Readers of my last post know that the New Dream House has appeared on London’s market. This poses some financial complications that I asked for help on, and I had some very useful replies. As it happens, things have developed quickly – on several fronts. Given the interest in the last post I’m going to post an update. If you’re not interested in prime London property machinations, move on!

Two important developments have occurred this week:

- We have had a verbal offer accepted on the New Dream House.

- The UK stock market has fallen 6%.

And I won’t even mention the much-flagged rise in US interest rates – the first for almost 10 years.

The London property market right now is being described by more knowledgeable people than me as ‘finding its correction point’. This means falling, slowly cutting through the inflated expectations, irrelevant anchors, difficult funding environment, and so forth that make house prices downwards sticky.

The Dream House has allegedly had a few offers, with the difference between Min and Max being almost 25%. Needless to say, Max was accepted but fell through, and Min was not accepted. My offer is closer to Min than Max. But even Min is at the top of the recent comparables. So suffice to say that the house is overpriced. Not a house Warren Buffett would ever buy.

But it is The New Dream House, for Mrs FvL and me. We have been thinking carefully about the pros/cons of moving and buying this house in particular and overall we are, as they say, sold. There is a limit to rational analysis in all circumstances, especially when it comes to a home over your head and at a price which, overpriced or not, I think we can afford.

Or should I say *thought* we can afford. To be clear this house, including stamp duty, will cost us less than half my net worth. Yes, I am planning to buy it first and then sell the Previous Dream House later, and while I hold both properties my residential property exposure will be uncomfortably large. But I pride myself on having a large liquid investment portfolio so in theory this is all manageable.

So with a verbal offer accepted, I have been putting serious thought to how I raise funds quickly. I’d already realised that actually a decent slug of my portfolio is in fact Unsellable. What I hadn’t quite realised was how even some of my theoretically Sellable assets are actually going to prove quite tricky to liquidate. These include:

- A large (for me) holding in a now publicly listed company. I have had my shares since before it went public, and have not registered them with a stockbroker yet. I think this is relatively quick to do, whereupon I can trade them online very easily, but this is a new experience for me and is an unknown.

- A portfolio held in an offshore bond wrapper. I have never really planned to touch this, as it falls into the camp of unsatisfactory investments sold to be by an IFA about 15 years ago. They are unsatisfactory partly due to my lack of control over them. And this lack of control is now making it feel problematic to sell them in a hurry. Asking an IFA to liquidate an investment which I regard as unsatisfactory but he will regard as very satisfactory reminds turkeys of Christmas.

- Some nasty funds/vehicles sold to me by my bank. These have proven not too bad from a returns point of view but the bid/offer spread on selling them is likely to be ugly.

In any case, the situation above is a fair bit of paperwork and won’t be easy over the Christmas break but is in principle under my control.

What isn’t under my control is my old sparring partner, Mr Market. And while I haven’t been paying attention, Mr Market has been sulking. Stropping, in fact. My mobile phone Stocks app is a sea of red ink. The FTSE-100 index has dropped below 6000, from 6350 a week or two ago. Just when I need some stability in the market, I have none.

Obviously there is a real lesson here. Not just for me, either – hence this blog post.

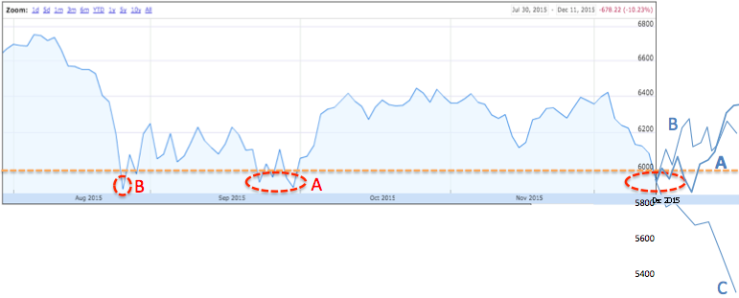

I know the past is no guide to future returns, blah blah blah, but since I have been obsessively anal tracking my returns monthly, FTSE has never closed the month below 6000. So I very much believe FTSE will return above 6000 during the period I am trying to close this deal. I’m not saying it will reach the ‘heady heights’ of 6350 any time soon (though that is likely) but I would bet on it reaching 6100 imminently. I.e. it is a short term buy below 6000. Looking at what has happened the last two times (A and B in my pic) it fell below 6000, it rose pretty quickly again back to 6200-6300. So I figure I’d be unlucky if this is the moment for it to take path C or, worse, the 2008 path which had it falling to 3500 over a few weeks.

So, on the basis that there is a good chance FTSE-100 will get to 6100+ this week, my current strategy is as follows:

- Carry on as normal with the house purchase at least until I need to exchange contracts.

- Optimise the portfolio to reduce my exposure to short term declines:

- Simultaneously, sell down any assets which look like ‘falling knives’ – i.e. where there is a good chance of continued declines. This means BHP Billiton, Kinder Morgan, etc – on which I can, erm, harvest some useful tax losses.

- Likewise, close out any marginated positions that expose me unduly to a falling market right now. I only have two portfolios in this camp but they are a loose end I will now tie up.

- Sell enough of the least-declining assets to pay the deposit, fees, etc. This will mean liquidating ~10% of the Dream Home value – a small enough portion that, if I have to Sell Low to Buy High, I can cope.

- And aim to liquidate half the total purchase price by the time I exchange. The aim here is to be 50% immune to market movements. I will do this by selling down existing portfolio holdings – painful though this feels. Achieving this liquidity will involve gambling on the stock market movements – if the market keeps falling I will not sell, and if it rises I may liquidate suboptimally early. Limit Orders are going to be the name of the game for the next few weeks.

- If FTSE keeps falling, I will have to pull out of the house purchase. I think my break point for this is 5500 (somewhat depending whether other markets move in sync; UK equities is under 50% of my portfolio). This will irrevocably trash my reputation with both the agent and the vendor.

- Assuming I stay in the game…. I then plan to borrow 25% of the purchase price. I am grateful to @stu here for his suggestion of using Interactive Brokers (IB), whose lending is ultra flexible and (at least until the mooted interest rate rise next week) cheap – I can borrow in GBP at under 3%, with practically no paperwork. I am also talking to my bank, which is making favourable noises and may accept (what’s left of) my investment portfolio as collateral too. This loan will be risky but in the scheme of things buys me time and ensures I don’t need to sell assets during a market downturn. If FTSE gets above 6500 within the next twelve months I will be very grateful for that flexibility. The extra complication of using IB will be that I need to transfer assets from other brokers into IB – which has paperwork and/or capital gains consequences that are an unknown to me at this stage.

- Liquidate further holdings for the final 25%. These assets will be the trickier ones to sell and may well involve closing some accounts.

- Once the New Dream Home is in the bag, we would move in to it and work on selling the Previous Dream Home in a calm but rapid way. While we would price to sell, this may take a while – one of my family members found themselves in this situation and it took 18 months and a fair bit of stress. We don’t really fancy holding another rental property and I’d prefer to rebalance my assets back to equity investments and away from London property.

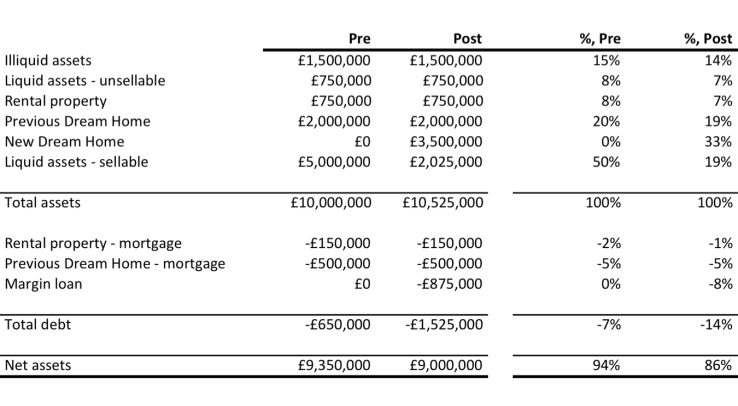

I’ve summarised this in a simplified balance sheet, pre and post, assuming all my assets added up to £10m (not an actual number). It shows:

- how Dream Homes (Previous & New) shift from being 20% of total assets to being just over 50%, an uncomfortable place to be for somebody who roughly shares @monevator’s views on London property. Including the rental property this puts me seriously overweight on property.

- how the debt (‘margin loan’) I’m contemplating is actually only 8% of total assets, a pretty manageable prospect even if FTSE goes down the toilet. Total debt rises from 7% of assets to 14% of assets.

- how my total net assets take a ~4% hit. This is because of the stamp duty/fees for moving, assumed to be 10% of the total purchase price. A lot of money to be sure, but this sort of movement is less than what Mr Market did to FTSE last week.

I’d welcome feedback/suggestions on the plan above. Am I crazy to consider a margin loan to buy a house? Is my London property overweight something I can do anything about? Does anybody have any experience crystallising an offshore bond wrapped portfolio? Any other tips?

Hi FvL,

Great to see the update, I was wondering how things were going, and congratulations on having the offer accepted. If it is the dream home for you, and it has everything you both want, then congratulations – finding that full stop is an achievement let alone in London! The fact that the house is less than half your net worth is a very good position to be in (pending of course selling your current home!), I am way too Long on London Property, but that is more luck as I have moved homes over the years. To answer your second question, your London Property Overweight, I think the short answer is there is nothing you can do about it if you want to stay in London – and have your dream home. You can either move further out of London, or downsize, or massively increase your other holidings to even it out (I am aiming for the 3rd). If its any consolation I thought I overpaid for my first 2 bed flat in Zone 2 14 years ago…. how wrong was I!

In terms of crystalising an offshore bond wrapper, I havent had to do that but I have discussed something similar with my FA – I am not sure if it is quite the same or not, but for what its worth:

– You send the money to the offshore and let it grow outside of the taxmans view as a loan

– At some point in the future (I am not sure when) you can then start drawing it down as an income stream, free of tax as it was a loan

I would seriously think about taking a good financial advise on this one, its way outside of my realm of expertise (ask me in a few years once I have spare cash after mortgage, pension, ISAs etc.!)

Registering shares with a broker. This is pretty straightforward – I did it with some old share certificates I had years ago (before Bed & Isa’ing them). From memory, I just registered and advised the broker, sent the Certs off, waited a couple of weeks, and they were there. The alternative would be to find a broker who would do a one of paper trade – it may cost a bit more (maybe 25 quid depending on the broker) but would be quicker, and avoid lost in the post. It all comes down to how fast you want it!

Nasty Funds / Vehicles. When are you actually ever going to sell these? If they provide you with a good steady income I can see the point in retaining them, but otherwise they are potentially just noise in your portfolio. What better time to get them out of your hair and annoyance than to help pay for your dream home? Think of it as “they paid for the “. Then anytime you go into that room, you will be reminded that its twice as good, as you also got to offload an annoying part of your portfolio (assuming I read your post correctly!)

Margin Loan. I’ve never used one, and personally, I wouldnt for buying my home – this is one area I am very risk adverse. I would ask yourself another question: “If everything went belly up and I had to pay off the whole of this house, could I still afford my bills and food etc.”. If you could, then in theory I see nothing wrong with using the Margin loan as it saves liquidating your portfolio, and with a backstop that its not the end of the world if things go belly up. I dont have the assets to pay off our mortgage (yet) and so hence I prefer the security of a fixed rate mortgage. If the loan will be cleared once you sell your existing home then I see no reason why not!

Hope that is of some help!

London Rob

P.S my two questions:

1. When is the house warming? 🙂

2. I really do want to know how old you are so I can plot myself against your success 🙂

LikeLiked by 1 person

Irrespective of the house buying issues, the drop and recovery of the FTSE this week shows you should never try to liquidate volatile holdings over a short period. In the same way that regular investing smooths variation, spaced withdrawls reduce risk. So equity is good for funding living expenses, but dangerous for big purchases. And if the purchase falls through, you’d be out of the market for a spell, to your peril or pleasure.

LikeLiked by 1 person

John. In principle, I agree with you. However for opportunistic large purchases, does one have an alternative? Seems crazy to eschew equities just for opportunistic opportunities – though I grant you that Warren Buffett does this. So far this week I have been OK – I have liquidated things which hadn’t fallen, in time for the fallen to recover and I have now raised the short term liquidity I need without taking too much of a bath.

LikeLike

[…] as a margin loan, and will amount to about 38% of my sellable portfolio at completion (in my simplified balance sheet, the £875k loan is just over 40% of the £2.025m sellable assets). My intention is to sell my […]

LikeLike

Apart from keeping an eye on the basic health and hygiene of the kid, a full time nanny in North

West London looks after the social upbringing of the child too.

LikeLike

[…] platform mix is simpler. Back in 2015, before the Dream Home seduced me, I had 9 different broker/bank accounts, six of which were material. Now I have five material […]

LikeLike

[…] readers will know that I have been an avid user of leverage, ever since I used it to buy my Dream Home in January 2016. At that point I was able to borrow funds, very flexibly, secured on my portfolio. […]

LikeLike

[…] these usual challenges, FvL turned up the difficulty level up to extreme by financing the purchase using margin lending, as opposed to a traditional […]

LikeLike