I’ve just totted up my invested portfolio’s returns in September. The bad news: I’m down 1.1%. The good news: the markets I’m in fell 1.6% on a weighted average basis.

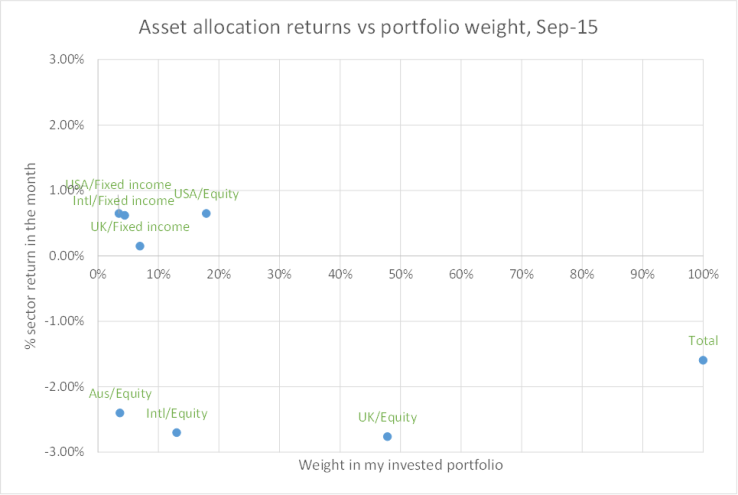

I’ve plotted below the returns of each of my major asset types (geography vs equity/fixed income) for September. Equities fell by 2-3% in UK/International/Australia – though not in the USA. Half my portfolio is UK Equities, where the market fell by almost 3% this month. Fixed Income assets were generally up – a classic case of uncorrelated behaviour between equities and bonds – which helped my overall portfolio return significantly. If I’d had purely passive exposure I’d have had the weighted average return of about -1.6% for the month.

In this context my actual return of -1.1% is fine by me. I’m not sure that my outperformance is luck, my genius, or my market benchmarking not fully allowing for dividends – of which my portfolio received a bunch in September as it is the quarterly payout month for both iShares and Vanguard.

As ever, I’m buying – trying where possible to rebalance to USA Equity which remains below its target allocation.

Is this format helpful/clear? Any suggestions for how I could improve it? Please leave me comments below.

Interesting your trying to rebalance into a higher proportion of US Equity – doesn’t the exchange rate just kill you right now? I really resent the US$ being so high against the £!!! I am wanting to buy into some US stocks in a second SIPP account, but just can’t bring myself to do it, even though there are bargains available, I am too tight about this exchange rate… aaaaa

LikeLiked by 1 person

@TV – I think the ‘normal’ range of £:$ is between £1:$1.5 and £1:$1.6. We’re in that range right now.

And the US stocks I’m buying have large (typically 50%+) non-USA sales, which diversifies/hedges the position too.

Which means, no, the exchange rate doesn’t bother me right now. Should it?

LikeLike

As i type, the taste is $1.5181 per £1, but you don’t actually get that when you exchange. You’ll typically lose 4 cents (maybe more) and then your broker will charge an fx fee on top, so you’ll be getting more like $1.45 per £1 – for me, that is too low to consider buying US stocks

LikeLike

Most of my USA exposure is through two brokers where I lose much less than 4 cents (one of whom, amazingly, charged commissions of under $5 for the last two trades). I do have one broker where you are right but I take the view that as I plan never to sell then the 4 cents is amortisable over several years.

What slows me down further is that I don’t put USA investments into my ISAs or SIPPs.

LikeLike

It’s great you’ve got a broker where you can get a cheap deal. Who do you use? I used to use TradeKing, but they now don’t accept foreign accounts for some inexplicable reason. They were dirt cheap.

LikeLike

The main one is Interactive Brokers. You can deposit funds in GBP, EUR, USD, CHF etc. And you can trade foreign exchange at market rates (via a very confusing interface, I concede).

LikeLiked by 1 person

but if it has the functionality… it’s probably worth it

LikeLike