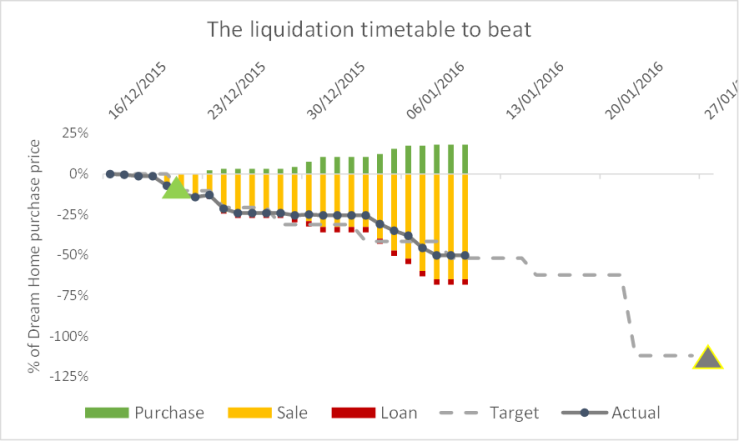

I’m about half way through the five weeks I’ve got to pay for my Dream Home. And my race to raise the funds is progressing roughly on track. Meanwhile, the global stock markets are in turmoil – the new year has had the worst start in two decades.

I’m selling off parts of my investment portfolio, and borrowing a chunky loan against much of the rest of it. So far I’ve been fortunate – the bulk of my asset sales have been timed, as it looks right now, to avoid the worst of the market’s recent dips. My benchmark here is 6100 for FTSE-100; while I haven’t totted up all the sales yet my gut says my average sell price will equate to a FTSE-100 price of just over 6100, even while the index has dipped down to 5900 twice during my sell window.

I have moved all the assets I plan to into the marginable accounts (shown in green, above), and sold almost all the assets I plan to. What remains is getting the money into the right accounts, making one other major asset sale and confirming my margin loan against the marginable portfolio.

My other area of good fortune is that I’ve started on a rebalance away from UK equities and towards US/UK bonds. I’ve bought a six figure sum of bond ETFs and these assets have actually gained in price as the equity rout has occurred (see graph above). The last week has been one of those textbook lessons in the value of bonds as an asset class that is uncorrelated with equities. And as the FT points out, UK bonds are strikingly good value right now. While I have more rebalancing to do – and thus will be in danger of selling low to buy high – I feel like the last week shows the merits of my revised strategy to reduce my exposure to UK equities and increase my exposure to US and UK bonds.

And I’ve had one bit of good news this week. It turns out stamp duty – amounting to about 10% of the Dream Home’s value – isn’t due on completion but actually 28 days later. When you take out a conventional mortgage it typically all happens at the same time, but in my case, without a conventional mortgage, I have an extra month. This gives me some breathing space, and may actually make a real difference. This is because I anticipate some liquidity, amounting to over 10% of my Dream Home’s value, in February that I haven’t been able to count on in January. All in all I feel right now like I could cope with one or two hiccups without breaking sweat – which for a transaction of this magnitude is very welcome.

What’s not going so well? I became a forced seller at the end of last week, and had to sell some prized assets at low prices. Fortunately these were a fairly small portion of the total I’ve had to redeem, but it hurt. And my current asset allocation is out of shape, as I’ve been selling based on my trading instincts and my unrealised capital losses, rather than maintaining my asset allocation. I will focus on rebalancing in February and March. And I’ve spent an exorbitant sum on trading fees – I will tot this up next month but it isn’t pretty.

My big stress now is securing my margin loans at the size I need. On the one hand I’m glad I haven’t drawn down the loans yet, because with the stock markets down 8% some of my margin for error would have disappeared. On the other hand the size of the loan that I can take out has dropped along with the markets, so I may yet need to liquidate further holdings. I won’t confirm this for another week at the earliest.

Hi FvL,

I did wonder how you were fairing given the recent fun in the markets – glad to see it’s more or less going on track! I have my fingers crossed for you that it doesn’t get too painful in the next week or two, but all the best for your move into the new dream home!

Looking forward to seeing how it goes, and also your experience of the margin loan once it kicks in!

London Rob

LikeLiked by 1 person

Hey FvL, Have you checked with your legal people that they are happy with the SDLT form going in 28 days later? Mine wouldn’t complete without the stamp Duty cash sitting in their account, and wouldn’t process the purchase unless they were doing (and charging me for doing) the SDLT form ( also for a cash purchase). Yours may be more reasonable than mine (wouldn’t be difficult), but check before banking on it!

Emma

LikeLiked by 1 person

If you buying without a mortgage you can delaying paying the SDLT – you will have a period of 28 days of priority at the land registry to protect your interest, as I am sure you will appreciate you can’t be registered until the SDLT is paid

Your solicitors who is not acting for any mortgagee takes instructions form you and it’s your call

LikeLiked by 1 person