This is the third in my annual posts about my ISA (tax-free) portfolio. I’ve written before about how there is an outside (~10%) chance of my ISA portfolio reaching $100m, if I live for another 40+ years. Yet, as of my last post a year ago, the total FvL ISA pot was worth ‘only’ £355k (~$500k, back then!). So how am I feeling about multiplying my ISA 200x?

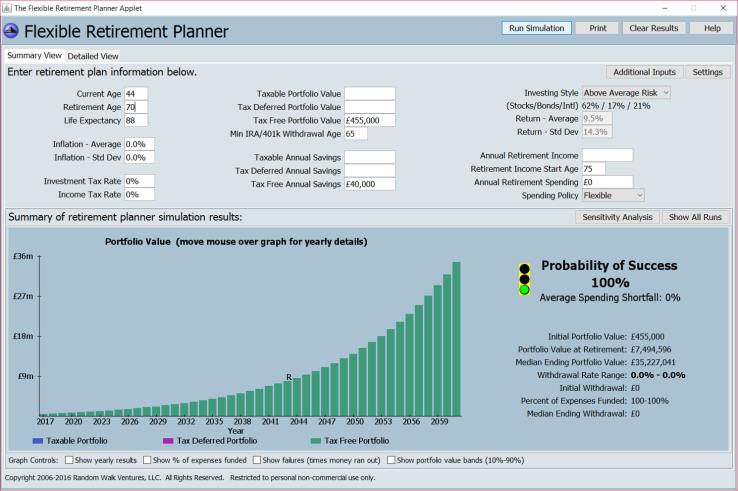

My $100m assessment was based on a scenario analysis over the next 40+ years. Making various assumptions (no withdrawals, regulation changes, etc), if I maintain contributions at £20k x2 per year, and achieve an ‘Above Average Risk’ level of return (>9% per year average, quite a high level of volatility), then in about 10% of predicted outcomes my total pot would reach $100m.

There are a couple of simple mental tricks that help me get my head around this growth. First of all, contributing £20k x 2 per year is quite a lot of money; over 30 years this is £1.2m. To make it easier to think about the growth of this annually-topped-up portfolio, let’s simplistically assume it isn’t annual top ups, but instead is a lump sum of £600k ($750k) in year 14.

Secondly, remember the rule of 70. Assuming I average returns of 7% then my portfolio doubles in 70/7=10 years. At an average return of 10% it takes about 7 years to double. So if I start with $0.5m, and averaged 10% return, after 35 years I have doubled 5 times, and I’m at $16m. But if I add (see previous paragraph) $750k in year 14, this $750k then doubles three times; this adds a further $6m. The two together get me to $22m in 35 years. Now assume I last a further 14 years , which takes me to the average life expectancy for UK males of my age, and I double my combined $22m pot 2 more times. $88m. Not quite $100m, but not far off.

Before you say that 10% per year is unrealistic, I am citing everything here in nominal ‘money of the day’ figures. This is before allowing for inflation. Historic returns for a diversified portfolio can easily achieve 5% per year on top of inflation. This works out as 7-8% per year in nominal figures. 10% is high, I will accept, but not absurdly so. If you have significant fees then you can forget it, but if you hold low-cost passive trackers this is not that unusual.

In the meantime, there I was a year ago with £355k. At today’s exchange rate this is barely $450k. How have I fared since then?

The first thing to note is that the annual allowance has increased about 33% from ~£15k per person to £20k per person. I have maxed this out, thus topping up my ISA by £40k (between me and Mrs FvL). If nothing else had happened, this would have increased my portfolio to £395k.

In fact after the tumultuous last 12 months my ISA portfolio has returned over 15% in pound terms, even before my top up. This is a less than my overall portfolio return, as my ISA is a) unleveraged, b) UK centric c) fixed income orientated, not equity orientated c) underweight on some key holdings that have done well for me (e.g. Amazon). But 15% is still well above 9-10% cited in my discussion above. The net result is that my ISA portfolio(s) now amount to £455k. A round £100k increase on the previous year. Delicious.

Starting today with £455k, and using the same Flexible Retirement Planner that I used last year with the same assumptions, the ‘middle scenario’ sees my pot reaching £35m before I expire. This is about 15% better than last year. Of course with the weaker post-Brexit pound the $USD hasn’t really risen (last year $43m, this year $44m). But there is a 10% chance my portfolio will exceed £100m ($125m even in these benighted times). My fingers remain crossed!

The point of this post is not necessarily to suggest we can all become ISA $100millionaires. That depends on starting with >£400k, having 40+ years left, being able to contribute £40k per year indefinitely, withdrawing nothing, and achieving decent equity returns on average; this is going to be a rare cocktail.

What I’m really getting at is that if I have a plausible shot of reaching $100m in my lifetime, a lot of people will have a realistic chance of becoming ISA $millionaires, if they put their mind to it.

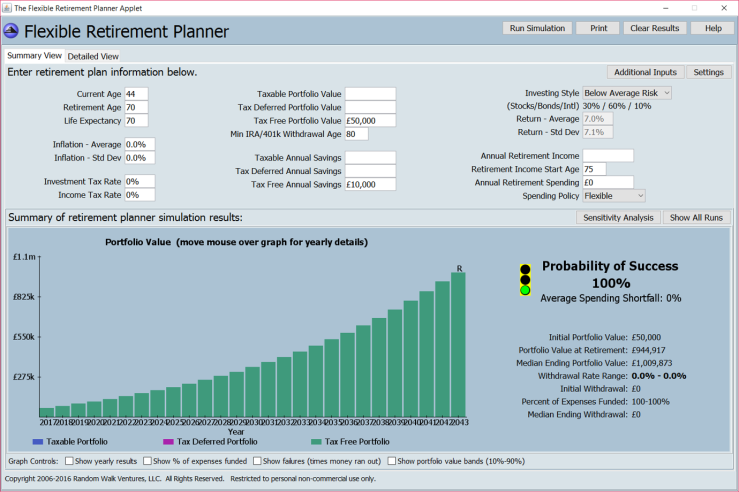

Becoming an ISA $millionaire, or even a £millionaire, is more achievable than you might think. For instance, it is achievable under the following assumptions:

- You are 44 or younger today.

- You live until you are at least 70.

- You (and your better half) have an ISA pot of £50k as of today. For every ten years younger you are than me, you can halve this starting point – so a 24 year old would need to start with about £12k in their pot.

- You invest £10k per year into your ISA(s) every year. Again, for every ten years earlier you start, you can halve this; the 24 year old with £12k in the pot needs only to top up by £2500 per year.

- You never withdraw anything from your ISA(s).

- Your ISA(s) achieve average returns of 7%, before inflation. This is very much in line with historical UK averages, provided you keep fees low

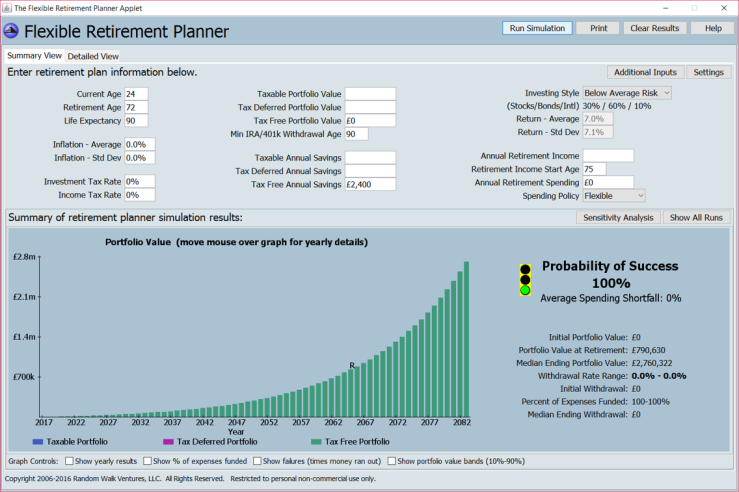

What about a 24 year old today, with nothing in the pot yet, and a tight monthly budget? Well, if they start saving £100 per month into their stocks/shares ISA today, persuade their other half to do the same, stick with the other half (what are the chances?!) until they die aged 90, then the graph below shows that happens. They’ll retire with ISAs of £790k – almost exactly $1m. And if they can avoid touching the pot during retirement, they’ll more than triple their ISA to £2.7m before their heirs fight over it.

Thats a whole lot of ISA you have there. Did you leave any allowance aside for a LISA this time round?

On the flip-side, theres little point expiring with $100m in the bank, you got a strategy for getting it spent before you pop-off?

LikeLiked by 1 person

Too old for a LISA, me! I seem to be spending well enough right now but if I actually end up in that sort of position then I expect I will head for the Buffet strategy with the ISA. Ie give most of it to well-managed good causes 7+ years before the end.

A more likely scenario is that the LTA policy expands to encroach ISAs, and then all bets are off.

LikeLike

Do you track spending as well as your portfolio performance then?

I think it could be nice to be a mega-philanthropist in old-age?

It would be a bit of a disaster if the LTA-ISA thing were to occur for sure..

LikeLike

Impressive, but what’s the point of a $100m pot when you’re 80-odd?!?

LikeLike

Hi FvL,

I love the idea of having £100 Million in an ISA – talk about set for life!

Seems like you are well set to be far in excess of the £1,000,000 mark so credit on that, and as you say with the new ISA limit that should make it even easier for those who were struggling to find a home for anything left over after the previous limit was hit.

Shows what good discipline can do to just put money aside – and seems you had a good year to chalk up to nearly £500k – hitting £100 million would be impressive, although surely at some point you will want to spend it? Even if only on your kids education, or philanthropy or a big yacht?

I would like to hit the ISA millionaire jackpot before I FIRE but with only 8 years to go that is going to require some serious returns, which I doubt are realistic.

Cheers,

FiL

LikeLiked by 1 person

You are right, @FiL, if I get anywhere near £100m I will in practice find uses for the cash. Philanthropy will be one for sure. But I hope my unsheltered assets will have grown too – albeit by a lot less – and will try to keep the ISA’s tax free compounding going as long as I can.

LikeLike

Hi FvL,

If I had both sheltered and unsheltered then like yourself I would look to use the unsheltered first and run the sheltered. The mortgage is stopping that at the minute 😉

Cheers,

FiL

LikeLike

Question: do you fund/invest your ISAs in one lump, or spread through the year?

LikeLike

Hi RAD. I top up the ISA accounts more or less in full right at the start of the tax year. And then start deploying the cash over the next few weeks. Right now I have deployed about £20k of the £40k just added.

LikeLike

[…] was a more significant month for my portfolio than the unitised return would suggest. I moved £40k into my+Mrs FvL’s ISA accounts. I had a couple of significant costs for which I raided the portfolio. Overall my portfolio […]

LikeLike

[…] goal to get my ISA portfolio to £1m+. I’ve been posting updates annually about this (e.g. here, and the […]

LikeLike