Time for an update on my ISA progression.

Regular readers will know that if I have a top tip for any UK investor, it’s this: make the most of the ISA tax break, and do it via Stocks & Shares ISAs. Note: definitely not Cash ISAs – saving tax on 1% interest isn’t the way to build your savings pot, whereas saving tax on 6-10% equity returns can make a real difference.

The annual ISA allowance remains £20k per person. I have enough of my savings outside a tax-shelter that I move as much as I can into an ISA every year, for both me and Mrs FvL. I’ve been posting updates annually about this (e.g. here). Touch wood, I am hoping to build my ISA pot into £millions over the next 30 years.

In case you are wondering about whether pensions are a better way to save than ISAs, remember that pensions have a lifetime pot maximum of around £1m before unfriendly taxes apply. If you are about 40 years old and planning to retire at about 70 (or 30, and aiming to retire at 60), then you start to approach the level where your lifetime limit could bite with a pot as ‘small’ as £125k. In contrast there is no limit on how large your ISA pots can grow while remaining tax-free.

We are starting to see more and more investors reach the £1m ISA milestone. It appears there are about 500 such investors in the UK at the moment. I’m not at £1m yet, but I am on track to reach it in a few years’ time, barring any change in government policy and/or market meltdown.

Last year saw disappointing market returns. My own ISA fell slightly before income/contributions, and while Mrs FvL’s ISA rose a little it still left my overall ISA pots down in value before income and contributions.

But while market gains/falls are fairly unpredictable, the portfolio’s dividend stream is much steadier. Thankfully my ISAs generated income of over £20k (a yield of around 4%). That income is entirely tax-free. But rather than withdraw it, I’ve reinvested it – to enable my returns to compound up. This (combined across me + Mrs FvL) income is still less than the taxman’s annual allowance for topping up my account, but the day that the annual allowance is less material than the portfolio’s own performance draws closer.

When I die I’m due to be £2m poorer than it appeared last year

A few days ago I topped up my and Mrs FvL’s ISAs, so my total ISA balance is now around £580,000. It seems hardly no time since (in 2015) I wrote my first ISA blog, with a portfolio of around £330k, and my pot has almost doubled since then. The curve I set out in 2015 is proving surprisingly accurate.

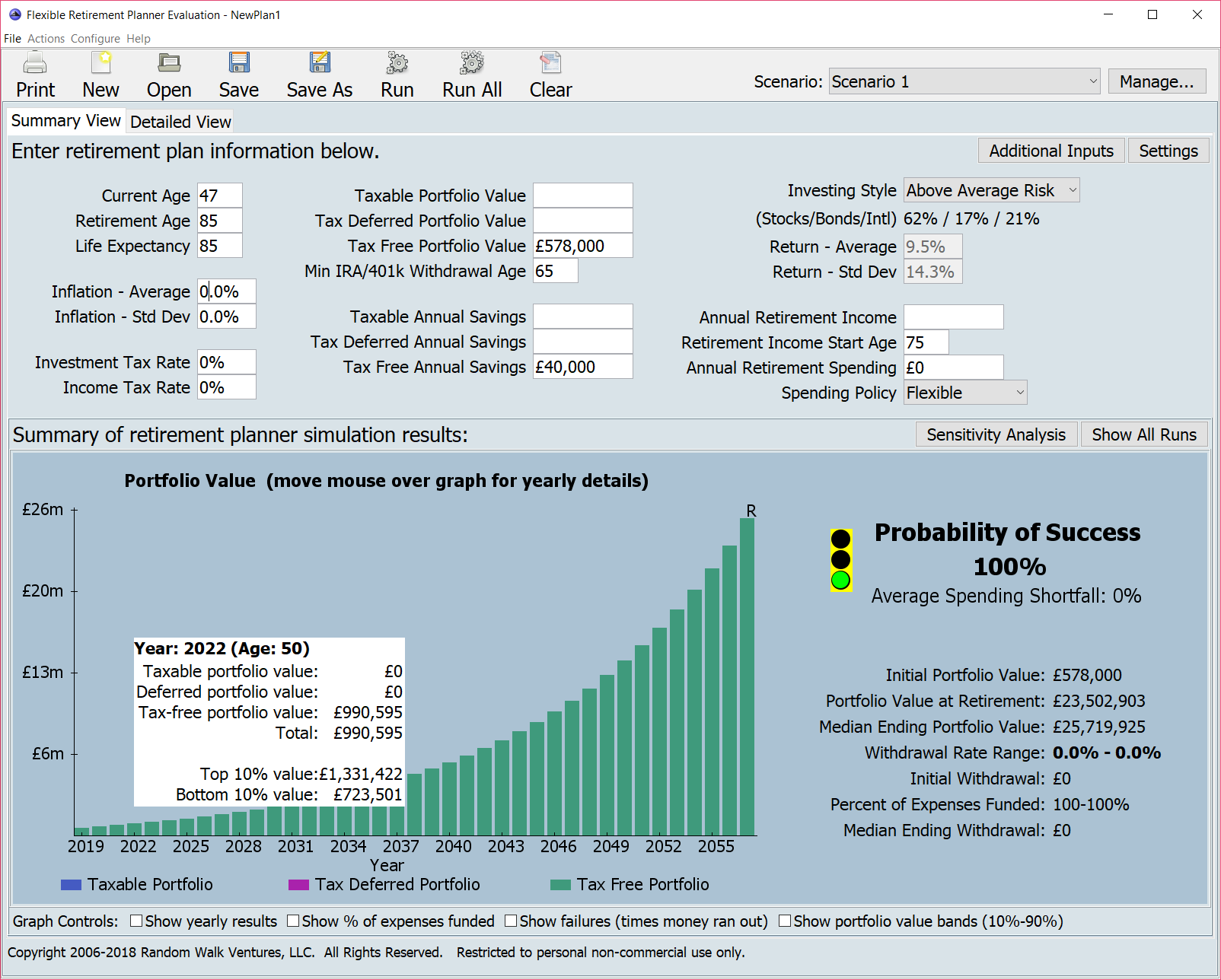

However, the projection for my ‘termination value’ has in fact dropped from £28m to under £26m. How come? Because my life expectancy has fallen from 88 to 85 in the last few years, according to HM’s statistical boffins.

My planning tool suggests I will cross the £1m threshold around year 2022. Of course in the short term, market volatility matters more than the compounding process.

But over the long term investment returns should do their magic. My planner’s median forecast of my ‘termination value’ of £26m, even allowing for inflation, will still leave me with a high quality inheritance tax problem. And there’s a 10% chance of my ISA growing to £66m.

Somehow I doubt those tax breaks will persist that long, but while they do this is working for me.

Some great progress there FvL – one day I hope to reach your lofty heights!

LikeLiked by 1 person

At over £48k for a family of four, ISAs have become a rather sizeable tax planning tool. The income you are generating is already nearly equivalent to median type earnings. Right now, ISA don’t cost the Treasury much in lost tax, around £3bn, vs. £42bn for pensions. That will change, however, as these ISA pots grow in value.

I took advantage of a scheme in 2009/10 set up by my company to effectively transfer the upside from pension contributions into my ISA. At the time the annual limit on pensions was £235k while on ISAs it was just £7.2k so the disparity was huge and this made sense. I had to stop contributing to my pension in 2012. A decade later, it’s worked far too well. I didn’t expect the S&P to go up 400%. So I’m vulnerable to ISAs being hit with a lifetime allowance like pensions. I did my 2019/20 contributions last week but I do wonder whether it’s time to stop and diversify back into more offshore products.

With regard to the mortality statistics. To be blunt they are not relevant to you. It’s clear that the wealthiest deciles are still living longer. Just assume that this longer lifespan will cost: that private healthcare insurance is going to rise much faster than CPI. Hold some healthcare and biotech as a hedge against this. As some say, it may be the case that the first immortal child has already been born. So think in terms of perpetual endowments rather than drawdown for FI and your family should be well set.

LikeLiked by 1 person

With a fair wind, we should hit 7 figures in the ISA pot this time next year. I will need to start using it to generate living expenses also sometime next year. I am a concentrated, total return investor and don’t focus so much on dividends so the real dilemma is how to maintain the cash buffer within an ISA which is stocks and shares based in the main. Rates on cash are basically zero. Prudence would require a 1-2 year of expense buffer within the ISA pot but as things stand, there don’t look to be many options that combine safety with at least some return.

LikeLike

With a fair wind, we should hit 7 figures in the ISA pot this time next year. I will need to start using it to generate living expenses also sometime next year. I am a concentrated, total return investor and don’t focus so much on dividends so the real dilemma is how to maintain the cash buffer within an ISA which is stocks and shares based in the main. Rates on cash are basically zero. Prudence would require a 1-2 year of expense buffer within the ISA pot but as things stand, there don’t look to be many options that combine safety with at least some return.

LikeLiked by 1 person

P2P lending (IFISA) could be the answer if you think it has space in your asset allocation. Starting last year I allocated my ISA space to P2P lending, and even moved some of the existing S&S ISA funds to IFISA. (I didn’t reduce equity holdings, quite the opposite, I increased them, but outside the tax shelter.) The rationale being that the P2P lending income is taxed at 45%, whereas equity at less than half that considering all the allowances, so the ISA shelter provides more relief that way (same reason I have more high yielding equity within the ISA than outside). I realise that doesn’t always work well in the long run because the compounding effect may be much stronger in equities, so the yield in 10+ years may be higher for equities staying at the same amount. But perhaps there’s a bit of market timing attempt there, as the combination of recent equity market strength and GBP weakness makes me think that high yielding GBP debt will outperform GBP denominated global equities in the short term. We’ll see.

LikeLiked by 1 person

I am not convinced by P2P lending. Only today in fact Funding Circle has just reduced its guidance on expected returns. I think long term returns for P2P are under 6% per year. I am confident equities can outperform that, with superior tax treatment along the way too. Plus liquidity is far superior. For my high yield play I prefer some direct bonds e.g. NWBD, LLPC, 87PN.

LikeLike

Not tempted by P2P as a place to park cash. To my mind, the model has yet to be tested by a sever recession, wave of defaults etc and I am looking for safety rather than maximising yield from this portion of my pot. In the end, I am currently keeping it in short term US treasuries which at least provide a real return in USD ( via the ETF IBTA). Yes there is a currency risk vs GBP but there is adequate compensation via 2.4% yields and safety is not in doubt.

LikeLike

Fair enough, that’s why I said if it has space in your asset allocation.

IBTA is $ denominated. Do you have mostly $ ETFs/stocks in your ISA? (Otherwise my bigger concern would be the currency conversion costs every time you trade in and out of it, rather the outright currency risk that I would account for in my asset allocation).

LikeLike

I don’t trade much so while the initial currency conversion is a factor, it is also the case that the coupons in IBTS get reinvested without involving a currency roundtrip so there’s that. I could have gone with the GBP denominated IBTS but that doesn’t accumulate so it tends to be a wash.

LikeLike

Hi FVL, with regard to your margin loan and portfolio leverage what is your long-term plan with it? Is it to gradually reduce over time or possibly to keep it static? Your currently at ~30% LTV I believe. Maybe your just keeping an eye on macro events and acting accordingly? Or possibly up it to buy an even dreamier dream home!

LikeLiked by 1 person

Pertinent question, thank you! In fact you remind me it is time to reconsider and in fact I have just tweaked my target allocation as a result of you.

The last change I made was in August 2018 (https://firevlondon.com/2018/08/13/recalibrating-my-portfolio/) in which my LTV reduced to around 14.5% .

I am currently at around 12% LTV and have had to ask myself what the long-term plan is.

I think my long-term plan is to remain around where I am now. My updated allocation says cash of -13% of my net value, which works out as LTV of 11.5%. This feels almost risk-free to me, and gives me a leverage benefit (provided I am in cheap EUR/GBP, rather than USD).

I am trying not to be too influenced by macro events but there must be a subconscious influence.

LikeLike

Many thanks – I can see I was a bit behind the times with the 30% figure! That is very useful to ponder. I am considering a similar prospect but with the less exotic option of an offset rather than a margin loan to provide the leverage. The interest rates available seem pretty attractive to me.

LikeLiked by 1 person

Lofty heights indeed. Not sure id but working in your position!! But sounds like you descendents may have an IHT problem. Will get spouse exwmption on first death but unless you gift it and live 7 years or leave to charity ir start transfer to pensions/sipp your beneficiaries will be left with a hefty bill? With the pension changes can choose to live off isas and not draw pensions so can pass these on without IHT.

LikeLiked by 1 person

[…] tool now suggests the median outcome when I pop my clogs is £21.3m. That’s 20% lower than last year. One fewer year and a diminution of value over the last twelve months are both impacting this long […]

LikeLike