September. The academic new year. The Jewish new year. The end of the press silly season. What did it hold for us? More banging on about Brexit – with the three Brexiteers all appearing to get slapped down by their boss at various points for saying we would / wouldn’t leave the single market / leave the customs union / trigger the legals by such-and-such. Amidst the heat and the light, what actually happened? Not a great deal.

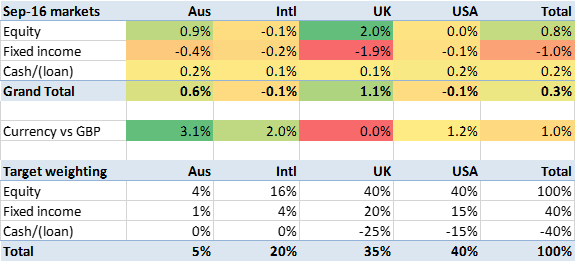

The pound fell, of course, a bit further (though nothing compared to what, at the time of writing, the Tory party’s annual conference is doing to it). This meant that UK equities were up. US equities were flat, remaining at record highs on some measures. Bonds fell everywhere I track – by as much as 1.9% in the UK. Does this mark the top of the bond cycle? Time will tell, and time will also make a mockery of anybody who tries to make such calls.

How did my portfolio do?

For much of the month my portfolio was heading for its first month-on-month decline since January. But the end of the month return was positive – up 0.5% – i.e. somewhere between the gain in the value of my non-UK exposure (up about 1%) and the constant currency weighted investment return of 0.3%. My other half’s portfolio (which is more UK/Australian equity weighted) was up over 2% so exact mileage does vary.

This still leaves me up, again, up 23% in 12 months. This is so far from being sustainable it is almost a bad thing.

I have actually been withdrawing some funds from my portfolio for use in non-liquid spending/investments, so while my portfolio has been returning a positive 0.5% in fact the absolute size of my portfolio has shrunk for the first time since January. It had to happen. Among other things this means my efforts to cut back on my margin loan are still struggling to show much impact. I’m keeping an eye on this and hope to have more to report next month.

Another good solid month – well done! I am with you that the markets (or bonds etc.) just seem to keep going up so I have avoided buying anything in my DIY portfolio now for some months, just waiting for the crash, which may or may not happen 🙂 My offset to this is that I still do the regular drip feeds into my other half’s ISA and my pensions, given they are long term investments, I cant worry too much as it will balance out eventually 🙂

Cheers,

London Rob

LikeLiked by 1 person

Hi, Thanks for the update. I always your monthly returns update and they are always thought provoking. Can I ask what method you use to calculate your total(?) return each month? I’ve been using a calculation which I am not sure is the best and am interested to know how other people calculate it.

I have been using the following calculation in excel with the logic being dividends/purchases/sales happen throughout so I’ll presume all happen mid month for ease:

((End val-(contributions-dividend income)/2)/(start val+(contributions-dividend income)/2)-1))

Regards

Paul

LikeLiked by 1 person

Hi Paul,

I use a really basic calculation, which probably under rates some, but basically, I take the end value over (start value + all contributions) – so assume that all contributions were made on the 1st day of the period when I mark myself (not always fair if you drip feed, so you get a worse performance return than may actually be the case).

Its not perfect, but it is easy 🙂

I know some people out there use the XIRR excel function, and also some who unitise their portfolio, but I am lazy 🙂

London Rob

LikeLiked by 1 person

Paul – I use the boglehead spreadsheet. Basically it does what you suggest but where the bracketed term is ‘net injections/withdrawals’. If I don’t withdraw or inject anything (which used to be the norm but sadly I am now making withdrawals most months) then the calculation is just (End Val / Start Val -1).

The process of taking the net injection/deduction and halving it and applying it to both start and end is a way of effectively saying all such changes apply mid month.

Any dividends etc are just captured in the End Val number. Dividends look after themselves, provided you don’t withdraw them. I.e. if you start off with £100k and then get £1k of dividends and at the end of the month your portfolio is worth £103k (£102k of holdings plus £1k of cash) then the gain is 3% – a third of which has come from dividends.

LikeLike