May was a pretty extraordinary month for my finances.

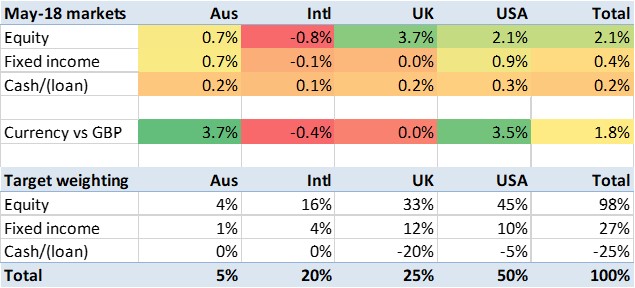

In the wider world, the most obvious newsflow appeared to be about Italy’s attempts to form a populist government, and the tariffs/trade war begun by Trump in the previous month. This led to the European currencies falling against the ‘Pacific’ currencies (USD and AUD is what I care about).

The FTSE-100 rose almost completely to compensate for the drop in the pound, as it often does. Eurozone stocks however fall slightly, in what was a marked shift versus UK stocks. And US equities rose slightly, which I think was a mixture of higher oil prices, further tech boom, and generally a sense that Trump is making some progress. Bonds barely moved.

But in my little bubble there was a lot more news than this.

The most dramatic news for me was in one of my illiquid holdings, where an offer to buy it has just come through unexpectedly, at a significant price premium to what I had valued it at. This is a significant holding for me, so the price premium is worth six figures. However, it is in a pot which includes my legacy private banking holdings, and I don’t include in my ‘invested portfolio’ tracking, so you won’t see this significant uptick in my monthly returns tracking.

Secondly I have had confirmation that I can expect the second of two windfalls I wrote about a couple of months ago to arrive later this month. This will add a useful sum to the invested portfolio. Between them, all these bits of good news increase my returns, or increase my portfolio, or both.

Overall I have had three unanticipated ‘exits’ within about one month. This will significantly reshape my portfolio. When exits are as rare as hen’s teeth, I feel blessed.

In addition, the US Supreme Court effectively lifted the federal ban on online betting. This immediately boosted betting stocks by 10%+. The UK is the world leader of this sector and two FTSE-100 businesses are among the beneficiaries, so this helped the UK market for sure. One of my top 20 holdings gained over 25%.

Adding to the roll call, my FTSE-100 ETFs were up 7-8% each. My S&P500 ETF was up 7%. Amazon was up almost 8%. The list goes on.

As an additional, welcome bonus, I have had not one but two of my ‘angel’ portfolio promise a dividend. Neither of these has landed in May, to be fair, but they are both adding to the invested portfolio in a pleasant way. In both cases the dividend will mean I have almost received back the entire amount of my original investment. This is highly unusual in the world of angel investing but it is certainly good news.

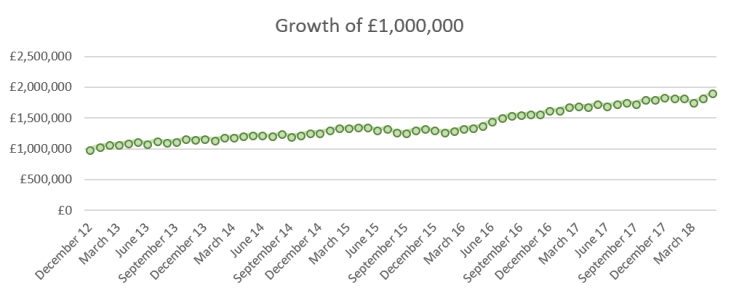

In any case, for the invested liquid portfolio, my returns for May were 4.4%. This is one of my best ever months, and is slightly ahead of the market average. The year now feels like it is going in a very different direction to how it felt at the end of Q1. Long may >10% annual returns continue. While I am still some way from recovering to the position I was in before I bought my Dream Home, I am getting appreciably closer.

As for Trump, the next 24 hours will be very interesting indeed. War or peace?

LikeLiked by 1 person

Fabulous FvL. Congrats on the exits!

LikeLiked by 1 person

Wow, an impressive May – I’m still intrigued by your large UK allocation given your brexit commentary – I’d down to ~16% UK stocks and feel I should go lower.

LikeLiked by 1 person

[…] Firevlondon, fast becoming one of my favourite blogs, has a stunning month on the financial front (25) […]

LikeLike

[…] the meantime, I’ve succeeded in reducing my leverage very significantly. In debt terms, by around half. In loan-to-value terms, by more than that […]

LikeLike