My goals in 2016 for each quarter were as follows:

- For my net loan to shrink by £10k per quarter, without any margin calls.

- Maintain investment income of at least £Xk

- Closely track my target asset allocation

Goal 1: For my net loan to shrink by £10k/qtr

As I’ve reported in my previous quarters, this goal is disappointingly difficult. I say disappointingly because ultimately this is about self-discipline and being honest with myself. Not my strong point, evidently.

To get my excuses out of the way first, I did consciously decide late last year that with the relentless gains in my portfolio I should take some money off the table. By this I didn’t mean sell assets to pay down debt, but rather swap public equity / bond assets for some other investments in other, uncorrelated asset classes. To this end I took about £100k out of my portfolio and reinvested it in some illiquid private investments (which are out of scope of my tracking on this blog, so these count as a withdrawal from the portfolio).

In effect by choosing to reinvest liquidated assets rather than pay down debt I was explicitly ignoring my quarterly goal. Worse, I was “borrowing money to invest in risky assets”. Mea culpa.

In any case the net result was that I finished Q4 with my loan £60k bigger than it started. Again, it wobbled during the quarter; at one point it was £70k bigger, then it shrank by £50k, then it rose again.

One lesson for me here is that I love the flexibility the margin loan gives me. It is like having a flexible amount of cash on tap. Generally speaking I am reasonably disciplined about it insofar as I don’t just spend this cash – I do return funds to the pot too. But on balance I have been moving the wrong direction.

The real test of how disappointed I should be here is the level of risk I’m running. A crude measure here is the Loan-To-Value of my margin loan. I finished Q3 with my LTV at about 29%. I finished Q4 with my LTV just under 30%. So the loan has increased slightly faster than my investment portfolio has.

Overall progress against this goal is a FAIL.

Goal 2: Maintain investment income of at least £Xk.

I had a disappointing Q3 (at 80% of target) but said that I expected Q4 to be much better. I expected an improvement for two reasons. Firstly because that some ETFs paid dividends early in October instead of late in September. Secondly because I let my old house in September and knew I had the rental income to look forward to in Q4.

So, what happened in Q4? Indeed, my income during the quarter (what I have seen so far or have very accurate estimates of) amounted to 120% of target. More to the point my rolling twelve month outcome was exactly 100% of target. Phew.

My overall result against this goal was a PASS, both for the quarter and for the year.

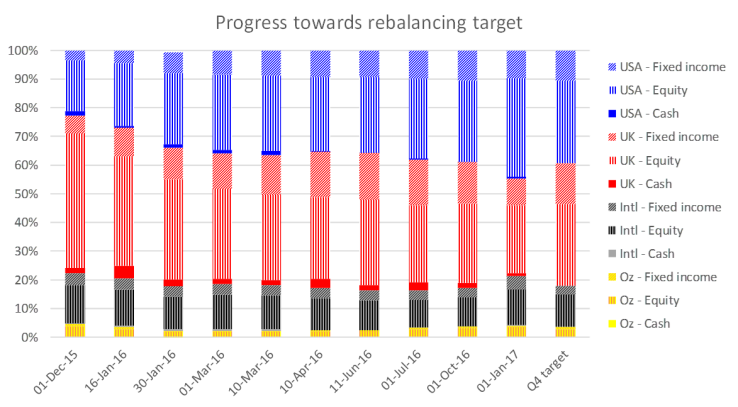

Goal 3: Closely track my target asset allocation.

In Q3 I said that I “kept magnetically close” to my target allocation.

Unfortunately, in Q4, the magnet came off. This was a direct result of me restructuring the private bank’s discretionary portfolio. This has the effect of replacing a UK-biased balanced portfolio with a ‘Global Beta’ portfolio with significantly less fixed income and more US exposure. As a result I am overweight USA, ‘International’, and equities. As it happened this wasn’t a bad place to be in December but I don’t like that it wasn’t planned properly.

Overall progress this quarter: FAIL. I think I deserve some credit for at least tracking this stuff – if it wasn’t for my spreadsheeting, I’d never have known from what the private bank explained to me that the shift I made would have such an impact on my exposure.

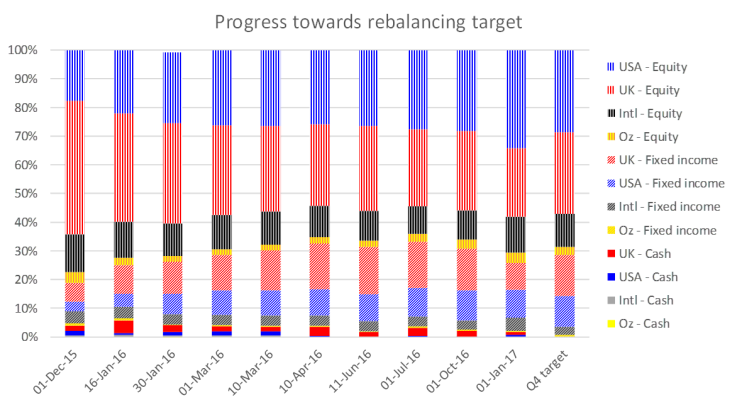

In fact I had a suggestion from @Monevator after that blog to present my numbers differently. Instead of stack ranking by geography (blue USA on top, red UK below, etc) he suggested I sort by asset class (striped equity on top, diagonal fixed income below, etc). In general, I am going to take him up on his suggestion. For Q4 though, I’ve included both graphs for the data geeks amongst you. You can see that the big delta was in fact the geographic swing.

By geography

This allocation mismatch I’ve ended up with has been good food for thought and I will return to it soon.

Thanks for sharing. Interesting trends in your exposure to the global markets. Do you find it hard to keep track of things — with various different currencies and equity and debt markets? I am trying to simplify my life more — leave most of it in index funds and concentrate on a smaller set of holdings in the portfolio.

Best wishes for the new year

R2R

LikeLiked by 1 person

Keeping track of things is indeed the issue! I am quite geeky about it – probably more than I should be but it gives me confidence. Today’s blog post gives more detail. And once setup, doing an update is quick.

LikeLike

Hi FvL,

A shame on the margin loan target not coming down, but I am glad to see it’s not just me who can’t always keep to the targets 🙂 In reality if you are confident of getting better returns elsewhere then why not – this is one reason I am not heavily overpaying the mortgage!

Great to see that over the year your income target was met despite the fluctuations – I think a good lesson for us all here and a reminder that some months are better than others, you need to have that cash stash to help smooth things out over the year, rather than have ramen noodles in Q3 and Caviar and Champagne in Q4!

Keep up the good work!

FiL

Disclaimer: I dont like Caviar…

LikeLiked by 1 person

[…] first goal was to stick closely to my target asset/geography allocation. I finished Q4 with a very different exposure than I started, thanks to a big sort-out of my private bank. At […]

LikeLike