Diversification is the “only free lunch in investing”, and I love it. However, I came to the conclusion as I started tracking my investment performance rigorously that I had overdone it. Since that realisation I have been rowing back slightly. I appraised my progress recently, and this rather dry blog post sets out my findings.

I track all my investment portfolio holdings in one single investment spreadsheet. One advantage of this approach is that I have a consolidated view of my portfolio which ‘de-dupes’, and makes it fairly easy to see large positions that amass when I buy the same ETF in multiple portfolios.

What is the appropriate number of holdings to diversity accurately? You’ll find as many answers as responders to that question. But consensus seems to suggest 20 holdings is more than sufficient, especially if you are using collective securities such as index funds or ETFs.

When I began my unified tracking I had no fewer than, erm, 228 holdings. Over two hundred holdings.

Almost every single one of my holdings I have personally chosen. With a reasonable amount of consideration, time and of course fees associated. Multiply this by 228 and pretty soon it sounds like a lot of time wasted.

How did I end up with 228 holdings?

Here is the breakdown from late 2013:

- 29 ETFs. Of these 29 (15%) of them were ETFs, amounting to just over 30% of the total portfolio value. VUKE was originally my largest, at just under 10% of my total portfolio; these days IUSA is my biggest, with about 5% of my portfolio.

- 57 Funds. Ouch. This was a testament to having used my fair share of IFAs and private bankers over the years. This lot added up to around 25% of my portfolio’s value. The largest holding was about 2% of the total.

- 122 equities. Half my holdings are directly held equities. They amount to about a third of my total portfolio value. They included, originally, 57 holdings of less than £10k each.

- 12 bonds. Individually held bonds are quite exotic things really so no wonder I don’t have many. Though my largest is 2% of my portfolio, the total amounts to only 5%.

- 8 cash equivalents. Eight! Five separate currencies, held in 8 different ways in total.

I decided, roughly when I wrote my Investment Philosophy, that this portfolio was needlessly complex and should be slowly pruned. The complexity cost of such a large portfolio is significant:

- Higher transaction fees. My minimum opening position used to be around £1000. At this level I am doing a lot of transactions and my in/out fee is over 2% even before stamp duty. With a higher average trading amount I cut my fees.

- Higher paperwork/admin time. Almost every single one of my holdings spits out income payments. I track many of these individually. Typing in £0.31 of tax credit on a Fidelity account for some <£2000 holding is not good use of time.

- Reduced mindshare. Warren Buffett has long espoused the ‘20 punch card‘ approach. He has a point. His point is choose wisely, and get it right – and limiting yourself to fewer bigger decisions improves your odds. And of course to stay up to date with 20 investments is far easier than keeping tabs on 228 investments.

- Carrying deadweights. Looking back at my 5 year old portfolio I recognise holdings that I knew were suspect, but I ducked the challenge of making a decision to liquidate them. When they’re small, the damage they are doing to the portfolio doesn’t feel worth the bother.

- Diluting my best picks. Some of my best performing investments have been my smallest. I have had a hunch, and invested £2k, £5k, or something similar. If I’d made my entry ticket bigger, and adopted a different approach to selling out duds, I think I’d have made more money without taking on appreciably more risk.

In any case, after quite a lot of gradual pruning, optimising and spring cleaning, my current portfolio looks considerably better on my ‘overdiversity’ measures:

| Metric | 2013 | 2018 |

|---|---|---|

| % of value in top 20 holdings | 42% | 49% |

| # of holdings | 228 | 168 |

| # of holdings <£5k | 35 | 3 |

| # of Funds held | 57 | 32 |

| Minimum size of new position | £1000 | £10000 |

| Fees, % assets (excluding private bank account) | 0.42% | 0.26% |

Along the way of reducing the number of holdings (by 60!), and bulking up the small ones, I have also cut back considerably on expensive Funds, and reduced costs across the board. As a result I’ve saved about a third of my fees.

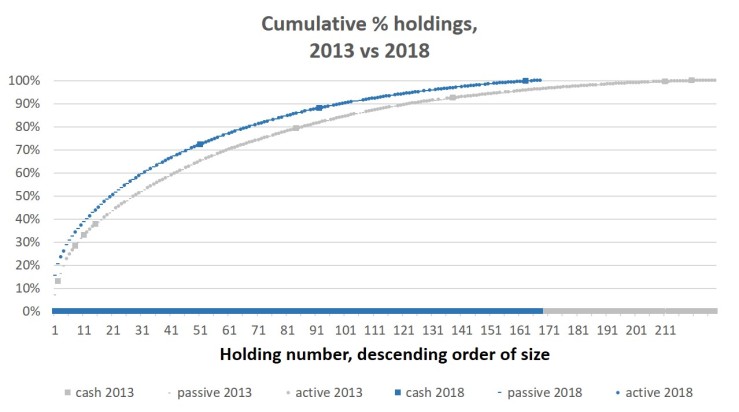

The graph below gives a visual representation of the pruning and ‘committing’ I’ve been doing.

How much further could I simplify?

I don’t think I could get anywhere near Buffett’s 20 punch cards, but he doesn’t walk his own talk himself (or on almost anything else, discuss – Ed.). But I could prune further; I feel like around 20 of my holdings are probably not providing a ‘return to mindshare’. Right now the smallest holdings amount to about 0.1% of my total portfolio; if I could increase this minimum to 0.2% I would end up with around 120 holdings without altering the underlying characteristics of the portfolio significantly. That’s probably my next milestone.

At the fat end of my portfolio, I am reasonably comfortable. I wouldn’t want my biggest holdings accounting for 10%+ of my portfolio. Maybe the top 20 could represent 75% of my total, but probably not 90%. That is a somewhat more concentrated curve than 2018 but very much the same shape.

I’d be interested to hear in the comments how other readers’ portfolios compare on some of these metrics – how many total holdings, how much % value in your top 20, and what’s your minimum size for opening a new position?

Thanks for sharing and good job of trimming the number of holdings. 168 positions still seems a like a lot to me as I hold 21 positions (including cash and pensions/401k). Apart from pensions, all comprised of direct equities and top 13 positions account for 90%. Still trying to trim down to c.15 as I feel it’s very hard to keep track underlying company’s performance

LikeLiked by 1 person

Interesting and thanks for sharing. I am at the opposite end of the spectrum with 14 equity positions, big cash buffer and no bonds. Largest 3 positions account for more than 60% of the value and include 3 years worth of expenses in cash. The smallest position is a 1% stake in an AIM biotech. I have held the largest 2 positions for more than 10 years and when recently some opportunities presented themselves due to market nervousness, increased my stake considerably. Personally it is easier for me to react calmly to market panics with a small group of businesses I understand and know very well than to hold “market” indices. If I shifted to capital preservation mode only, I would probably adopt the Buffett allocation – 90% S&P 500 and 10% cash. In theory this allocation is more volatile than a highly diversified but I have not had trouble sleeping at night – so far anyway,

LikeLiked by 1 person

Buffet and the 20-card punch. True he doesn’t walk his talk on this one but to some extent that is a factor of ‘his’ size since no 20 investments could absorb all BRK’s cash. But in the sense he buys businesses with a view to holding them forever I would suggest he is in some sense applying the punch card test.

FvL and the 168-card punch. To my mind this is still hopelessly over-diversified. It would be over-diversified even if all the holdings were single stocks, let alone baskets of stocks (ETFs, funds). 20 STOCK holdings reap substantially all the benefits of diversification. Just ONE diversified ETF is diversified ‘enough’ that adding more positions to your portfolio adds the costs you mention (fees, trading costs, lower mindshare) without adding benefits. The 90% S&P allocation mentioned by @Lemsip above is actually pretty rational in that context (ignoring that 90/10 might be the ‘wrong’ asset allocation for you, and that $-denominated investments might not ‘match’ your future consumption basket).

Clearly your approach has worked for you so well done. The question, with hindsight, is whether you could have done BETTER, perhaps by developing your hunches into meaningful positions. And if in hindsight you might have done better, what does it say of future strategy? The concern of course is that by over-diversifying you lose the substantial benefits that come from concentration.

If you will forgive the presumption I would suggest you make your starter position AT LEAST 1% rather than a sterling amount. Then cut everything below that threshold. There should be no fear of FOMO since even if a 0.1% position you sell subsequently doubles, the gain foregone would amount to a tiny fraction (0.1%, natch) of your NAV.

LikeLiked by 2 people

CORRECTION: my minimum for a new position is not £2k, as originally stated, but now £10k (up from about £2k). However my minimum top up trade amount is £2k (up from £1k).

LikeLike

I do have about about 20, but I only believe in trackers. My weakness is p2p where I keep trying new companies, but start small, and get left with rumps ibad debt.

My parents had 80 accounts when dad died, and it was hard work for my brother getting probate. They weren’t sophisticated investors, just got privitisation shares and diversified pension lump sums. He kept all the paperwork well.

I’d not want more for tax form filling and mental control. Cgt planning is the problem for simplification. But there is the tension in not wanting just one broker, fund provider etc

LikeLiked by 2 people

Hi FvL, in answer to your questions:

1) How many total holdings?

30 individual stocks. I think your sanity would benefit from an additional trim from your current 160-odd. Perhaps 100 is a reasonable maximum? But personally I prefer 30 as a reasonable balance between concentration and diversity.

2) How much % value in your top 20?

75%, which isn’t surprising given that I have 30 holdings! The top 10 make up about 40% and no single holding is more than 5%. I’ll trim a position if it goes above 6% or so.

3) What’s your minimum size for opening a new position?

3% of the portfolio. If I had a small portfolio then it would be £1k to stop fees becoming too much of a drag. In general, new positions tend to be about 4%, so 3% would be the minimum.

LikeLiked by 1 person

I’m extreme in opposite direction with only 4 equities with my top share taking up 75% of my portfolio, a major long term position for me that I’ve been topping up over the years. New positions are usually £10k+.

LikeLiked by 1 person

Wow, that’s a lot of holdings. I’m at 14 holdings – all passive ETF funds. The average charge is 0.15% which I’m happy with. My top ETF is a S&P500 tracker at about 40% of my portfolio, which feels diversified enough for me.

I’m trying to avoid new positions, and if I did would instigate a £10k min holding rule – or more likely a one in one out rule.

LikeLiked by 1 person

168! How do you even keep track of filings for the large number of equity holdings? Back when I picked stocks (as a teenager) I worked up to around 15 companies. But I found it a lot of work. Maybe I would manage it better now, having learnt a lot about portfolio management (from, amongst others, a commenter above, UKVI).

These days I’m 100pc trackers. I have 14 ETF/funds. 50% of value in 3 holdings, 75% across 6 holdings. Over time I’m hoping to consolidate down towards a five fund portfolio. I invest in minimum 3k tranches.

LikeLiked by 1 person

YoungFiGuy – great to hear how you do it.

In my defence, a lot of my holdings are legacy holdings I have accumulated over the years because when I was at your stage I wasn’t as well-informed as you are now. As I have learnt more I have bought new stuff, but not sold old positions. And now I have at least 25+ holdings which I hold because I don’t want to realise the capital gain from them, but certainly have no active opinion on.

As to the filings, I hand a bunch of statements (soft copy, where possible) to my accountant! This is an additional expense I accept though it does give me peace of mind.

I do think though that with my asset allocation approach I am always going to need at least 8 holdings. And for the major cells (UK Equities, US Equities, etc) I will want 2-3 separate holdings across Vanguard, iShares, etc. Plus I want at least 5 currencies in Cash.

So my irreducible minimum I think would be about 20 unique holdings.

LikeLike

An interesting post – thanks for sharing. It has inspired me to create a master sheet of all my holdings too – excluding cash and direct held property, then do similar analysis.

In return, I can share my numbers which look like this:

– 39 total holdings (12 ETFS, 11 equities, 9 investment trusts, 7 funds)

– 8 holdings 10% which is obviously not ideal. These funds will end up in my SIPP as passive ETFs and some in a VLS60 fund in a new provider as soon as I can figure out the cheapest place to hold Vanguard LifeStrategy in a SIPP (hopefully soon Vanguard..). I really don’t want to be done with researching and tracking things outside of passive funds these days. I probably won’t add more individual equities, possibly some ITs from spare cash.

LikeLiked by 1 person

Ugh sorry less than sign scrambled my numbers..

– 39 total holdings (12 ETFS, 11 equities, 9 investment trusts, 7 funds)

– 8 holdings less than £5k

– Top 20 holdings make up 87% of the portfolio

– Top 10 holdings make up 69% of the portfolio

LikeLiked by 1 person

I’m a bit better than you but not by much. I seem to have around 86 holdings, excluding cash accounts. The top 20 seem to be around 45%. The number of funds/ETFs is around 42 (22 trackers, 12 active, 8 hedge funds). There are no single stock positions but I do have 11 bond positions (ring fenced for school/uni fees), also 12 private equity investments, 18 direct lending investments, and 3 P2P accounts (+ another 7, I don’t use anymore)

It’s also the sheer number of investment vehicles. 6 ISA accounts, 5 pension accounts (inc 1 Super in AUD), 12 cash accounts (GBP/USD/AUD/EUR), 1 private bank account, 1 offshore life bond, 1 PIC (not much used), a number of accounts with people like IB for derivative/option trading etc.

Min investment is meant to be £50k but I tend to backslide on that.

LikeLiked by 1 person

Thanks for sharing.

I don’t include my private equity holdings (angel investments), nor a couple of tiny P2P accounts, in my list; my list is all liquid investments (ish, in the case of a PE fund sold to me by the private bank).

I get disproportionate enjoyment from the single stock positions so am surprised you haven’t got any at all. Otherwise, we sound fairly similar.

LikeLike

I’ve just spent some hours on your old posts, following the tale of your Dreamhome, your margin loan, and your Personal Investment Company. Good stuff! I should also congratulate you on the calibre of comments you attract.

Now then, this PIC of yours: how do you intended to get the money out eventually? Are there obvious tax-efficient ways? Or even subtle tax-efficient ways?

LikeLiked by 1 person

@Dearieme – thank you for getting stuck in to my humble blog! Yes I am very fortunate with the calibre of my readers.

As to the PIC, in fact I must say I haven’t fully worked out how I get money out. I can withdraw the first £Xk that I put into it by just repaying the initial capitalisation loan that set the business up. I can also withdraw a bit tax free by making contributions to Mrs FvL’s pension, at least until drawdown etc. If I make it to doddery old age I also can pay myself payroll up a low number in effect tax free. But thereafter money I deduct will be at marginal tax rates.

There may be an inheritance tax optimisation I can do if this PIC becomes a business asset that I can transfer tax free (unlike most of my assets), but I am not yet thinking about that as, touch wood, it is some years away and rules will doubtless change before then.

There may be something I could do about winding it up and making a special distribution, but I would need to take advice on that.

I also have in mind trying to ensure that these assets land, at least partially, in charities. Not sure how to do that yet.

But basically as and when I start pulling the rest of the money out, I think it will be taxed as if it was sitting in my personal name anyway, and in the meantime it will have grown to a rather bigger number by compounding up after 19% corporation tax rather than compounding up after 40%+ personal income tax.

LikeLiked by 1 person

Hi FvL

Wow, I’m not surprised you have your accountant helping you out with the statements – that could be a full-time job just managing all those positions in your portfolio!

Just looked at my own and I’m at 50 holdings (this includes the 10 stocks in my ‘experimental portfolio’ which are <£250 each), with the breakdown as follows:

16 investment trusts, 22 individual stocks, 8 ETFs, 4 tracker funds.

I don't rule out adding a few more positions but I don't want updating and keeping track to turn into a chore.

LikeLike

Hi FirevLondon,

I stumbled across your blog via @Monevator and read the whole thing back-to-front while recovering from appendix surgery! Really enjoyed it so far!

One question I have as I’m not sure I’ve seen it overtly discussed anywhere is how you think about the currency exposure of your holdings (as distinct from the geographic or asset class allocation). Your geographic exposure is something like 22/50/22/6 UK/US/Intl/Oz, but apart from the cash allocation how does currency fit in? For example you might hold Oz exposure through BHP but denominated in GBP? Or you might have Intl ETFs held in USD and GBP?

The reason I ask is I’m from the UK originally but I’ve been based in Sydney for the last 2 years. I used your super-duper-spreadsheet to get a consolidated view of my asset and geographic allocation (I had to tweak to adjust for fund-of-fund exposure such as Vanguard Lifestrategy), which in itself was food-for-thought as I previously have considered my UK SIPP, Aussie Super and Aussie trading accounts as different ‘buckets’ with their own asset allocation.

Doing the exercise it turns out that independent of asset class or geography, my current portfolio is almost exactly 50:50 split AUD:GBP. (For reference my equity split is approx. 7/7/50/27/8 between Oz/UK/US/Intl Developed/Emerging – but this will be held across GBP and AUD accounts, not necessarily with the same 50:50 currency split for each asset).

I’m not sure I have expressed it particularly well, but I’d be interested in how you think about this dimension of your portfolio. I’m aware of Monevator’s excellent articles on the pros and cons of hedged index ETFs, but that for me relates more to the ‘how’ of portfolio execution than the ‘why’ thinking. Ultimately currency is an issue that I’ve neglected thus far, but I like to understand what risks I am taking so I should probably face up to it!

A second (bonus) question – I have a margin loan here in Oz which equates to approx -13% of the portfolio. So in my ‘cash’ allocation line I have -13% for Oz, which is almost exactly the same as the rest of the Oz allocations for equity, fixed income etc – hence I come out with an exposure of approx 0% for Australia. Does that make sense? – I mean is it really true that my net Oz exposure is neutral? Would it be better to think of the 13% in terms of the 50% AUD currency exposure?

Like I say really enjoying your blog. Great that the likes of you and Monevator put so much time and effort in – we could definitely do with something similar here down under.

Cheers,

From a cold(ish) Sydney

Alex

LikeLiked by 1 person

@Alex – many thanks for your kind words and thoughtful questions. I’d be interested to know of your AUD direct holdings (if you have any) as I find that market somewhat hard to find convincing stocks in.

I think your bonus question is the easier of your two questions to answer.

Conceptually, if I borrow AUD$100k, let us say at 2% per year, and put it in an AUD bank account paying (net of tax) 2% per year, then I think it is true that I have zero net exposure to Australia. If the AUD halves or doubles, it makes no difference. If interest rates rise or fall, it makes no difference.

If in practice I borrow AUD$100k and buy $100k of Aussie house, then my exposure is slightly different to the example above, but not by much. Really I have exposure to Aussie house prices and how they move relative to cash, but I don’t have too much exposure (except of course as a % of my net exposure, which is semi-infinite!). Again, if AUD doubles or halves it doesn’t make much difference to me – except that probably if AUD doubles house prices will fall, and so I will probably end up owing money.

Having, as you roughly do, zero net exposure and a combination of margin loan, equities and fixed income is still close to the analogy above. In effect you have very little capital tied up in Australia. Your exposure to change is something, but not a big number. Probably the clue here is the semantics between ‘capital tied up’ and ‘exposure’, which are slightly different things. I tend to use them interchangeably but that isn’t quite right.

As to your first question about currencies. I don’t think too carefully about this, I’m afraid. I generally take the view that you can’t easily capture any alpha out of the forex markets, and I certainly don’t try to. I also think roughly speaking currency is basically a wash – you win some and you lose some. Whereas my reasons for investing in say the USA are somewhat independent of the dollar. This is particularly true of the FTSE-100 where these are companies based in the UK but with much larger overseas activities than UK activities, which is denominated in USD, Euro, Yen, etc. So really a bet on FTSE is pretty independent of a bet on GBP, and if you measure FTSE in dollars you can see that pretty clearly. So I treat buying a stake in VUSA or IUSA (Vanguard and iShares’ GBP-denominated S&P ETFs) as indistinguishable from buying SPY (SPDR’s S&P ETF, denominated in USD). If you measure them both in the same currency you get the same outcome.

Monevator’s posts on currency hedging leave me a bit cold. Personally I am not really interested in currency hedging – it feels like a currency bet to me, and I don’t want to pay to do that. But this isn’t a very thoughtful position and I would defer to @zxspectrum48k or others on both theory and practice.

LikeLike

FvL,

Thanks for your quick and detailed reply!

When it comes to AUD direct holdings I’ve just got ETFs for the moment. You are right that the market here is a bit thin. The capitalisation of the ASX is about a third of the LSE. There are some interesting smaller-cap opportunities here but you have to go looking; I feel that when it comes to blue-chip divi paying type shares these are skewed pretty heavily towards financial services and resources.

I’m toying with the idea of building a bit of a portfolio of ASX listed shares as I think there is opportunity there and also if you pay your tax in Australia you get the benefit of franking tax credits for divis paid by Australian companies.

I think you’ve hit the nail on the head – it’s the difference between exposure and ‘capital tied up’. In that I do have a fair proportion of capital tied up in Oz (if I were to liquidate everything and pay off the loan it would be about 40% of the total portfolio left in AUD). But still I feel a bit uncomfortable with the idea of increasing my (eg) Australian equity exposure for the fact that I have margin netting off the ‘Oz column’. I see what you are saying but conceptually I like the idea that what happens ‘above the line’ is independent of financing.

When it comes to currency – I’m not a macroeconomist (it isn’t my forte…) and likewise don’t want to be making a ‘bet’ one way or another. I think the point is that I don’t want to end up unconsciously stumbling into a position where I am making a bet without having thought about it. For example if I keep adding to my holdings in AUD, and end up with 90% of my portfolio in AUD – is this something that I want? In the UK it never bothered me to hold exclusively in GBP as I’d never lived anywhere else and therefore didn’t think much about it – now it’s almost like I’ve created the problem myself by virtue of the fact that I have holdings in two currencies!

Not going to solve it this minute, but I feel positively that at least it has crossed my mind. Even if I park it for a while, I think I’m better off for having given it some thought and had the chance to chat to others about it.

Cheers again,

Alex

LikeLiked by 1 person

Thanks Alex.

Another thought experiment for you – suppose you just plonked everything in VWRL, Vanguard’s World Stock Market ETF. Would it matter which currency it was denominated in?

I think if you keep adding to your AUD holdings the key question is what are the holdings. If they are in an AUD denominated S&P500 tracker then that is not philosophically any different from having them in IUSA. Just the digits look different; the underlying performance of it, tracker in a consistent currency, shouldn’t differ. I think.

LikeLiked by 1 person

NO! FX hedging isn’t a currency bet, not FX hedging is the currency bet! My view is always that risks should be discretized. So taking an open FX position in a foreign asset market is mixing fx and asset risk and therefore adding correlation risk. The practical reality, however, is that it may depend on the bilteral currency pair and it’s correlation with the asset class. With G10 fixed income, their are good reasons to fx hedge. The currency volatility will otherwise swamp the duration risk. With high yield EM fixed income it’s more difficult since the carry is coming through the fx exposure, not the bond yield. By currency-hedging you lose most/all the carry. If you don’t currency hedge, however, then in a risk off environment, you’ll likely to find both yields rise and the EM currency weakens – double whammy.

With equities (not my area of professional expertise) it can be even harder. Equity volatility is much higher than bond volatility, so FX volatility is less likely to dominate. In fact FX vol is sometimes almost completely diversified away. In the 70s through to mid 90s, fx hedging generally improved the Sharpe ratios on G10 equities. Since then results have been more mixed. These days (being very general) investors whose base currency is less risky/a funding currency/has a current account surplus, should hedge (example Japan). When a risk off event occurs, the foreign equity market falls and their base currency will appreciate. So an open currency position will cause additional pain and hedging will negate that. Conversely an investor whose base currency is risky/current-account deficit should normally not hedge. In a risk off, the foreign equity fall will be offset by an appreciation in the foreign currency. With GBP as the base, the results are, frankly, mixed but, if anything, GBP tends to act more like an risky currency these days.

LikeLike

@ZX48k – many thanks for weighing in here.

So while I think I understand your point, it feels counter intuitive to me. Perhaps reflecting my equities-centric perspective.

If I buy shares in, say, an Australian mining company (mining lots of things, say), and measure my performance in USD…. I have two basic risks here: 1) operating / business performance of the mine 2) AUD fx risk. If AUD halves, the operating performance goes up, and my share price goes up. These are not independent things, they are highly correlated. Roughly speaking, my investment is hedged against the AUD. But if I hedge the FX separately then I am taking more of a risk based on the AUD, because if AUD moves down then the mine goes up in value and vice versa.

In the real world, GBP and FTSE have behaved like this to some extent. By having holdings in FTSE I am somewhat hedged against the GBP. This feels lower risk to me than hedging out the FX risk.

Am I missing something?

LikeLike

I started to build up some ASX positions. Unfortunately, some of the companies do hedge AUD. I would rather take the AUD FX risk. Hedging is not a free lunch and I would rather not pay for AUD stability (my expenses are in CHF anyway and so AUD doesn’t matter to me).

LikeLike

Firstly I can’t believe you called the article over diversification not diworseification. Secondly holdings in currency you’re not going to spend it in are always a risk. Hedging just bonds is the same as just equities when 5050. The improvement in operating efficiency argument doesn’t test will for any index I’ve looked at I’m afraid.

LikeLike

Thirdly buffet’s argument about keeping up to date with your investments is only valid if you think you have alpha. Hassle is a strong disincentive but in a tax free account I say the more the merrier, so long as they’re low correlated.

LikeLike

I don’t think you are missing anything in practical terms. Intellectually, however, your positive view is just on the equity, not on the currency, so it makes sense to just buy the equity and not take currency risk. As you say, however, in the case of many equities (but not all) it may be the case that the currency has a negative correlation with the equity (as the currency falls, the equity performance improves, so hopefully the equity price rises). That correlation means that taking the fx risk is appropriate. Of course, you are assuming correlation risk and correlations do break down. Many equity markets are full of “currency hedge stocks”, South Africa, Australia and the FTSE100 for example.

This doesn’t always work, however, since not every equity market is correlated with the FX in this way. Take Turkish equities as recent (extreme) example. The fall in the Turkish lira has made them more competitive but since it has also increased import costs for raw materials which offsets this. Also many Turkish corporates have USD denominated debt, so their ability to repay that has decreased, raising solvency issues. Here the FX risk is clearly positively correlated with equity risk and in fact massively increases the overall risk being taken.

LikeLiked by 2 people

[…] Firevlondon addresses overdiversity in his portfolio (27) […]

LikeLike

[…] holding can nonetheless result in an increasingly sprawling portfolio – as my recent ‘overdiversification‘ blog […]

LikeLike

Your was very timely as it tipped me over the edge to make some changes to “simplify” my key portfolios:

1. I sold the shares of three UK companies none of which were more than 1% of my UK share portfolio. 43 holdings down to 40

2. I reviewed by US$ based portfolio and reduced the holdings from 46 to 33 reinvesting in VEU.

That leaves me with 73 holdings in my two key portfolios.

There is more to do, but thank you.

LikeLiked by 1 person

[…] can it be to learn something new, I ask myself. Well I certainly have found the blog post about Diversification, and its comments, have got me thinking. But I’m not sure what I’ve learnt yet. […]

LikeLike

[…] FvL’s portfolio has around 80 unique holdings in it. This is fewer than the ~200 in my portfolio, but is nonetheless highly diversified. Half of the value is in passive ETFs/index funds. The […]

LikeLike

[…] general the size/concentration of my portfolio remains roughly as it has looked for a while: about 170 holdings, with a ‘tail’ of 60 holdings amounting to 10% of the portfolio, and a […]

LikeLike

[…] previous posts here and here I’ve discussed the complexity that has arisen in my financial affairs. Partly this is a […]

LikeLike