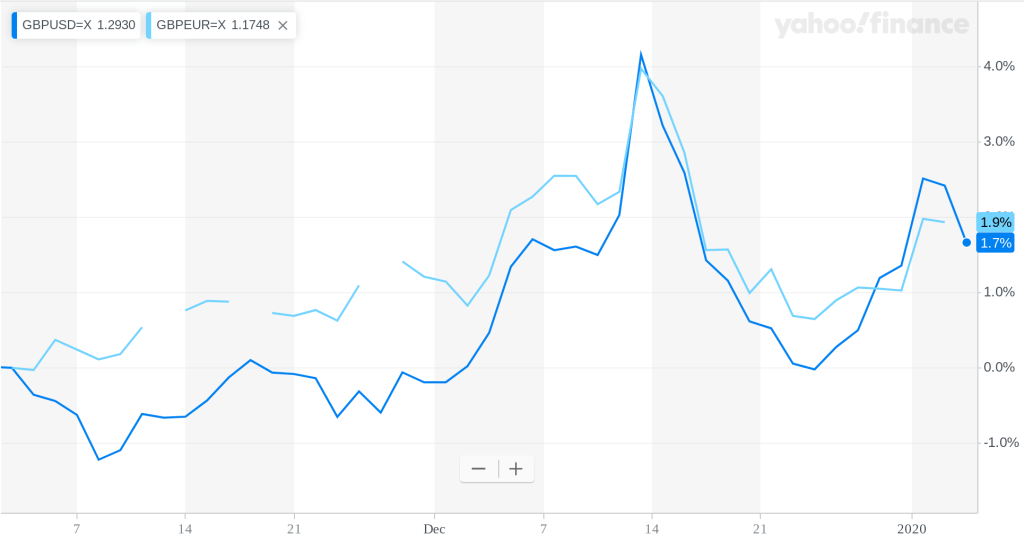

And much as I am no fan of the Tories and the Tory Brexit, the improvement in mood / confidence / sense of clouds lifting after the election result was palpable. The dimwit forex markets lifted the pound above $1.35, before dumping it back where it started once they came to their senses. By the end of the month though sterling had climbed 1-2% against the USD/EUR.

Elsewhere, we saw the new EU commission take over, the USA/China trade war rumble on, and some nasty early season bush fires take root in Australia.

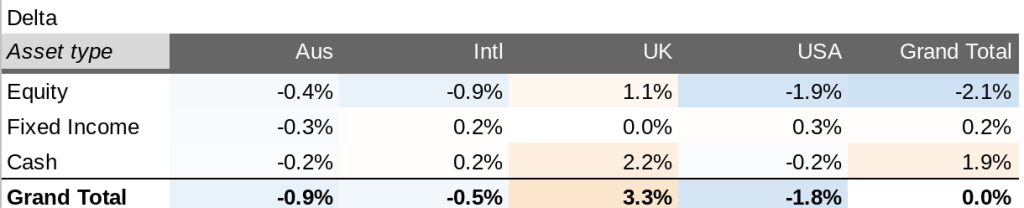

And amidst all this noise, equity markets rose. The UK market grew the fastest, bouyed by the election result presumably; both European and USA markets also saw good gains, admittedly mostly cancelled out by their currencies falling against the pound. Only Australia was the outlier, with a drop in its ‘share market’ somewhat mitigated by the rise in the AUD.

Bonds in UK/USA barely moved. Elsewhere they had a rather dismal month, but given that I hardly have any exposure outside UK/USA, this makes minimal impact on my portfolio.

For my portfolio, December saw a gain of about 1.6%. I ended the month as I started it, modestly adrift from my target allocation – underweight on US equities in particular, and overweight UK cash (actually underweight on my UK margin loan!). My margin loan is currently just over 10% of my gross investment value, a level of leverage I feel entirely comfortable with (even with an impending market drop).

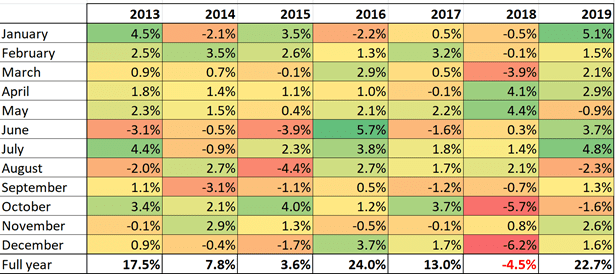

Looking back at 2019, it has been an extraordinary year to be invested. Even bonds posted about 9% increase on the year (led by the UK, at 11%). But equities saw 30% gains in the USA, already the largest market in the world. In fact, against the USA’s rise, the FTSE’s 19% gains seem disappointing.

Overall, the benchmark for my market allocation rose by [21%]. Against that benchmark, my actual portfolio rose by 22.7%. The 2019 markets rose almost as much as they did in 2016, when the pound dropped by 20% and lifted my overseas holdings accordingly.

Completing 2019 sees my monthly track record conclude its seventh year of tracking. In seven years, at 10% p.a. growth, something doubles. My portfolio has been growing, on average, faster than that – so my ‘double’ occurred in the middle of 2019. My annualised returns since inception (1/1/2013) are currently 11.6% p.a. A lucky year.

I’m part way through a big refactor of the spreadsheet, reminded me of your prior post about the ideal portfolio tracking tool. I’m now using a new-fangled google drive sheet to semi-automatically pull in live prices. I’ve also discovered the OFFSET() function. How did I live prior to knowing about this?

Still a bit of manual manipulation required on a monthly basis, but hopefully less..

The portfolio got a whole lot more complicated in the last quarter of 2019 so I needed to take action to lighten the tracking load.

Its not quite right how much I’ve enjoyed tinkering. I must be a deviant?

LikeLiked by 1 person

@Rhino – thanks for the update!

I got a couple of good tips in response to that blog post, and spent a few hours tinkering as a result. However in the end I have stuck with my original toolkit. I concluded that the key thing I lack with my current arrangements is the ability to import investment portfolio transactions into tracking software, and the new tool I was checking out was no better in this regard than my original tools. Maintaining live stock prices is the other omission but is nicely taken care of by my Google Sheet.

OFFSET() is a useful function indeed – albeit a rather brittle one!

LikeLike

[…] portion. I completely ignore my angel portfolio from the point of view of any net worth / FIRE / returns / allocations / complexity analysis. If I receive an exit from an angel investment, this windfall […]

LikeLike