I’m a patriot, you’re a nationalist and he’s a xenophobic racist Nazi pig. We’ve all been conjugating the irregular verbs of narrow mindedness in August.

Having recently read Jodi Picoult’s Small Great Things, I found the Charlottesville incident fascinating. I was interested afterwards by the political/business angle. Business and the Republican party have just had a wedge driven between them. It’ll be interesting to see how long and wide the Democrats can make the wedge. I’m not confident that Bernie Sanders’ party can capitalise on the opportunity, but let’s watch and learn.

Over on this side of the pond the Brexit process is getting stuck in quicksand. Nick Clegg puts it well in the FT:

“Conservative Brexiters and the rightwing press have started to do what they always do when things don’t go their way: whining about how intransigent and slow the EU is (what do they expect? It is a convoy of 27 governments) while throwing insults”

I’ve caught up with two friends who voted for Brexit in the last few weeks. Trying as I might to be open-minded to their perspective, I find myself reflecting how an underlying dynamic of many Brexit supporters is an inability to consider the world from other countries’ point of view. This failing is at work whenever you hear Brexit types say they want to be in the single market but retain full sovereignty. This argument doesn’t address the fact that if all the other 27 EU countries had the same objective you’d have 28 countries all railing against the protectionism of each other and with no shared institution for resolving the disagreements.

The link between civilised Brexiteers like Daniel Hannan and the appalling thugs at Charlottesville may not be obvious. But to my mind the white supremacists’ inability to consider how the world might end up if everybody thought as they did feels worrying similar to the attitudes of many of the Brexiteers – certainly anybody who aspires to ‘take back control’ but remain in the single market (which includes quite a large portion of the 52%).

You can call it patriotism. You can call it exceptionalism. But it feels like blinkered supremacist thinking to me.

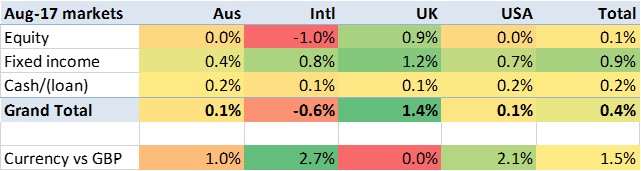

In any case, the Charlottesville fracas doesn’t seem to have much impact on markets. The most obvious development in the month was the rise of the euro and the continued fall in the pound. The weighted portfolio impact for me of these forex movements was a 1.5% gain, thanks to the large amount of non-UK exposure I have.

In both the GBP and Euro cases the equity markets somewhat ‘auto-corrected’ – FTSE rose slightly and the Euro equities fell slightly. In the meantime, USD equities remained flat.

Bonds rose across the board in August. I’m not sure why.

Across equities and fixed income the market, as weighted by my exposure, rose about 0.4%. On top of the forex gain this added up to a 1.9% tailwind. Handy, having a globally diversified portfolio, isn’t it?

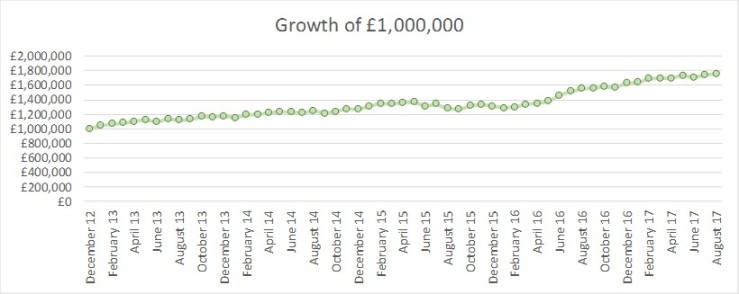

How did I actually do? I didn’t gain 1.9%, sadly. My portfolio grew ‘only’ 1.1% on the month. This still equates to an annualised 14% or so, so I’m not complaining.

In other news, I am increasingly nervous about the stories about ‘longest bull run‘ and high valuations, so I’m trying to deleverage. I managed to reduce my margin loan by around £50k, by selling leveraged assets. I’m slightly underweight on UK equities, but remain very close to my target allocation. I haven’t made much progress on shifting assets into tax efficient buckets (Mrs FvL, for starters) but am increasingly focused on it. Watch this space.

UPDATE: the actual returns were in fact a bit higher than stated in this post. I realised over the weekend that one of my larger accounts wasn’t updated at the end of the month so was a week or two old (and lower than it closed on 31 August). With this corrected my net performance was in fact a bit north of 1.5% for the month. I didn’t take a snapshot on 1st September and by the time I write this I can’t be sure about what August and what’s September, and can’t be bothered to go back in to the historic prices. It will even out when I do an update at the end of September/Q3.

LikeLike

Hi FvL,

“I’m a patriot, you’re a nationalist and he’s a xenophobic racist Nazi pig” <- Love it! 🙂

Good solid performance going through once again so congratulations on keeping up the good growth work for the portfolio.

I am with you on the nervousness on this "longest bull run" and so forth, but I am for now continuing to try and pay down the mortgage a bit extra each month, and just keep as fully invested as I can which I intend to continue doing regardless of the market.

Cheers,

FiL

LikeLiked by 1 person

Of course I agree with you about Brexit and the Brexiteers. I’ve almost gone full circle on motivations for the vote, especially for the comfortably well-off middle/professional classes. After a year of trying to see their point of view from some sort of reasoned perspective, it actually makes much more sense if you see it as idealogical/revolutionary, and those motivated by non-rational reasons.

Glad to finally see more de-leveraging, as you’re ever worrying uncle… 😉

LikeLiked by 2 people

You’ve mentioned margin loans in this and other pieces. A bit like Family Invetment Companies, it seems to me these are a magic solution known only to those with serious wonga, especially those with City backgrounds.

Is it possible for those of us with more modest investment portfolios to obtain such loans? If so, where do we get them from, and what are typically the terms?

LikeLiked by 2 people

@Mark – So far as I know there is only one easy solution for UK non-City not-yet-serious-wonga investors, but it is an excellent one: InteractiveBrokers. They have a fully UK-suitable offering (with one glaring exception – they don’t handle ISAs). I think they make sense once you have >£10k of assets, and certainly once you are at >£100k. And they will offer margin loans straight out of the box – you need to choose such an account when you set up but it is as easy as that. Rates are currently about 1.6% in GBP and about 2.6% in USD; rates fall a lot above ~£80k ($100k) of loan. Check out https://www.interactivebrokers.com/en/index.php?f=1595

LikeLiked by 1 person

Many thanks. Interestingly I see there’s a UK subsidiary, which gives me additional confidence. I’ll check them out.

LikeLiked by 1 person

It was clear that Leave voters were voting to leave the single market, and there is no evidence a majority of people want to stay in the single market now. Staying in the single market means staying in the EU (which is what Remain voters would, obviously, like).

A video of cherry-picked snippets by a Remain pressure group can at least equally be countered by one showing government ministers stating very clearly, voting Leave means leaving the single market: (see 1 minute into this clip)

Thanks for the blog anyway. Enlightening to see how your journey to FIRE is faring…

LikeLiked by 1 person