Idling away an hour on the long weekend, I found myself examining whether my mental model of how I invest is actually honest.

In particular I have an investment philosophy of holding for the long term, of buying (not selling). Is that true? How often do I in fact sell things?

My philosophy is to minimise fees wherever possible. But it is also to reinvest dividends manually, not automatically, so that I can rebalance as I go – rather than ‘high buying high, and low reinvesting little’. Moreover, my minimum amount for a trade in Mrs FvL’s account is only £1000 – the amount of cash that must accumulate before we reinvest it. So my philosophy leads to me making plenty of transactions, for which Mrs FvL pays full price. Does this lead to high trading expenses?

To answer my own questions I did the following analysis:

- I looked only at Mrs FvL’s portfolio history. I manage her portfolio using the same investment philosophy, but in a simpler/cleaner way, as my own. I track all of her transactions in one place, unlike my own funds. And though her asset allocation is slightly different (lower weight USA, more domestic bias), this shouldn’t materially affect a transaction analysis.

- I looked at the last tax year – i.e. the 12 months to 5 April 2019. This was a year in which I moved significant funds into Mrs FvL’s accounts, so there was more money to invest than normal – more than just dividends.

Mrs FvL’s portfolio has around 80 unique holdings in it. This is fewer than the ~200 in my portfolio, but is nonetheless highly diversified. Half of the value is in passive ETFs/index funds. The largest holding (an Australian Equity ETF) is about 8% of the total value, the biggest single stock is about 3%, and the smallest holding is worth about £2k.

Here is what I found:

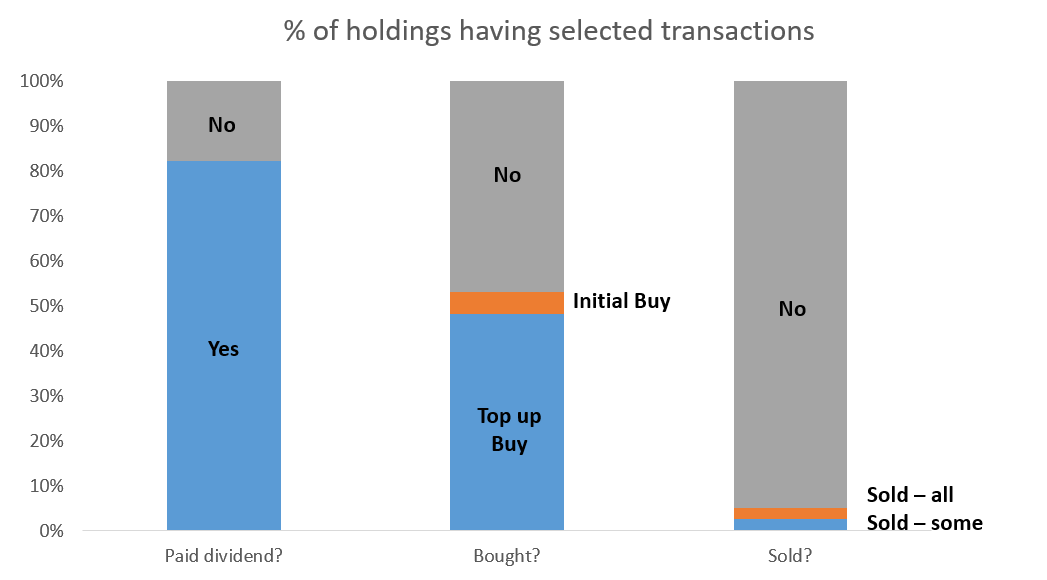

- About 80% of her holdings paid out dividends (or interest income) in the tax year. The rest were mostly accumulating funds.

- We only sold 4 securities that year. Of these, one was an involuntary sale when our holding was acquired. A second was us closing out a position (Vodafone, in case you’re interested). The other two were reducing our positions but not eliminating entirely; in both cases there were purchases too during the year. This doesn’t feel very sensible.

- We made 144 purchases, across about half the stocks in the portfolio. Four of these were entirely new positions (Rightmove, a new Eurostoxx ETF, the Vanguard UK Long Duration Gilt index ETF, and the UK Index Linked Gilt ETF). The others were all topup purchases.

- Of the purchases, around 45 were ‘involuntary’ – either reinvested dividends (in a small account where accumulating cash is pointless) or in a managed pension fund; the costs of these will be low. Of the 99 ‘discretionary’ purchases, the average purchase value was around £3500, and they ranged in size from £1k to £11k.

Assuming each discretionary purchase cost around £20 (fees plus taxes), our trading here cost around £2k. Mrs FvL’s brokers/platforms are doing pretty well out of her. Very roughly speaking, I would attribute three quarters of these costs to ‘initial fees’ for deploying new money (about 0.5% of the amount invested), and one quarter of this to the cost of reinvesting dividends manually (about 2% of the dividends themselves). I think that, with 500+ transactions in total, Mrs FvL is doing pretty well out of her brokers/platforms.

If we doubled our minimum trade size, from £1k to £2k, we would have saved about 10 trades, or perhaps £200. This is not a material sum in the context of this portfolio.

In summary, I am reassured to find that my investment philosophy is working well.

- We do indeed Buy, not Sell. The portfolio is not suffering a lot of churn. Nonetheless the fact there are a couple of holdings we both bought and sold suggests, and I can’t easily audit why, suggests room for improvement.

- And though there are plenty of Buy transactions on the account – around 100 ‘manual’ ones in a year – the ‘excess’ cost of this is well under 0.1% (only a few bps).

- For the funds in my own accounts, I follow almost exactly the same approach. The only material difference is that my minimum trade amount is bigger – £2000 or more (depending on the account), and I have more US holdings (including tech, which often doesn’t pay dividends). So while the volumes/etc are bigger than those in Mrs FvL’s portfolio, I think the same conclusions will apply.

Finally, some questions for you and your portfolio:

- Have you thought about the unintended fee consequences for your investment approach?

- If you use Dividend Reinvestment programmes, are you happy to be reinvesting in the same holdings, not the ‘best ideas’ at that moment?

- Are you rebalancing your portfolio? If not, should you?

- When do you make trades? Is it based on newsflow? Or financial needs? Or a regular schedule? Or when you have enough cash to deploy? Is your answer to this the best answer you could give?

- Have you bought and sold the same thing in the same 12 month period? Would you know? Would you do the same thing if you had those 12 months again?

How much time did it take you to research, execute and log each of these 99 discretionary purchases ? Should this be included along with the ‘initial fees’ ?

LikeLike

@Olivier – that is a very fair question. The total time taken to monitor/administer/trade is significant but, I really hope, is almost entirely ‘time wasted’ (hobbyist time). For better or for worse, I find investing intellectually interesting and ‘waste’ a lot of time thinking about it.

In fact of the ~100 discretionary Buys, almost exactly half were of ETFs. These decisions don’t require much time – they just ‘pop out’ from variances against my target allocation. I.e. if I am underweight US equities, and don’t have a particular equity I think is good value, I will buy an ETF (e.g. S&P500) instead.

LikeLike

> And though there are plenty of Buy transactions on the account – around 100 ‘manual’ ones in a year – the ‘excess’ cost of this is well under 0.1% (only a few bps).

You’re overlooking the cost of complexity on your time.

There are roughly 2 purchases a week in your wife’s account. Your own account has more than double the number of holdings “using the same investment philosophy, but in a simpler/cleaner way than my own”, so there may be another 5 trades per week there.

Each position gets reviewed, evaluated, researched, and actions considered.

A select few have a trade executed to manually reinvest, though weightings and allocations are reflected upon each time.

Given you appear to be an evidence based investor, I would be you rarely pull the trigger without spending at least 15-20 minutes per trade weighing it up.

That adds up to roughly 2 hours per week. Megacorps in the city often apply a “blended rate” to calculate the human capital cost of projects. If you worked out how much a typical working hour of your own was worth, I suspect you’d find the time costs associated with managing your portfolio run at more than £200 per week.

No judgement here, managing your portfolio is clearly a hobby that provides you with pleasure in addition to the monetary value. It is worth factoring in all the costs of your approach when measuring its cost effectiveness however. This is particularly true when seeking to compare it to the approach of others that might not be materially financially different to yours, but do leave your peer with hundreds of additional hours of leisure time at their disposal.

> 1. Have you thought about the unintended fee consequences for your investment approach?

Yes. Fees (and taxes) are a consideration. It may be more tax effective to realise a capital gain than receive a dividend. Is worth calculating returns based on total return, then factoring in both tax and fees into decisions about how (if at all) to realise income streams.

> 2. If you use Dividend Reinvestment programmes, are you happy to be reinvesting in the same holdings, not the ‘best ideas’ at that moment?

I perform much of my rebalancing via new money and manual reinvestment of dividends, based upon my preferred target weightings and asset allocations.

> 3. Are you rebalancing your portfolio? If not, should you?

See above.

> 4. When do you make trades? Is it based on newsflow? Or financial needs? Or a regular schedule? Or when you have enough cash to deploy?

As infrequently as practicable. Trading incurs a cost in time and thought.

> Is your answer to this the best answer you could give?

I worked in the Equities division of a large investment bank long enough to learn that if I wasn’t on the inside of the information flow then I would just be gambling in the dark, playing a game where somebody else was determining the rules and setting the odds.

> 5. Have you bought and sold the same thing in the same 12 month period? Would you know? Would you do the same thing if you had those 12 months again?

Rarely. Occasionally circumstances or information have presented themselves where doing so was financially advantageous.

LikeLiked by 1 person

Many thanks for a v interesting comment.

You are right, this analysis totally overlooks my ‘hobby’ costs.

In fact in reality for most of Mrs FvL’s accounts, it is a Buy every couple of months. The conspicuous exception is her day-to-day broking account where there is on average Buy activity every couple of weeks. Definitely this broking account is where the dopamine hits.

In practice what I am doing is checking cash balances every week, in most (but not all) accounts; this process takes 10-15 mins. The feeling of ‘oh, cool, there is now >£1000 in this account’ is a dopamine hit and helps make the whole journey feel real.

If I have enough cash to deploy then I check my allocations (which is tracked in realtime via a Google sheet), which tells me what asset type I need to buy. Depending on the asset type is, I either know what I will buy already, or have to do a bit of hunting. Right now for instance I am underweight USA equities but don’t have a particularly clear Watchlist; most likely I will be topping up on a NASDAQ-100 ETF.

In the background I follow financial news/etc partly for the day job so I have a level of awareness/etc which makes assessing ideas and stocks quicker than it would be for most people.

But yes this all adds up to a lot of distraction/opportunity cost.

LikeLiked by 1 person

I definitely consider costs in purchase and it impacts the amount I purchase and the frequency. Just out of curiosity, what is your average amount invested per purchase? Your first thought of the fact that there is room for improvement because you have sold a few shares may not be fair. Not every investment decision will work. You can’t control companies and their actions. You can make an educated guess based on past history. But it won’t work every time. What’s important is figuring out what you learned from each investment decision that you make. Thanks for the article and letting me learn about a different investing strategy today.

Bert

LikeLike

My point about room for improvement is that buying and selling the same thing in a short space of time is something I strongly disapprove of. There will be circumstances where it happens (e.g. news changes, new facts emerge) but it should be rare.

LikeLike

[…] Firevlondon analyses his own trading behaviour (28) – I need to come back to this […]

LikeLike

I sold one thing last year, an unsheltered Europe tracker to use my CGT allowance, and bed-and-ISAd the remainder into a different Europe tracker, so 3 transactions.

While the ISA stuff is ACC, the SIPP and unsheltered is INC, and I generally take the quarterly dividends and buy one thing, so that’s 8 transactions a year, perhaps 10.

The £150 in transaction fees is well less than 1% of the new investments, so I don’t take any notice of it.

I did lots of micro-transactions in p2p, and that’s all gone wrong, even after I realised I didn’t want to spent my retirement doing micro transactions.

LikeLiked by 1 person

1. Have you thought about the unintended fee consequences for your investment approach?

Fees are always incorporated into my investment approach. But by fees I also include bid-offer on transactions, withholding taxes etc. Anything that causes a deviation from mid.

2 If you use Dividend Reinvestment programmes, are you happy to be reinvesting in the same holdings, not the ‘best ideas’ at that moment?

First, very little of my portfolio pays dividends (I have <25% of my portfolio in listed stocks). Where I do, I would never use dividend reinvestment programmes. I want maximum control.

3. Are you rebalancing your portfolio? If not, should you?

Yes. I have a target risk budget (with VaR, max drawdown, stop-loss) and a target return. I rebalance to those targets. I don't rebalance to specific % of bonds/equities etc. Nominal amounts of cash are utterly meaningless. Risk is what matters.

4. When do you make trades? Is it based on newsflow? Or financial needs? Or a regular schedule? Or when you have enough cash to deploy? Is your answer to this the best answer you could give?

I trade when the asset/derivative hits the valuation level required to offer the correct reward-to-risk ratio. Newsflow is basically irrelevant. Within microseconds of hitting the wires, assets will have repriced. Newsflow offers only the opportunity to obtain the correct valuation level. I have no schedule and no concern if cash builds up. I waited over six months to deploy capital into the US equity market in 2018. It wasn't at the right level so I didn't buy until Dec.

5. Have you bought and sold the same thing in the same 12 month period? Would you know? Would you do the same thing if you had those 12 months again?

Of course. Every discretionary investment or trade has a stop and a profit-take. Without those there is no discipline. My investments in funds are generally longer-term but I have parameters around those where I would add or reduce. If those levels are triggered more than once in a year (due to high volatility say) it's perfectly possible I would buy and sell in the same year.

LikeLiked by 1 person

Sounds a lot of individual stock holdings. Thought only need 30 to be diversified?

I use index funds accumulation in both investment isa and sipp. Trying to balance by increasing equities as have a lot in cash isa not earning much.

But as get close to fire target guess will adjust back in years time to more cash holding.

LikeLike

30 individual holdings is enough to be diversified, yes; in fact Mrs FvL’s 80 are mostly ETFs/funds which are themselves diversified. But 16 are half the value; this is the backbone.

I don’t like Acc funds because they make rebalancing harder, but they are less effort.

LikeLike

Hi FvL, I also think about my investing behaviour. Even though I’m “passive” it doesn’t feel like it as I check the values monthly and think about whether I have it right. As you get older should be more conservative to reduce risk. But as I’m overweight in cash in personally think I need to have more in equities. Also considering future consolidation of savings pensions and investments. As have so many and will inherit also will in future make it simpler to consolidate. Last think about IHT planning as not a problem for me yet but will be in future if continue working beyond 50. Cheers, Adam

LikeLiked by 1 person

[…] recently read an article from a fellow blogger regarding their portfolio where they looked at their actual behaviour vs […]

LikeLiked by 1 person

When I first came to use the online platforms I was very wary of the “kid in a candy store” factor, and that the ability to chop and change at the click of a button would lead to me racking up significant dealing fees (and bad behaviour chasing fads and fashions). So I set myself a few ground rules:

– I didn’t want dealing fees to add more than the equivalent of another 0.1%OCF maximum.

– If I buy something, I’m sticking with it for the next 5 years before I’ll consider selling it.

Assuming (I’m using ATS numbers) the expense is a £10 dealing fee to enter and eventually exit a position, that works out as the minimum viable size investment is £4000 (£20 spread over 5 years is £4/year and 0.1%pa of £4000). For already held things top-ups can be a bit smaller: trades are £5 using the “reinvestment” mechanism, and with the exit charge notionally already accounted for £1000 is a reasonable minimum amount to keep the impact of costs below 0.1%. Numbers will differ on other platforms of course, and I suspect a lot of people would struggle with the 5 year minimum hold , but I’m rather with Warren Buffet on “our favourite holding period is forever” and so far I’ve stuck to it apart from following a couple of managers to new funds and some most uncharacteristic for me 2016 currency speculation. Having said that… for “core holdings” (boring index trackers and multi-asset passives) I invariably deal with significantly larger sums; these minimums have been more relevant to keeping the tinkering-round-the-edges satellite holdings under control.

LikeLiked by 1 person

It’s a very good point – I definitely don’t sell – so I do buy and hold, but I probably need to review my dividend approach. Not to mention that I might soon have to start manually rebalancing, which will involve more transactions.

LikeLiked by 1 person