A startup I used to know for had ‘doubling parties’. Every time the business doubled in size, there was a party. For the first party they had a glass of prosecco per person… by the 7th or 8th party, the bash was a pretty major affair.

The big picture I cling on to on my investing journey is Doubling. I want my portfolio to double as fast, and as many times, as possible.

Closely connected to Doubling is the Rule of 70 (strictly, 72). The Rule of 70 is mental shorthand for doubling: it says that if you compound growth of X% per period, you will double in 70/X periods. I.e. if you grow at 7% per year, you will double in 10 years. More to the point, if you grow at 10% per year, you will double in 7 years.

I started my rigorous portfolio tracking at the beginning of 2013. I unitise my portfolio, so I am tracking ‘underlying’ growth, stripping out deposits and withdrawals. One question I’ve been keen to answer is: how long will it take me to achieve my first Double?

As it turns out, I briefly Doubled in August 2018, barely five and a half years after starting. This was by achieving a compound return of over 12% – which is almost Warren Buffett levels. But this amazing result lasted barely days, and I closed the month at 1.98x my starting point. A whisker away from doubling, but a mile away too. No sooner had I spotted this good fortune than global markets started their precipitous 2018 H2 tumble, leaving me to finish just 1.76x up at the end of 2018.

Since the miserable 2018 Q4, my portfolio has delivered steady good news. I surpassed 2.0x a couple of weeks ago, and as at the month, quarter and half year end I am pleased to report that I am officially 2.024x up my 1/1/2013 starting position, on a unitised basis. Six and a half years in, I’m 2x up. The rule of 70 tells me I’ve been compounding at (70/6.5) 10.8% per year, which is very close indeed to the actual number – 11.5% according to the BogleHeads methodology.

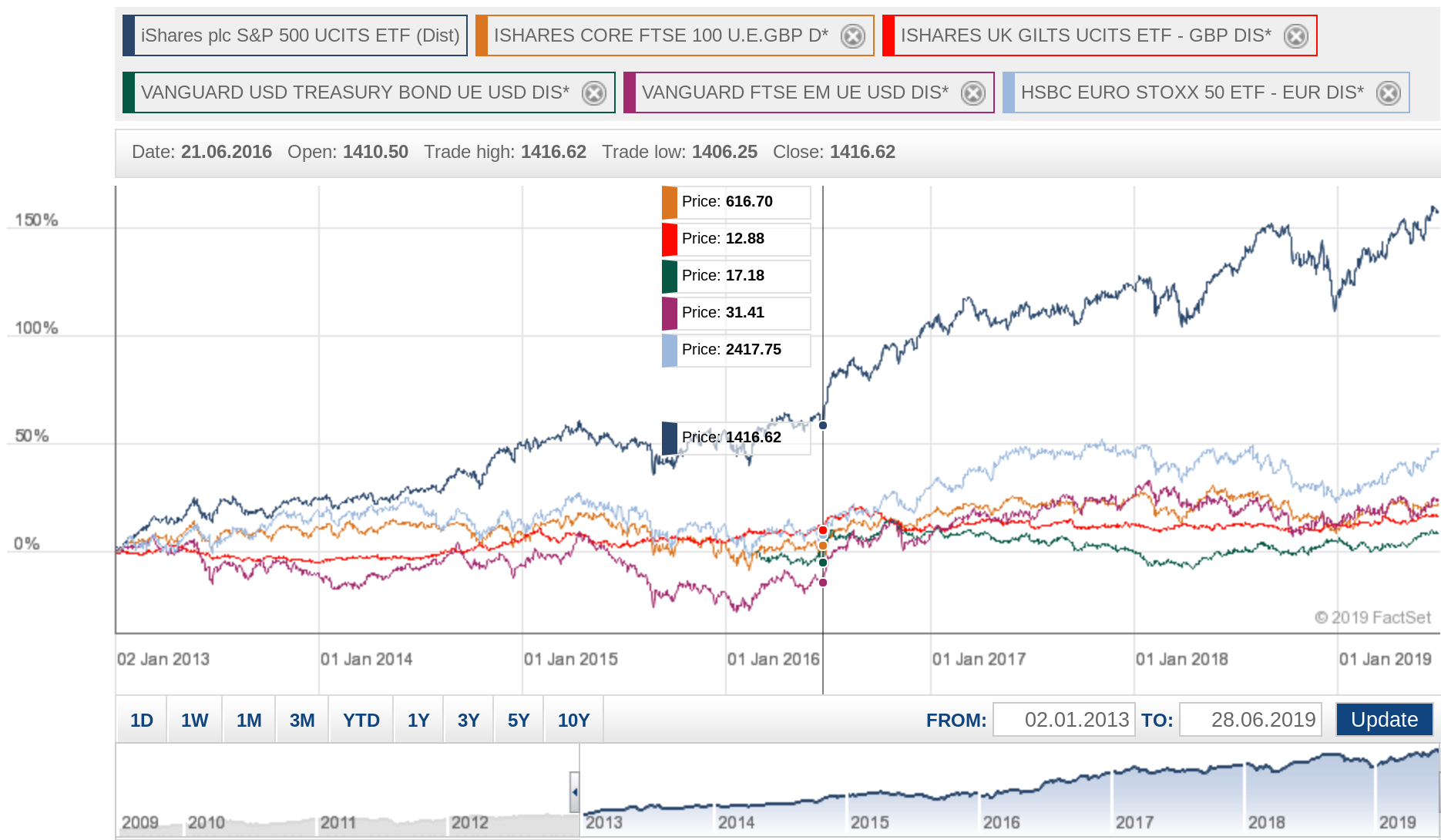

(Updated) How does this performance compare with the market? Obviously, it depends on which market. The standout contributor to market returns since 2013 has been the USA stock market. Other equity markets, particularly the UK, have returned barely 50% in the last 6-7 years. But the S&P500 index has risen from ~1500 to ~2800 (up 87%). Add in dividends (about 2% per year, so about 14% in that timeframe) and you are at about 100% growth. And measure it in pounds which, thanks to the Brexity 52% of the UK electorate, has devalued by about 20%, and you see a gain of about 150%. My portfolio has been almost 50% weighted to USA equities; and hence has caught about half of this good fortune.

Doubling every 6.5 years is very unlikely to continue. But if it did, it is not beyond medical precedent to think I could double 10 more times. Doubling ten times is a 1024-fold increase. A million pounds, doubling 10 times, would increase to over a billion pounds.

Becoming a billionaire as a centarian would only be in the money of the day, whatever that is worth at that point. Inflation is an important consideration here. If £100 doubles over 6 years to £200, what role does inflation play? With inflation relatively low, right now, relative to historical levels – the impact is not dramatic. Over 6 years, £100 has lost about 10% of its value. So in other words, £100 in 2013’s money, having grown to £200 in today’s money, is worth about £180 (90% of £200) in 2013’s money.

From a Doubling point of view, I tend either to a) ignore inflation – and just focus on the psychological wins of ‘cool, I’ve doubled’, or b) subtract my notional inflation number from my actual annual returns, and recalibrate – so rather than obtaining 11% returns (which double in <7 years), I’m actually obtaining about 9.5% returns above inflation, and 9.5% doubles in about 7.5 years. On this definition I’m still theoretically a year away – and thus maybe in pratice a generation away – from doubling in real terms.

Just as important as inflation is the economic cycle. Equity markets, in particular, move in cycles. The last bust was in 2008/2009, a few years before my measurement started. Since then we’ve had a long boom, which hasn’t yet its climactic bust. Until that bust happens, I have to assume my Doubling is provisional. But even a 30% drop in markets now would leave me at 1.4x up since 1/1/2013. When that happens, please ignore my gnashing of teeth.

As I sit here today, in my forties, I find it hard to comprehend the Einsteinian logic of compound interest. Statistically speaking, I am likely to live into my eighties or beyond, which gives me 40+ years left; on this basis I am likely to Double at least four more times (before inflation). Let’s call it three more Doubles, after inflation. Doubling three times is an 8x increase; four times is a 16x increase. If I doubled 7 times, that is a >100x increase. Any of the above, even allowing for me spending a certain amount of my dividend income, would leave me a deca-millionaire a few times over. The maths isn’t wrong but it doesn’t yet feel right to me.

r > g

LikeLiked by 1 person

Potentially a silly question but does the return include additional contributions?

LikeLike

No. The returns are calculated afteelr unitising the portfolio, ie stripping out the injections/withdrawals.

LikeLike

(Post updated after publishing to show the performance of major markets since 2013)

LikeLike

[…] Doubling: party! → […]

LikeLike

[…] Firevlondon appears a little overwhelmed by the power of compounding (29) […]

LikeLike