In the ongoing saga which is my attempt to raise an absurd amount of cash to buy a few hundred square meters of Dream Home in London, I have had three bits of bad news this week.

At the start of last week I thought that I had pretty much sold everything I needed to sell. I’d only just become a ‘forced seller’, which saw me liquidating for example some FTSE-100 stocks at a FTSE of around 5900 – around 5% below the level I entered this process at. I had three things to do: collect cash from assorted bank accounts, confirm my margin loan, and sell one particular asset.

The particular asset I have needed to sell is a block of shares in a listed smallcap UK company. I won’t divulge the name of the company. Suffice to say that I have needed to do some paperwork in order to sell these shares, which I have been waiting on and which came good late last week. This block of shares has been my largest holding so for various reasons it makes sense to downsize it.

This last week has seen three bits of bad news:

- My margin loan has come up £400k short. Most of my loan is coming from one provider, and they told me on Thursday that they could only offer £400k less than they had previously indicated. This is for a couple of reasons; partly because for some random reason they won’t lend against some of the Australian iShares ETFs that I use, but mostly because my ‘particular asset’ has just become unmarginable (due to low trading volumes). £400k is a hefty chunk – it is roughly the amount of the stamp duty I need to pay.

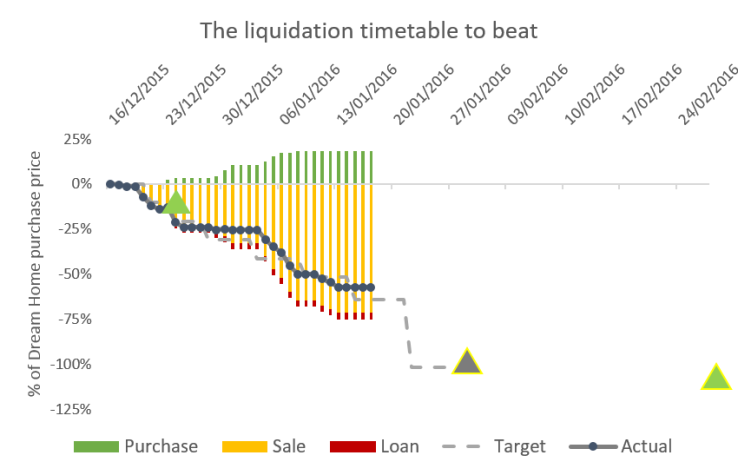

- My ‘particular asset’ has just dipped in price by 10%. At some level this isn’t surprising, because most UK stocks have dipped in price and many by much more than 10%. But it had been holding up well – see the graph below. It has now just dropped to a price where I am very very uncomfortable selling it. I have just sold about 10% of my holding, and I suspect that my sell order has pushed the price down. This leaves me in a quandary about what to do with the other 40% of the holding that I had planned to sell.

- The main stock markets have carried on sliding downwards. I had hoped that this wouldn’t really matter any more, provided I didn’t breach my margin loan requirements, and putting aside my frustration I can’t participate in the buy-now-while-stocks-last promotion Mr Market is offering. But now that I need to find about £400k more funds than I had expected this is a headache.

One other bit of news, which has been under-reported and isn’t obviously good or bad for my predicament, is that the pound (and the Australian dollar, in fact) has fallen dramatically against the US dollar (5% down) and the Euro (7% down). This does at least partly mitigate the falls in US stock prices / S&P-500 for us UK-based investors.

I am conscious that I said in an earlier update that I was happy to take USD/GBP currency risk on the chin so it serves me right that the pound has just promptly fallen to its lowest level since 2000. If the pound stays where it is against the dollar, I am going to make sure that at least 50% of my margin loan is in dollars. Mean reversion says there is a better than evens chance that the dollar will weaken before I repay the loan, and thus my debt will shrink.

All of this news left me on Friday taking fairly drastic remedial action.

First of all, I have swapped out of my unmarginable Australian iShares into marginable alternatives. It turns out that the highest level of margin available is on individual bluechip megacap stocks – my bank will lend me 75% of their value. This is even more than the 70% they will lend against regular diversified Vanguard/iShares/etc ETFs – go figure. I am waiting for the Australian market to open but expect to see that I have ‘found’ about £100k more margin loan by close of play Monday.

Secondly, I have sold about £200k of assets I had previously not planned to touch. I got around 90% of what these assets were worth even in late December; had I known the margin loan situation more accurately back then I would have saved myself around £20k. This cash hasn’t arrived yet so isn’t yet shown on the tally below.

I still need to find around £300k more cash. I had intended for about £150k more to come from my ‘particular asset’, but right now I am not so sure. And most of my other liquid, non-tax-sheltered assets are not ones I relish selling at the prices on offer from Mr Market today. And yet time is becoming tight – I don’t have many days to wait to see if the market rebounds. And of course I risk the market falling further – Blackrock’s CEO Larry Fink is cheerfully predicting a further 10% decline.

This leaves the tally so far as shown below. I’ve adjusted my targets slightly to take into account that I don’t need to find the stamp duty until late February, and the fact that my margin loan will be about 10% of the Dream Home’s value less than I had expected.

Do you really want to margin loan to buy this property? For me, risk in the current investment environment is too high.

If you really want the property, then sell other assets to purchase it. Those sold assets will soon be replaced if you continue to follow your existing savings plan.

LikeLiked by 1 person

@Ausfire – fair challenge, thank you. I feel like I can cope with further market falls and don’t want to miss out on market gains. And the market income yields are reasonable, and improving, right now – and I put a lot of psychological value on the regular income that the portfolio generates, which I wouldn’t forsake readily. If I had no margin loan but instead sold assets then my portfolio income would shrink to a level where my savings would be tiny and I’ll never rebuild the sold assets. But you are right that in the current investment environment a margin loan is a risky undertaking.

LikeLike

Why not get a mortgage? You can do it after the house completion (so you are still a “cash” buyer) and have the funds before the stamp duty becomes due. With an offset mortgage you may be able to soon reach a situation where you are not paying any interest and effectively have a standby overdraft facility.

LikeLike

@GreekTaxPayer – good question re mortgage. The key reason a mortgage doesn’t work so well for me is that I have a pre-crisis mortgage on my Former Dream Home already. It’s not enormous – it’s about 25% of the total value I’m borrowing this time around – but it’s at base+0.59% so it’s very cheap. The mortgage I’ve been offered by my bank, which is the only route I’d trust to be fast enough, would have been about 1.5% more expensive and would have needed to pay off the prior mortgage. The portfolio loan is similarly priced but lets me keep the mortgage in place.

LikeLike

Hi FvL,

I did wonder how things were going with the recent drops, although this mornings uptick may help a little – it shows the rollercoaster of fun that is the stockmarket! I really do hope that things work out and you manage to find the extra 300k (not thought about a P2P? :)) – fingers crossed….

London Rob

LikeLike

Appreciate you’ve thought this all through and are more aware of the ins and outs than we are, but similar to the poster above, I wonder if your position moving so badly against you in just a matter of weeks (days?) does give you any pause as to whether this is the best way forward?

As I’ve mentioned before I’m watching with interest, not least because given my assets-to-my-income-to-potential-CGT situation I could imagine exploring this route someday. But boy it feels like it amps up the emotion! 🙂

LikeLiked by 1 person

@Monevator – AlI I need to really test my confidence is the people I really respect asking me ‘are you sure?’ / ‘aren’t you mad’ / similar. Thanks for being candid – I really appreciate it. All the more reason to finish my analysis on a stress test of my situation, as @WheelieDealer has suggested. I’ll do it later this weekend.

LikeLike

An update to this post – especially regarding the ‘particular’ asset. I’ve decided what to do with this and am feeling much happier as a result.

In the first instance, I have sold 20% of it at market prices. I got a price of about 10% below its steady state price for this. So perhaps I took a 20%x10% = 2% hit for my trouble.

Secondly, I have resolved to leave the question about whether to sell another 20-30% until next month. At this point, I will have completed on the transaction but not yet paid HMG the stamp duty. I have four weeks to raise funds for the stamp duty. I’ve put limit orders in place to catch any uptick in the price and I will give it a week or two. If that fails to catch, I’ll sell low-vol assets – most likely bonds (which have risen in value during the recent turbulence).

Lastly, I have decided to buy some of this stock in my tax-sheltered accounts, to ‘sterilise’ the sale a bit. These accounts are not being used for my house purchase. I have bought about 20% of the sold amount back again, and paid about 5% less than what I sold them (in my unsheltered accounts) for. A profitable trade.

LikeLike

[…] volume dip, and its liquidity levels fall, it can suddenly become less useful as collateral. I saw this happen when I first set up my margin account – a large position I had in a relatively illiquid stock flipped overnight from […]

LikeLike