I was asked to help a friend of mine, a (~50 year old) widow, complete her UK tax return recently. In the UK the final deadline for filling in your own tax return is 31 January, and the process these days can all be done online via the taxman’s excellent website. Her finances were illuminating.

What is a rich widow?

This widow’s income is roughly as follows:

- £45k of earnings. She is a freelance creative.

- £25k of investment income, about half of which was taxable (‘unsheltered’). She has about £700k of investments, roughly half in tax-free accounts (ISAs/SIPPs), and half unsheltered. She has no other income-generating assets.

- £10k of contribution to her pension. She is a (non-executive) company director of her ex-husband’s company which doesn’t pay her but does make £10k per year payment into her SIPP.

- £12k of (realised) capital gains last year, all in unsheltered accounts .

This lady’s total income/gains last tax year amounted to over £90k. This puts her in the top 10% of the UK by income, but not the top 5%.

But how much does an ‘average striver’ pay in tax?

Now, before we continue with my widow friend, let’s have a think about ‘average Joanna’, a typical striver in the UK.

Consider Joanna, a (hypothetical) 50 year old who works full-time for the NHS, earning £45k (roughly the London average wage). For a like-for-like comparison, her pension (contribution, from her employer) and (NHS pension investment equivalent) income on top of this would add about £25k to her taxable income, all tax-free.

Joanna pays £6.6k of tax, and £4.4k of national insurance, totalling £11k of tax/NI. This works out as 24% of total gross pay.

How much tax does this ‘rich widow’ making £90k pay?

What total tax/social charges (National Insurance, in the UK) do you think she owes on her annual income/gains?

Before continuing reading, think of a number.

My friend is clearly ‘well off’. Rich, you might argue. Her income last year was comfortably ahead of an MP’s salary (though not an MP’s total earnings, on the same definitions). With over £80k of income you’d think she was clearly a higher rate income tax payer, and so some of her income would be taxed at 40%+. If you estimated that she pays about 30% tax then you’d have been where I would have guessed, given a few seconds to think about it.

If you guessed about 20%, on the basis that I wouldn’t be writing a blog post about this if it was an easy number to guess, then fair cop to you.

The actual figure? This well off widow’s tax bill (including her Ltd company’s tax bill) for the last tax year totals….. less than £10,000.

In other words, around 17% of her pay, and only 10% of her total income/gains. I think, based on the figures in this BBC article, that on a personal basis the widow is in the bottom 5% of UK income tax payers.

One of two big drivers of my friend’s low tax rate is that she works through her own Ltd company, and all her £45k turnover goes through it. This Ltd company employs her, on a salary of £11.5k (co-incidentally the personal allowance, i.e. the amount you are allowed to earn personally before paying any income tax). The company then declares a profit of over £30k, pays 19% corporation tax on it, pays about £400 national insurance (on the £11.5k salary), and passes the rest through to her as a dividend (on which she pays a further 7.5% tax).

The other big help for my friend is the tax assistance she is getting for her pension and ISA saving. The £10k pension contribution she receives is tax completely free. And the £10k-£15k dividends that her pension/ISA investments receive is also tax free. In this respect, my friend is taxed very similarly to ‘average Joanna’; in fact because she has, relatively, a smaller pension but more assets outside the tax-free pot, she is arguably more highly taxed than Joanna.

The rich are just like you and me, but pay less tax?

There is something counter-intuitive about the UK’s tax system.

- A young graduate in a good job, earning perhaps £35k, will pay tax/NI of around 25% of earnings, but will see deductions of over 33% of earnings (due to their income-contingent student loan repayments a.k.a. graduate tax).

- That young graduate’s dad, in a similar job, who by now is significantly richer than the young graduate, will probably be paying tax/NI and deductions of under 25% of earnings due to having more pension/similar assets saved, and no loan repayments to make.

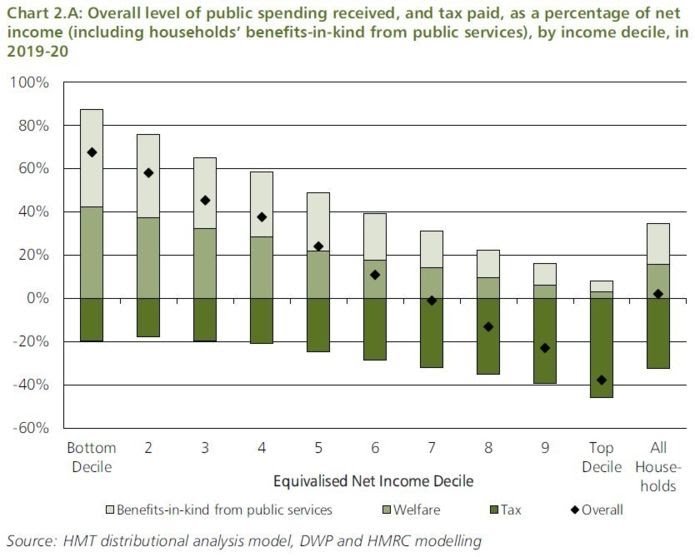

- And some richer folk out there are paying tax/deductions of under 20%, as per my widow friend. On average, the top 10% of households by income (equivalent to income of £75k+, I estimate), are paying an average tax rate of ‘only’ c.30% of total income, based on my reading of the UK Treasury’s 2017 graph below (which does need careful attention!).

There is something odd that the highest tax rates apply to regular jobs, and lower tax rates apply to unearned income, and then arguably the lowest of all tax rates apply to fixed property. You’d think the government didn’t like people to work in jobs.

When the left says ‘let’s tax the rich more’, the media immediately jumps to ‘that means putting up income tax, and then normal middle class people will be paying more than 50% of their income as tax’. Not likely, that isn’t.

Policy prescriptions

I can’t help but wonder about the policy implications from these observations.

While no firebrand leftie myself, it feels reasonable to me to ask richer people to pay more tax than poorer people. Obviously there will be reliefs/incentives that will create exceptions/opportunities but the widow I’m describing here doesn’t deploy very many of those.

Putting it another way, I think people like my widow friend could pay, say, £12k of tax instead of £10k of tax (i.e. 20% more tax) and it wouldn’t cramp her style at all. If you could increase the tax take from the top 1% of the country by 20% you’d have, well, enough to paint a lot of red buses.

For starters, she should pay more National Insurance than the £400 she pays at the moment. By contrast, Joanna pays over £4k NI. This was the direction Phillip Hammond, our Chancellor, went in until he got stopped by the Tory backbenchers / media backlash / cowardly PM / take your pick. If you made the minimum contribution £1500 you’d have an extra £1k out of her straight away.

Secondly, the increase in personal allowance, much as it is positioned as ‘lifting poorer people out of the tax net’, the main beneficiaries are the higher earners like the widow. If her allowance was £6k, not £11k, you’d have another £1k out of her. Job done.

Of course you could tax unearned income more. Dividends and/or capital gains could be taxed more. To make £1k more out of my widow you’d need to reduce the dividend allowance to nil, or put her dividend tax rate up to 15%, or a blend of both. I think these would have ‘unintended consequences’ because money is easy to move. Certainly it would be good for accountants and lawyers.

You could raise corporation taxes. If you put an extra 3% on corporation tax, raising it to 22%, you’d have over £1k more from my friend. The 26% proposed by Labour would raise over £2k more from her; annoying, but I contend it would change very little. But some companies would leave the UK, and others might not move here; I suspect Labour would end up with a lot less than the £2k they think they’ll get.

You could raise property taxes. My friend hasn’t moved for ages, won’t move if she can help it, but lives in a house worth over £2m. Her council tax of around £2000 amounts to 0.1% of her property value a year – a fraction of what she’d pay in the USA, for instance. If you asked her to pay a ‘mansion tax’ of 1% p.a. she’d feel you were forcing her out of her home, but if she was asked to pay £4000 a year council tax, she could definitely do it. She would however hiss and cluck a lot.

Or, you could put income tax rates, any of them, up to whatever you like. It wouldn’t raise a penny from my friend the widow.

Either way, those blasted taxes don’t seem too bad from this perspective. At least as long as you don’t go to university just in order to ‘get a proper job’. What am I missing?

I agree with much of what you’ve written except for:

1. I’d abolish corporation tax. It’s a tax on SMEs. Multinationals largely avoid it

2. CGT lowers the net returns generated by capital. Viewed another way it raises the cost of capital, the return needed to warrant making a given investment given the expected risks. Which is bad. Also, it deters efficient capital allocation. If I buy £100k of Shell shares and a couple of years later believe that the management has lost the plot so sell them and reinvest the proceeds in rival BP, I haven’t become any wealthier. But if the shares have risen to say £130k during the hold period and they’re unsheltered, I’ll be taxed. Which might point to the need for a wealth tax instead, provided as with corporation tax, we could be sure the very rich would pay it and not just the mass affluent

3. Taxing immobile property is inherently logical because it can’t be hidden, it doesn’t matter where the owner is domiciled and the asset can easily be seized and sold if there’s a default. Charging a premium rate for investment or additional property would also make a lot of sense IMO.

LikeLike

Great post and fully agree that our tax system is too lazy and closing simple loopholes that drive this type of inequality must be done ASAP To drive greater social cohesion and investment. I don’t think the Isa allowance should be £20k (lower). Radical idea but I think that all dividend income should be taxed as personal income (folks have ISAs to shelter dividend wealth) vs dividends at a corporation tax level which should only apply for companies with more than 250 employees (employees not turnover a more difficult bar to achieve esp for family offices, hedge funds etc … but rewards the real wealth creators and employers in our society). Also in favour of a land tax being linked to your council tax to more accurately reflect the property wealth that many hold but agree this shouldn’t be punitive but at least double what folks pay today. Still surprised that we haven’t nailed the company expenses” piece … huge abuse IMO by almost all folks who have their own business yet use it to support their personal life. Like you am a conservative, a top % earner who has benefited from sheltering wealth in ISAs, SIPPs and in BTLs and just getting a bit fed up with how unfair the game is to some …

LikeLike

Thanks @Mike. Did I say I was a conservative?! I’m not – I ‘float’.

LikeLike

A really good post – it’s something I ponder a lot how the tax system incentives incorporation rather than employment. Another one that is interesting is you get “interest” if you pay your corporation tax early, but not if you pay your personal tax early.

While hardly a socialist myself, I do wonder if we are really driving the right behaviours while also feeling guilty about playing the system myself.

LikeLiked by 1 person

Yes, sorting out the tax system might well be harder than figuring out Brexit. And what about if you FIRE and decide to stop earning, and find yourself not paying any income tax at all for a couple of decades, or more, until any pensions kick in?

LikeLiked by 1 person

Fascinating post, and shows how some of the inequalities in our country are reinforced. I agree with the above comments that the system needs to be reworked, and I think you’ve explained very clearly that simply increasing tax rates is not the answer!

LikeLike

The Starting Rate for Savings also allows for anomalies, £5k allowance for interest that could be p2p and other exotic products. If you have a bit of everything, its surprising how many allowances kick in. NI and student loan repayments are really starting to kick the working young.

LikeLiked by 1 person

I’m currently paying 3.1% IT and NI combined made possible purely down to being asset rich – and thats still siting within PAYE. Its not right, but if its possible and legal, its difficult to resist.

LikeLiked by 1 person

This is a common “hack” which allows people operating in LTDs to pay themselves in a very tax-efficient way. As long as the freelancer is allowed to operate as a one-man-band company then the low tax doesn’t surprise me.

But what if HMRC only let her work as a sole trader until she really becomes a company? ‘really becomes a company’ is up for discussion though. I expect some reform (aka IR35 for the private sector) in the Autumn 19 budget.

Contractors, like myself, operating through their own LTDs will start being taxed as a PAYE. However, not sure this is ideal either since they will not enjoy the benefits of perm employment (holiday, sick pay, pension match etc). It’s hard to tell who is genuine self-employed too.

Btw this is not a UK-only problem. Buffett has publicly said his secretary should not be paying a higher tax rate than him.

Expect some hissing 😉

LikeLiked by 2 people

I completely agree.

A retired couple can generate £63.1k/year from investments before paying any tax (2×11.85k personal allowance, 2x5k savings allowance, 2x1k PSA, 2x2k dividend allowance, 2×11.7k CGT allowance). An equivalent working couple earning £31.55k each (total £63.1k) would pay a total of £13.43k in tax.

CGT is 28% and corporation tax is 20% when income tax is 47% (inc 2% NIC). Investment income is not subject to NIC but income from labour is. We punish labour mobility through SDLT on property, rather than having an LVT.

Pension tax credits cost the government around £42bn/annum in lost tax revenue, more than the UK defence budget and about the same size as the 2017/18 UK fiscal deficit. Most of this tax relief goes to the higher paid (40/45% taxpayers) or to corporations through lower employer NIC. I’ve always found disturbing that a Tory government, ideologically obsessed by reducing the fiscal deficit and “austerity”, managed to miss this easy £40bn cut. Instead they decided to cut things like Disability Allowance, Incapacity Benefit, SureStart etc. We add to this by providing high income earners with further avenues such as VCTs/EIS/SEIS. Multi-millionaires can benefit from Entrepreneur’s Relief with a tax rate of 10% on up to £10mm.

I’ve utilized pretty much every one of the above allowances. It’s legal tax planning. I don’t, however, feel the system is in anyway just or fair. It’s incredibly poor at wealth redistribution, not progressive, and easily exploited for tax arbitrage. The UK tax system was constructed based on historical vested interests, mainly around land and property. It’s now justified via macroeconomic theory that is not just incorrect but often a blatant lie. The UK clearly favours “rentier capitalism”. Perhaps appropriate for a country that never did shake off feudalism.

LikeLiked by 2 people

A very interesting post. In a similar way, by setting themselves up as limited companies, some buy to let landlords are able to get round the new tax restrictions, which are meant to prevent them from ‘raking it in’ as it were.

LikeLike

This is a very one-sided piece… to me it looks like quite a bit of thought has gone in to the tax planning here and as for freelancing I would have a look at what Dave Chaplin has written, I think you will find that a lot of freelancers pay considerably more taxes than if they were permanent employees….

Collecting more taxes is not always the answer and there are for more taxes being lost via cash in hand jobs like cleaners, plumbers, painters etc than freelancers

LikeLike

@Libertine – “I think you will find that a lot of freelancers pay considerably more taxes than if they were permanent employees….” I work for a recruitment firm and this is not true.

One of the main reasons why contractors do not want to be permanent employees is because of the tax benefits.Another is obviously to be their own boss. There is more risk not having a permanent role, ie they risk being unemployed in between projects/contracts but the tax benefits (and higher salary) generally outwweighs this risk.

LikeLike

Appreciate the piece is aimed at Contractors but I think Libertine is talking more so about Freelancers which is completely different to Contractors. As a freelancer you tend to have multiple clients at once which is completely different from contracting work.

It tends to include far more ‘admin’, zero pension contributions and in some instances freelancer=free to some potential clients.

There’s a whole world of digital freelancers who don’t have the luxuries of contractors/employed. They do it because it allows them to facilitate a more flexible family/work life.

LikeLiked by 1 person

Sole traders incorporating does always seem to me to be a ludicrously easy tax dodge. I suppose there are non-tax reasons for incorporating though, such as wanting the limited liability. It seems to me that the easiest thing would be to change the dividend rate to the same as income tax rate to take tax out of the equation, although I suspect that would cause a great deal of the “hissing” the government wants to avoid.

On another note, thanks for that HMRC graph. I’ve been trying to find something like that to establish when people become net contributors to the state, in the context of people moaning about IHT on the basis they’ve paid tax all their life. I always want to point out that not only do most people die net debtors to the state but the average married couple is probably nowhere near the IHT threshold anyway. And I’m guessing that graph doesn’t include the state pension either.

LikeLike

Thanks! I think that graph does include the state pension, though I’m not certain.

LikeLike

Great post. Some alternative cases for the defence

– The chart you post suggests that only 30% of tax payers are paying in more tax than they take out. With the other 80% very dependent upon the top 20%. There is the additional quote that suggest the top 1% are paying almost 30% of all income tax. This doesn’t seem particularly desirable – feels like we are very vulnerable if these people have reduced earnings for whatever reason – recession for example, brexit requiring some bankers to relocate maybe

– I personally have built up a large (for me!) investment portfolio and have structured it such that if I stopped working, I and my spouse could generate approximately £50k of income and pay virtually no income tax. This is all through the allowances ZX Spectrum mentions above. On the face of it, I agree with the tone of the article / comments but…I personally have paid over £1m in income and national insurance tax over the past 8 years alone to earn enough money to help build up that portfolio and worked pretty hard thought it all….I sort of feel like, I’ve done my bit.

– The investment portfolio I have created also means (a) I will never be a burden on the state (b) I will not make use of some state provision of services – health care, schooling, leaving more resources for others. I don’t expect a state pension (although not turning it down if offered)

– I fully accept that I was lucky enough to have an advantageous start in life and I have been lucky enough since to be able to make the most of it

– yes other european states charge a lot on divi tax but check out what belgium’s cgt rate is.

– It used to be much worse (? maybe wrong wording) – divi allowance until a higher rate tax payer, no cgt if you held property and were outside the uk, unlimited pension accrual

– a really good way to pass wealth down is for grandparents to give wealth to grandchildren and use their tax free allowance with no impact on grandparents if they live for 7 years. mmmm this doesn’t feel like something that is for the greater good now does it…

– family investment companies are a whole new ball game on top of all of this – beyond my means for the moment

– btw – I feel using the CGT allowance on an annual basis to convert capital gain to income is harder than it seems, Psychologically and practically

– just wanted to say, really value the blog, the comments, shout out for zx spectrum, weenie and others

apols if a bit of a ramble.

LikeLiked by 1 person

[…] Avoiding tax in the UK → […]

LikeLike

[…] A cracking piece from Firevlondon featuring worked examples of tax ‘minimisation’ strate… […]

LikeLike

Well done for pointing out the value the employer contribution in a (NHS) defined-benefit pension.

However, the pensions contribution is simply not tax-free income, as the article indicates. The money within a pension fund is tax-deferred.

It will be taxed when accessed, as income received.

LikeLiked by 1 person

I think the pension fund money is much more tax-free than tax-deferred.

The pension fund will be accumulating gains tax free for probably another 10 years. This is income.

If she chooses to, she can stop working, and the Ltd company would go dormant. At that point the pension can pay her £12k per year tax free. On top of that she will have dividend and interest allowances.

£12k a year, as a Safe Withdrawal Rate of around 3.5%, would require around £350k of pension fund. I imagine her pension will be worth a bit more than that – perhaps £500k – so she could take a bit more and end up paying tax on the excess.

This feels much more ‘free’ than ‘deferred’ to me!

LikeLike