Finally my delayed liquidity arrived. I have sold two large assets, leaving me with a lot of cash to redeploy.

As with an earlier angel investing windfall, when I have unexpected liquidity I follow a process. First of all I set aside taxes due, then charity donations, then other ‘IOUs’. Then I move the funds into appropriate portfolio accounts and start investing cash against my investment allocation.

However the size of the cash this time around has left me making a few tweaks to my setup.

At last, sleeping soundly at night with an equity portfolio loan

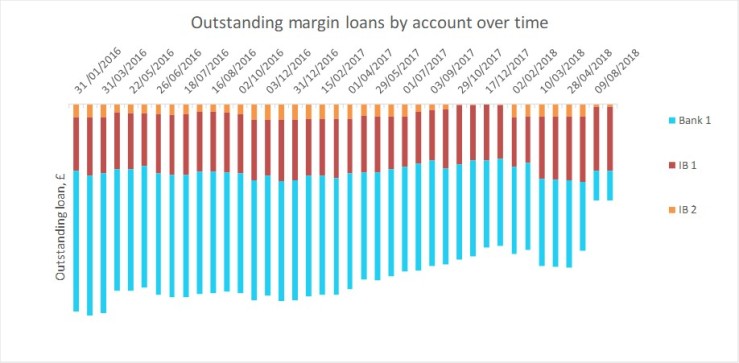

First of all I am taking the opportunity of this liquidity to pay down a significant chunk of my margin loan.

I am surprised what a positive psychological impact my loan reduction has had on me. I feel like the episode that began in December 2015, on a whim, when Mrs FvL and I decided to buy our Dream Home, is now over. Not because my assets have recovered to the pre-Dream Home level, which they haven’t. Nor because the loan is now fully repaid, which it isn’t. But the risk I took by taking out a £2m+ portfolio loan is now, for all practical purposes, gone.

I am surprised what a positive psychological impact my loan reduction has had on me. I feel like the episode that began in December 2015, on a whim, when Mrs FvL and I decided to buy our Dream Home, is now over. Not because my assets have recovered to the pre-Dream Home level, which they haven’t. Nor because the loan is now fully repaid, which it isn’t. But the risk I took by taking out a £2m+ portfolio loan is now, for all practical purposes, gone.

To ensure my loan reduction is sustained, my process requires me to update my ‘target allocation’ – in terms of the amount of cash/(debt) I aim to hold. I’ve reduced my target to minus 17% of my net portfolio value (for context, when I kicked off in January 2016, my target was minus 50%!). In effect a target of minus 17% means I now have a Loan:Value ratio of 17:117, or 14.5%. This feels like a modest level of gearing to me.

To illustrate why I consider LTV of 14.5% as practically ‘no risk’, consider a dramatic drop in the markets. If, for instance my (diversified, multi-asset class) portfolio dropped by a third, which would be pretty worst-case by the last 30 years’ standards, then the gross value of my portfolio would drop from ‘117’ to 78. This would leave my net value down at about 61 (78 equity less 17 loan), i.e. a drop of 39%. This would be painful, sure. But it would leave my Loan to Value ratio at 17:78, i.e. 22%. This would be nowhere near the level where my loans would trigger margin calls.

I may end up pulling my target loan level in to minus 15%, or even lower if interest rates rise much above the current level. But this would be purely for round number simplicity. I do right now think the current level of leverage (i.e. max 22%) is sustainable pretty much indefinitely.

At the same time, my investment portfolio has now grown, which allows me to reconsider my risk appetite; I am, contrary to general wisdom, reducing my target exposure to bonds slightly and upping my exposure to equities – on the basis that with a bigger pot I am more resilient to a large drop.

If Rees-Mogg can do it, …. it’s time to move funds out of the UK

As to which geographies I diversify into, of course Brexit is on my mind. And, as in early 2016, it seems to me that the UK has more downside risk than upside risk. So this makes me prefer to move my cash out of the country – or at least invest it in overseas assets; I’ve pulled my UK assets down from a third to a quarter of my total, left the USA at almost 50% weight, and bumped up ‘other international’ to 20% of my total portfolio, and Oz portfolio from 4% to 5%.

As it happens, I am also concentrating my margin loan position in GBP. In effect, I am becoming quite highly leveraged in the UK, and very lightly leveraged everywhere else. Or, to put it another way, I am borrowing sterling to buy overseas assets. This is essentially a bet that the pound (in which I have a large loan) will fall, and that UK equities (which are highly exposed to overseas currencies) will rise. I’m comfortable with that bet.

My asset allocation has changed as follows:

|

Moving on from my risk appetite and my Brexit aversion, I’ve been trying to stay true to my Investment Philosophy. In particular, this calls for:

- Diversify in as many ways as possible. In addition to by geography and by asset class, which I’ve covered above, I want diversity across providers.

- Tax efficiency

- Minimise fees

- Work to reduce the number of underlying holdings.

I have made good progress on improving my position in regard to all of these.

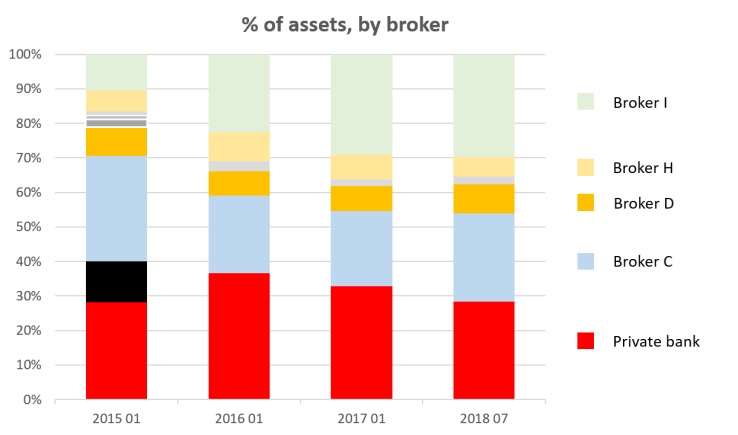

Improved diversity across providers

With the new cash influx I have been spreading the money around quite a few accounts. Much as I like Interactive Brokers, it has the biggest single amount of my portfolio and I don’t need its margin loan facilities as much as I did. So I have taken the opportunity to bump up the allocation to some of my ‘lesser’ accounts, really on a ‘what if the worst happened’ point of view. These accounts have slightly higher fees, or slightly worse platforms, but I’d rather have a more even spread of my money.

The graph below shows the broker split over time. The changes look quite minor but I consider them to be significant. For me this graph represents significant progress, in that:

- My private bank’s share of wallet has shrunk. This spiked up above 35% after I bought my Dream Home, but is now below 30% and falling.

- My platform mix is simpler. Back in 2015, before the Dream Home seduced me, I had 9 different broker/bank accounts, six of which were material. Now I have five material providers, and hardly anything else.

- I’ve spread the load more equally between my four big providers. Broker D, whose coffers I had to bleed distressingly dry to fund the Dream Home purchase, has received quite a lot of love from the recent influx of cash and is on its way to 10% share again. And much as I love ‘Broker I’, and I do, I’m managing to resist the temptation to give it more than 30% of my money. Broker failure remains a key risk for me and diversification feels the best way to mitigate it.

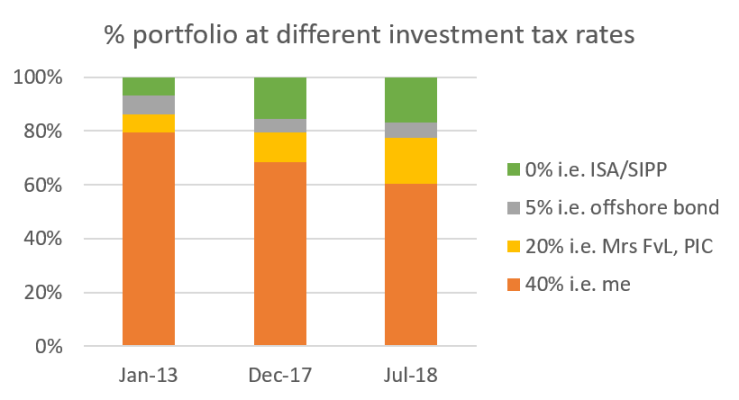

Tax efficiency has, on one measure, doubled since 2013

In the process of allocating funds I’ve also made good progress on tax efficiency. The chief ways I do this, aside from ISA top ups at the start of the tax year, is by moving new funds into Mrs FvL’s portfolio and my personal investment company. Her unsheltered portfolio is now just about at the point where her investment income would bump her into being a higher tax payer so this lever is now at the Max position. Henceforth the lever which still has further to move is the personal investment company, where investment income is taxed at 19%.

Even since the end of last year I have made surprising progress here. The proportion of my portfolio that is not fully taxable at my personal rate has almost doubled in the last five years, from around 20% to around 40%. Even in the last six months it has shifted by almost 10% – through a mixture of ISA/SIPP topups, shifting assets into Mrs FvL’s name, and adding funds (actually, loaning funds) to my personal company.

My investment fees are now ‘only’ a 19% tax on my investment income

Finally, on one of the most important investing questions of all, I’m making good progress on reducing my investment expenses. As ever, by retaining my private banking account, I am getting stiffed here relative to truly low-cost investing. But my private bank fees, as a % of my total portfolio, are falling as I make sure funds are deployed outside the bank. In fact my annual private bank fees now account for only 0.36% of my investment portfolio, down from 0.51% less than two years ago.

My total annual fees amount to about 0.56%, down from 0.75%. Of course, these fees are still equivalent to being a 19% tax on my annual investment income, so they are still the devil’s work. But not too long ago it was hard to even buy an index tracker for 0.56%. I can’t claim to be ultra low cost but I’m getting closer.

Quick question on your tax rate in your investment company. I consider the income in this pot as ‘tax free’ because the dividend income is already taxed, no additional corporation tax is payable. Tax is only payable if you want to draw money out of the PIC as a dividend, if you leave it in there it can compound for ever tax free. Am missing something here?

LikeLiked by 1 person

I think you are right for dividends for most businesses. Capital gains of course are taxable at corporation rates, less a bit of indexation I think. I have a bit of interest income too which is taxable.

LikeLike

The Chancellor has discreetly phased out the indexation relief. https://www.gov.uk/government/publications/corporation-tax-removal-of-capital-gains-indexation-allowance-from-1-january-2018

LikeLiked by 1 person

Aha – I hadn’t noticed that – thanks for enlightening me.

LikeLike

I’m very pleased to see your gearing coming down. I appreciate I was a wuss on this in the beginning, and you’ve done well from it — fortune favours the bold and all that — but once you’ve won the game why take the risk and so on. 🙂

Now onto the £. I don’t dispute it could still be vulnerable to further falls depending on what and when the Brexit comedy roadshow throws up next. But personally I think it’s probably closer to the bottom than any sort of top. Not a reason at all to dump everything overseas and go 100% sterling or any online commentator madness like that. But I am definitely moving my pieces on the chessboard with that in mind, personally. Don’t want to fight the last war!

Time will tell. 🙂

LikeLike

@Monevator – Thanks for your comment, and for the oxygen of Weekend Reading publicity. With both you and @zxspectrum48k on similar pages re GBP:USD, I concede I may have overplayed this point. But let’s let time tell.

I don’t really accept that you were ‘a wuss’ on gearing. Just because your house didn’t burn down doesn’t mean you were wrong to buy insurance. I was fortunate. I think I had more ability to manage my risk than would be clear at the distance you observe from, but I certainly don’t consider your reaction back in 2016 to have been ‘wussy’!

LikeLike

[…] Firevlondon – a high-value investor adjusts his portfolio (21) […]

LikeLike

Not certain about the GBP/USD view. At 1.40+ to take a short GBP/USD position made sense; you were looking at 1.50-1.60 on downside vs. 1.00-1.10 on a cliff edge cockup/Corbyn scenario. So a 3-4:1 payout ratio. I’d always take that. Plus you were getting the USD cheap (DXY was close to lows). Now at 1.275, it’s pretty much a even payout on GBP/USD, GBP is cheap on all long-term value metrics and the USD has moved 7-8% stronger in just 3 months.

Also I prefer not to interfere with my long-term bond/equity asset allocation based on short-term currency views. If you want to take a ccy view, just overlay a short GBP/USD forward (it’s even got small positive carry if you care about that). It’s massively liquid and you wip it off in a blink of an eye if something goes pear-shaped.

Personally, being someone who prefers to be long gamma rather than short over unpredictable events, I’ve been buying GBP/USD volatility through fx options. It was dirt cheap a few months ago but it’s getting more expensive as we head toward key events in Oct. Nonetheless, it still makes sense to own in my view; we can get a 10-20% move over the next 9 months and multiple 5% moves seem perfectly possible. In addition you are long some volatility regarding themes like trade wars, US exceptionlism etc. I’m happy to risk a few percent for all that optionality.

LikeLiked by 1 person

Very good challenge. Thank you.

I don’t think I’ve explained all of my thinking. A lot of my shift of Fixed Income into GBP is not a short term currency view but rather the @Monevator etc inspired argument that says the only genuine type of bond is a domestic treasury bond. I have been rather long on USD corporate bonds, and now am a bit happier heading for the uncorrelated and FX-free benefits of UK gilts.

Your point on the GBP/USD risks being fairly symmetric right now is a good one and has had me pondering. I think my considered response, 24 hours later, is to say that if Brexit goes t*ts up and the GBP falls to, say, $1.08, then the wider implications about the democratic process / political establishment / UK government are sufficiently depressing to have me wanting minimal exposure – i.e. the currency is only one reason for reducing my UK exposure.

I’m afraid that being ‘long gamma’ is a bit beyond my ken, and FX options are definitely outside my comfort zone. I buy your basic argument but will leave you to it.

LikeLike

[…] and recalibrates what’s left (28) […]

LikeLike

I am a chartered accountant with 30+ years of regulatory and fraud investigations under my belt. I completely agree with your “diversity across providers” or do not put all your eggs in one basket. I split mine into a US provider, a UK stockbroker and funds under an IFA + a number of directly held funds. This is not perfect as the IFA is taking more fees that I would like, and I need to work out how to sort this, but I feel a hell of a lot more relaxed by this diversity.

LikeLiked by 1 person

[…] Fire v London rebalances his portfolio […]

LikeLiked by 1 person