Previous readers will know I’ve spent the last two months unexpectedly buying a house. It’s been quite a journey, and it’s now complete. HOORAY!

This is not just any house; it’s the most overpriced house in its expensive area of London. I have paid a premium per square foot of over 15% compared to any of the immediate neighbours. I don’t anticipate making any return on this purchase for years, and even then I will be lucky to beat inflation.

This is not just any house but it’s a Dream Home, at least according to me and Mrs FI RE v London. Two months in, I still think this, which is a good sign. We are finding ourselves welling up with tears at the prospect of leaving our former home, and then bursting into broad grins when we arrive at the new Dream Home. Hopefully the grins will win out.

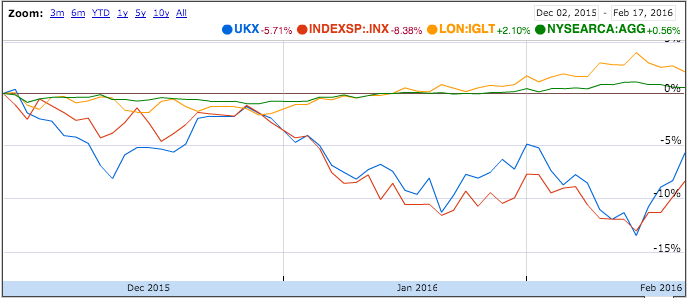

This is not just any house purchase, but a purchase made by liquidating my investment portfolio in some of the biggest market turmoil we’ve seen for years, with UK/US equities both down almost 15% at one point and six swings of over 5% in either direction in less than three months.

And this house is not my only new commitment. I also am responsible for a new >£1m loan. This loan is not even secured by the house; it’s secured by my investment portfolio – which in theory could fall enough to trigger a liquidation of the whole portfolio. But even if that happens, I keep the house(s).

I couldn’t have bought this house without the help of my readers. Well, I probably could, but I would have bought it differently and I’d have been considerably more stressed. Thank you all for helping me think through my finance options, helping me analyse the risks I’m running, helping me deliberate over whether a house move will add or subtract from the net happiness in my life, helping me get my head around the colossal taxes I have to pay for this transaction, and helping me manage the process in a reasonably efficient way.

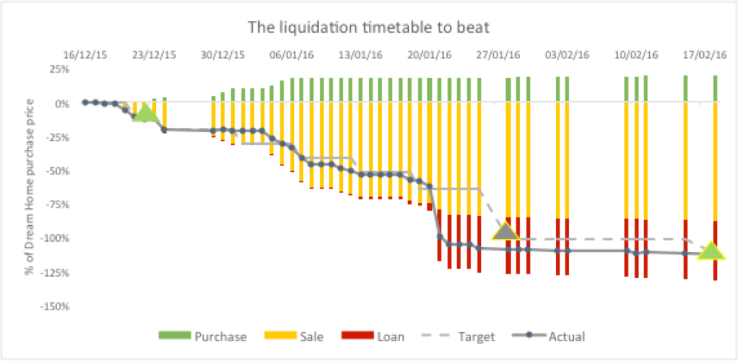

I left paying the stamp duty until last. This has been a significant relief, because it has allowed me almost twice as long to liquidate the trickiest assets in a market which has been bouncing around in all directions. This has saved me thousands of pounds.

It seems ages ago but in December when I started liquidating assets I couldn’t believe how slowly the funds came together; I was liquidating funds across about ten accounts, as well as moving significant sums from some accounts to others. I needed a spreadsheet to keep track of it all. But it all worked in the end, as you can see in the graph below:

My investment portfolio has shrunk dramatically. To allow for the riskiness inherent in a leveraged portfolio, I have adjusted my target asset allocation significantly towards bonds and away from equities, and away from the Brexit-affected UK. At this moment my rebalancing is incomplete, so I am unhealthily exposed to UK equities and insufficiently cushioned by bonds in the UK and the US. I am giving myself until the end of March to get within acceptable tolerances of my new targets, and hoping that any market meltdown can wait until after March.

I am feeling nervous about my ability to manage my cashflow over the next few months. My investment income, which I rely on for my unencumbered lifestyle, is much reduced. And my expenses are up significantly. I will be slowly draining my principal until I sell my former home. This is a new experience for me; while I have been using investment income to fund living expenses for some time now, I have always had enough income to be able to reinvest a sizeable proportion.

My temptation now is to throw any spare incoming cash at reducing the loan. But this misses the point; the reason I have this loan is to enable me to maintain my investment portfolio. So the rational way to invest incoming cash is in this portfolio. At the same time I feel my loan is too toppy for peace of mind. So my conclusion is to try to divide incoming cash roughly half:half between paying down the loan and adding to the investment portfolio.

My big priority for the next few months is to sell my former home. The selling/moving process feels alarmingly expensive at the moment, with various expenses associated with moving / selling / etc now looming unexpectedly. And it turns out the old house has been measured to be smaller than I had realised, so my valuation expectations have been depressed too. Time will tell how we do on this front. Any tips would be much appreciated.

Wow, would love to see the Dream of a House that has prompted you to go to such spectacular lengths to secure it! I am impressed that any London house could have a cash buyer. Congratulations and best wishes for many happy years in the house of your dreams.

LikeLike

Congratulations and wish you all the best in your new home after such a journey!

LikeLiked by 1 person

Congratulations! Really hope it works out for you.

At least you don’t have to worry you’ve bought the most expensive house in an expensive area and ALSO AT THE TOP OF THE MARKET because I haven’t thrown in the towel and bought yet, and when I do, that will be the tell.

Hope you have a very happy forever in there. 🙂

LikeLike

Long time reader, 1st time commenter! Congratulations and good luck.

LikeLike

Firstly, congratulations! I Am glad to hear you have managed to move in, and enjoying the new home – its great to hear 🙂 Good luck selling the old place – there are lots of tips on the internet on how to sell it quickly – declutter, clean, etc. – when I had to sell my old place fast I put most stuff into storage, cleaned it up but left enough to make it lived in (sofa, tv, beds etc.) so that people could imagine living there, if its just empty people sometimes struggle to see past.

In terms of the loan versus investment its one I struggled with when we moved. Our mortgage is higher than I would like, however I dont want to miss opportunities to use our ISA allowances and any other tax free options. I battled long and hard with this, and in the end I kept with filling my ISA as much as possible (usually completely), filling Mrs. LRs ISA as much as possible (next financial year I hope to fill completely), but taking any income it generates out of the ISA, and using it to overpay the mortgage. Ok it will stunt the growth of the second ISA but will give me a regular income to help pay down the mortgage and I will feel better and sleep better for it 🙂

Anything else left over? Most likely a taxable account to take advantage of the dividend tax free allowance coming in, and then the income from that will also overpay the mortgage.

In effect re-earned income will pay off extra on the mortgage!

I also had to adapt my lifestyle with a *cough* somewhat larger mortgage than before, but actually now I am used to it its not so bad 🙂 I cook in a lot more, which means we get better food than most restaurants, and a MUCH better value wine list 🙂

Enjoy the new home!

London Rob

LikeLike

[…] Housing, pt11: it’s over. → […]

LikeLike

[…] voted for Brexit. Never mind my own personal milestones – leaving school, getting married, buying a house etc – history is truly being made today. And it feels […]

LikeLike

Congratulations.

In case anyone comes to this and needs to do something similar in terms of breaking a housing chain and buying the new property before disposing of the old, there is a new option……

Since April 2016 you can withdraw and then repatriate an entire ISA balance provided both the withdrawal and repatriation is done in the same tax year (and your ISA manager has put in place the processes to do it). That opens up:

(1) Breaking a housing chain. Buy new house (with some ISA money), then sell old house, then mortgage new house.

(2) Keeping an ISA balance and paying down the mortgage with the same pot of money.

– Offset mortgage (or one allowing overpayments and borrowback)

– Withdraw ISA money on say April 10th

– Expatriate by April 1st the following year

– Keep full ISA subscriptions along the way

– You are mortgage free for 11 months and 20 or so days per year.

I see this as a huge new benefit, particularly if you can then pay off the actual balance with your 25% SIPP tax free lump sum at 55 (or 57, 62, or whatever else the rules are when you actually come to do it).

LikeLiked by 1 person

[…] my loan reduction has had on me. I feel like the episode that began in December 2015, on a whim, when Mrs FvL and I decided to buy our Dream Home, is now over. Not because my assets have recovered to the pre-Dream Home level, which they […]

LikeLike